US stock markets have fallen for two consecutive days and futures point to a gap down opening today also. Why are US stock markets falling and can you benefit from the slump?

Dow Jones futures were down 1.6% in pre markets today while the S&P 500 was down 1.3%. The tech-heavy Nasdaq was down 1%. Nasdaq closed in the green yesterday also even as other indices closed with losses.

How stock markets globally performed today

Looking at other major markets, stocks were mixed in Asia. China’s Shanghai Composite Index gained 0.46% while South Korea’s KOSPI gained 0.62%. However, Japan’s Nikkei lost 0.29%. Indian stocks were the worst performer in Asia today and the benchmark Nifty Index tumbled 1.5%.

However, European stocks were down between 1.5-3% today. Germany’s DAX Index was the worst performer in early trade and was down nearly 3%. UK’s FTSE 100 fell the least among major European stock markets but was still down 1.6%.

Why are US stock markets falling?

There are three main reasons behind the recent plunge in US stock markets. Firstly, coronavirus cases have spiked in the US as well as parts of Europe. Lockdown measures are back in some European countries and we could see more countries announce lockdown measures in a bid to control the spread of the virus.

Secondly, the stimulus talks between the Republicans and Democrats have been stalled and the likelihood of a stimulus before next week’s presidential election looks quite dim now. The previous round of stimulus helped the US economy recover from the pandemic’s impact. Federal Reserve chairman Jerome Powell has also called upon lawmakers for fiscal stimulus on more than one occasion.

Pre-election volatility

Finally, US stock markets are repricing themselves ahead of the upcoming presidential elections. Donald Trump might contest the elections in case he does not emerge victorious in the elections. US stock markets had tumbled in 2000 after the election results were contested. However, along with the contested election, weak earnings had also dampened US stock market sentiments that year.

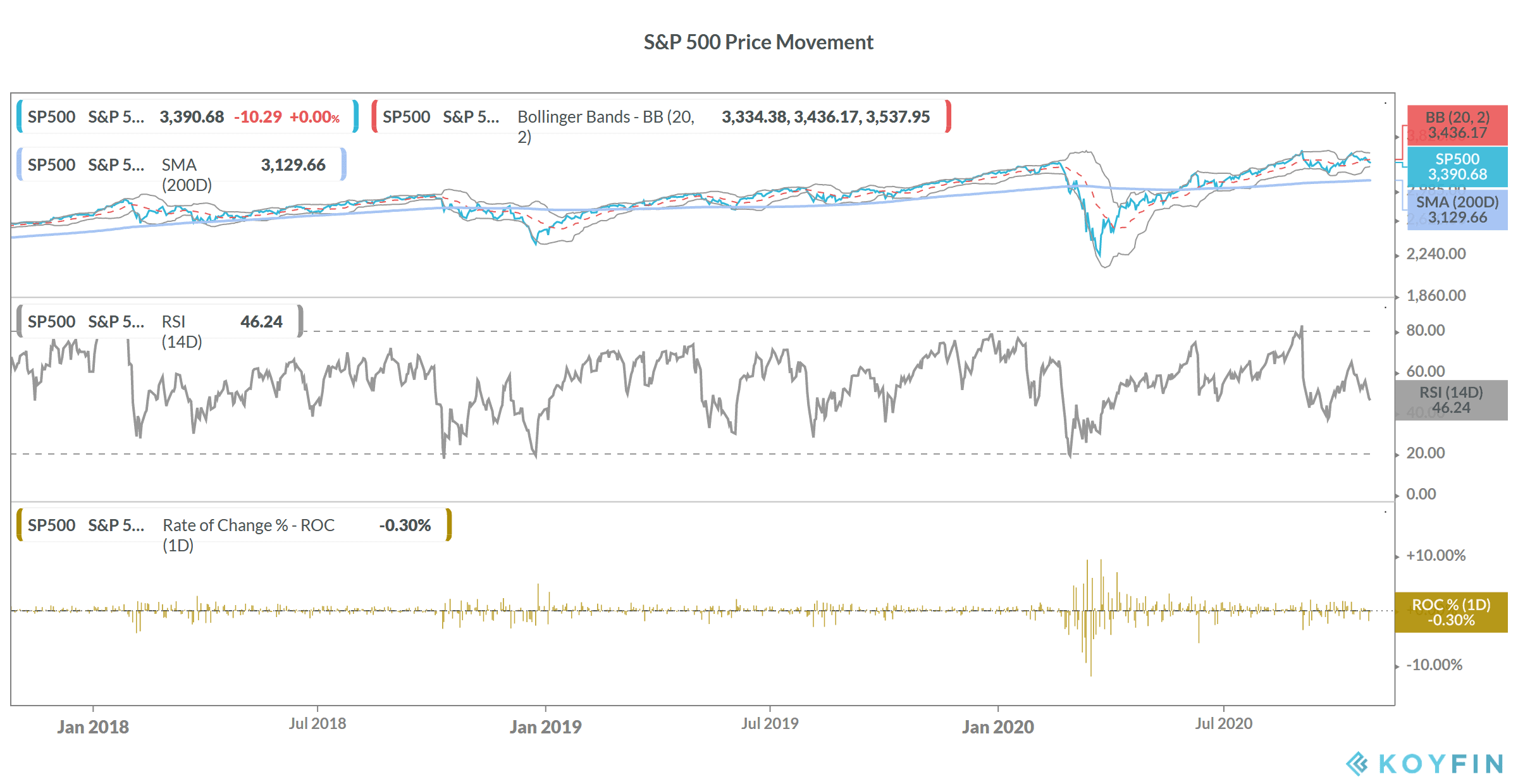

Mark Mobius sees a “double top” in S&P 500

Legendary investor Mark Mobius sees a double top in the S&P 500. A double top is a bearish technical indicator where a stock makes consecutive tops with a small fall in between. “It is interesting if you are a technician, you look at the S&P 500 and it looks like a double top is forming, which is quite dangerous, so I think people are quite concerned not only about who will win, but whether there is going to be a hung election,” said Mobius.

He added, “I think a lot of investors, not only in the U.S. but around the world, are watching this very, very carefully because they know a downturn in the U.S. market will affect everybody.”

US stock markets in 2020

Despite the pandemic, US stock markets have been strong this year. The S&P 500 is up 4.9% for the year. The index hit a new record high last month. However, tech stocks have since come off their 2020 highs.

How to benefit from the plunge in US stock markets

Volatility in US stock markets has risen over the last couple of days and we could see it remain elevated over the next week as markets brace for the elections. One way to play the volatility is to buy an ETF that tracks the volatility index. These ETFs rise in value when the volatility rises while they fall with a fall in volatility.

By investing in an ETF, you get returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is a guide on how to trade in ETFs.

You can also go short on the US stock markets using several instruments including CFD or Contract for Difference. We’ve compiled a list of some of the best brokers for CFDs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account