Crude oil futures are struggling to move higher lately, as traders keep eyeing today’s meeting of the Organization of the Petroleum Exporting Countries (OPEC) and its allies – also known as OPEC+ – in expectation of any modifications to the latest supply cuts.

WTI futures are losing 35 cents per barrel this morning at $44.92 as the cartel is expected to resume talks today, after postponing a meeting held on 30 November amid disagreements on oil policy.

The US oil benchmark has been trading steadily in the past few days after reaching a post-pandemic high on 25 November at $45.71 per barrel, while the price jumped 1.6% yesterday at $45.28 due to a decline in US crude stockpiles of 679,000 barrels – despite the drop falling short of analysts’ expectations of 2.4 million barrels.

Meanwhile, the price of Brent futures has been hovering above the $46 level in the past few sessions, with the global benchmark unchanged during today’s early commodity trading activity at $47.94 per barrel.

Any decision hinting to a rollover of the supply cuts the organization implemented in early April amid the pandemic could end up plunging the price of the commodity in short notice, as market players remain concerned about the pace of the recovery in the demand for crude despite vaccine optimism.

In this regard, ANZ Research said in a note to clients: “Any sign that the group is struggling to reach an agreement could weigh on prices”.

Sources reported that disagreements during the last OPEC+ meeting focused on Russia’s desire to progressively hike its output by 0.5 million barrels per day starting in January, while the United Arab Emirates was seen willing to support that decision if other members commit to complying with their respective cuts.

What’s next for crude oil futures?

WTI futures have lost more than 26% of their value since the year started, as the pandemic plunged oil prices amid a strong deceleration in the demand for crude.

Oil prices have recovered significantly since they settled at negative prices in April, but the price is still struggling to move past the $40 level even though the latest positive news on the vaccine front have helped lift the ceiling to the high 40s.

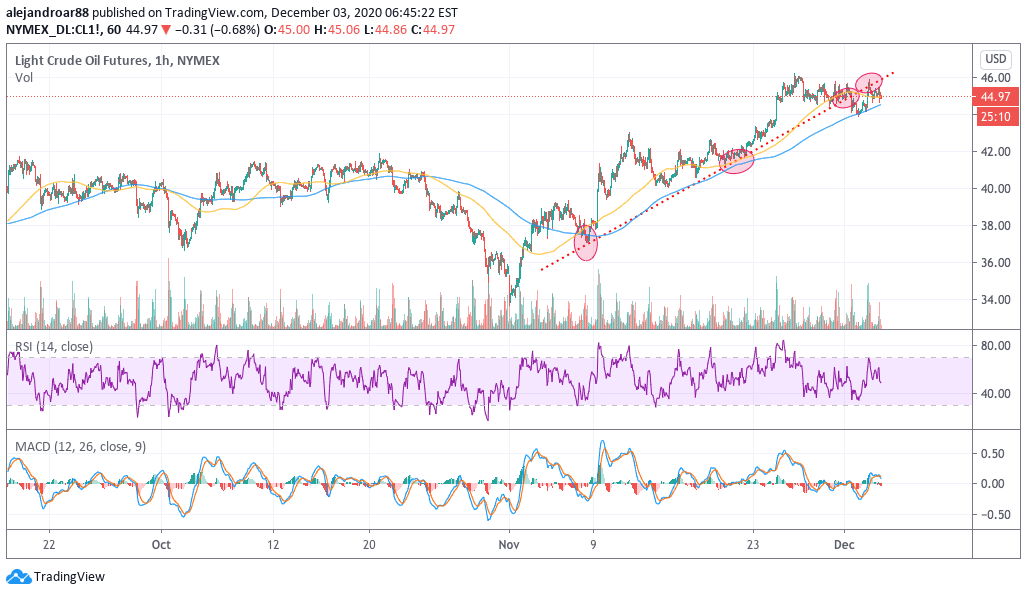

The hourly chart above shows how that the price has been in a strong uptrend since the 9 November vaccine news, although the price action has broken below that support line lately while there was also a failed retest yesterday that ended up in a rejection of that same line – which has now become resistance.

The short-term outlook for oil remains pegged to any decision coming out of OPEC+ today, which means that taking a directional position is highly risky as the market expects a big swing in any direction depending on the outcome of the meeting.

It is worth noting that traders are expecting a move in the range of 1.3% and 1.5% for oil prices, based on the implied volatility of options expiring this Friday for the United States Oil Fund (USO) exchange-traded fund.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account