Zoom Video Communications (NYSE: ZM) released its earnings for the fiscal third quarter of 2023 yesterday after the markets closed. While its earnings were better than expected, it lowered its full-year guidance.

Zoom reported revenues of $1.1 billion which were 5% higher than the corresponding quarter last year and were in line with what analysts were expecting. In the previous quarter, the company’s sales had risen 8%.

Zoom reported an increase in enterprise revenues

Looking at the breakup of Zoom’s fiscal third quarter revenues, the company’s Enterprise revenue soared 20% YoY to $614 million. It had 209,300 enterprise customers at the end of October which is higher than 204,100 customers at the end of July.

Zoom said that at the end of October, it had 3,286 customers who contributed more than $100,000 to its trailing 12-month revenues. The metric increased 31% YoY. It reported a 31% trailing 12-month net dollar expansion rate for Enterprise customers. Zoom’s CEO Eric. S Yuan said, “In Q3, we drove revenue above guidance with continued momentum in Enterprise.”

He however cautioned that the company continues to see “heightened deal scrutiny for new business.”

Meanwhile, Zoom’s online revenues fell 9% YoY to $487.6 million. It reported an Online average monthly churn of 3.1%, which was 60 basis points lower compared to the corresponding quarter last year. During the earnings call, ZOOM CFO Kelly Steckelberg said, that the Online business was having “a dampening effect on the overall growth rate of the company.”

She however said that the company expects Enterprise customers to be an even bigger contributor to its revenues over time.

ZM earnings beat estimates

Zoom reported an adjusted EPS of $1.07 in the quarter while analysts were expecting the metric at $0.84. Its GAAP operating income was $66.5 million in the quarter as compared to $290.9 million in the corresponding quarter last year. The company generated free cash flows of $272.6 million in the quarter which was below the $374.8 million in the corresponding quarter last year.

Zoom ended the fiscal third quarter with total cash and cash equivalents of $5.2 billion. The company is actively looking at potential acquisitions. Steckelberg said, “The compression in valuations is not lost on us.”

Notably, given the crash in valuations of growth companies, both listed and private, cash-rich tech companies are actively scouting for acquisitions. Zoom has also repurchased almost $1 billion of its shares this year

Zoom provided a lower forecast

ZM lowered its full-year revenue guidance to $4.38 billion. For the fiscal fourth quarter of 2023, it forecast revenues between $1.095 billion to $1.105 billion, which was below what the street was expecting. It forecast EPS between 75-78 cents, which was again lower than the 81 cents that analysts were expecting.

Steckelberg said, “This outlook is consistent with what we are observing in the market today. Specifically, it assumes that our enterprise business will grow in the low to mid-20s, while our online business will decline approximately 8% for the year.”

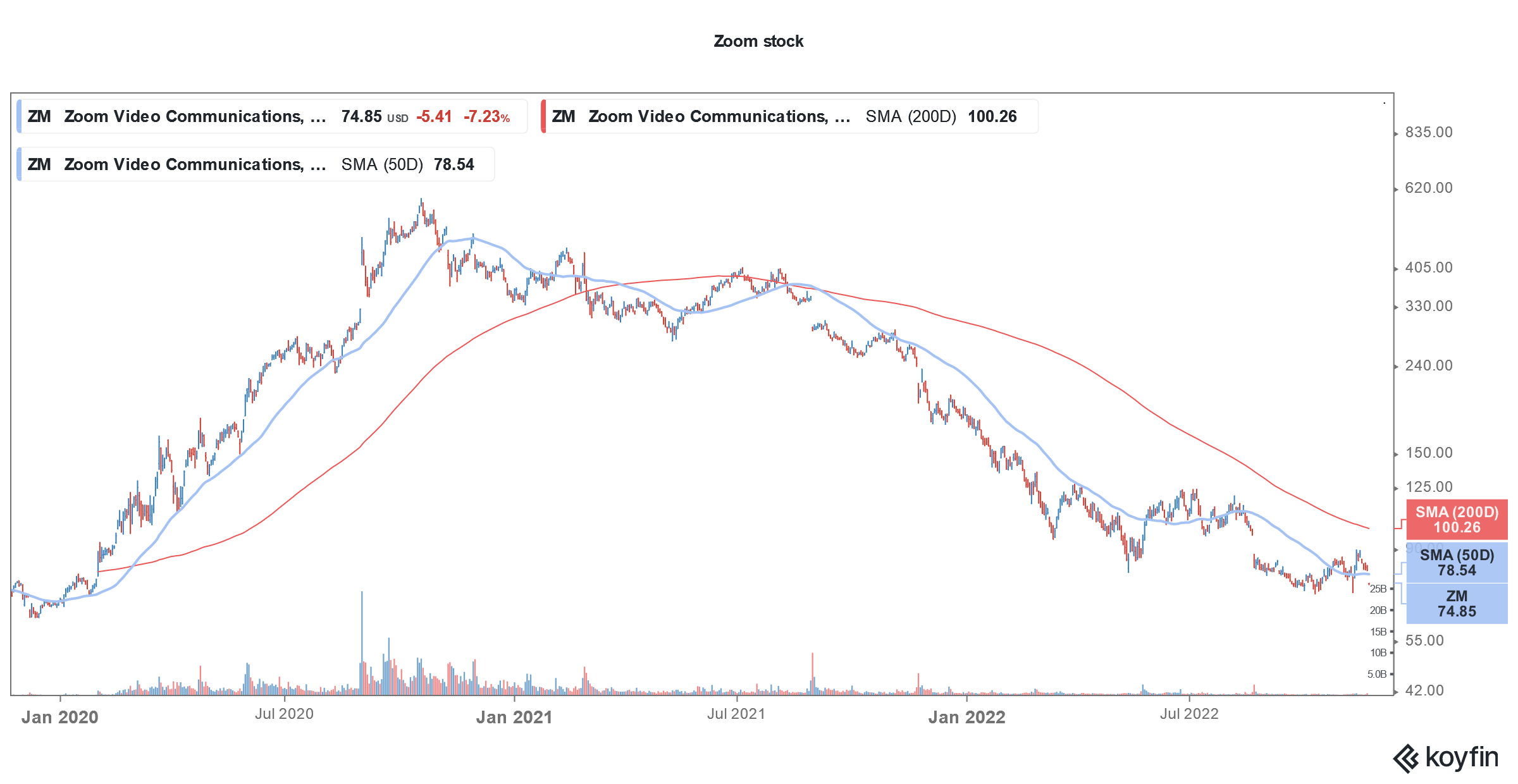

Stay-at-home companies are witnessing a severe slowdown

Former stay-at-home winners like Zoom, Chegg, and Teladoc Health are witnessing a severe growth slowdown. Taking about ZM, the demand for the company’s services has come down as the economies have reopened. Also, there is increased competition, including from Microsoft Teams.

Citi analyst Tyler Radke is bearish on Citi stock. After the earnings release, he said, “Despite some modest revenue upside, the leading indicators suggested signs of incremental deterioration.”

Notably, last week only, Radke lowered Zoom’s target price from $76 to $72 and maintained his sell rating.

Citi sees more pain ahead for ZM stock

In a client note, Radke said, “ZM’s post-COVID recovery, may continue to falter in Q3 as tightening IT budgets and a weaker macro outlook keep SMB new customer acquisitions low and churn elevated.” He added, “We see the hurdles from last Q holding, with rising competition (MSFT/Teams), macro-related weakness, and further margin risk from mix shift.”

Radke also lowered the company’s earnings estimate and said, “We further cut our estimates (Q4+ FY24), with revised revenue and FCF still 9% and 2% below the street in FY24. We forecast near flattish revenue growth next year with slight FCF growth.”

Cathie Wood doubled down on Zoom stock

Meanwhile, Cathie Wood of ARK Invest has doubled down on ZM stock this year and it is now the biggest holding for her flagship ARK Innovation ETF (NYSE: ARKK) accounting for 9.73% of the portfolio.

Tesla, another long-time Wood favorite, is now the ETFs second-largest holding. Usually, the Elon Musk-run company is the largest holding for the ETF. ARK ETFs have crashed this year amid the Fed’s relentless rate hikes.

Wood believes that the Fed is making a mistake with its aggressive interest rate hikes and could end up causing an economic “bust.” Contrary to what many believe, Wood has long stated that the US economy is headed for deflation.

The US Fed has been on a rate hike spree and has raised rates six times this year. Also, at the last four meetings, the Fed has raised rates by 75 basis points each. Fed’s rate hikes have taken a toll on US stocks and the Nasdaq is trading near a two-year low.

Growth stocks have crashed

Meanwhile, while Wood was among the star fund managers in 2020 as the rise in stay-at-home winners lifted her ARK ETFs, the funds have sagged in 2022.

Many have been critical of Wood’s investing style as buying the dips in growth stocks hasn’t worked well, at least so far in 2022. Many of her names have slumped to new lows even as Wood continues to have a high conviction. Growth stocks have been particularly at the receiving end of the Fed’s rate hikes.

Zoom stock is trading lower in US premarkets today which would further add to the woes of ARKK.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account