The third quarter earnings season kicks off this week led by leading US banks including Bank of America that would report its earnings on Tuesday. What should investors expect from Bank of America’s third quarter earnings?

Earnings season

This week, leading US banks including JP Morgan Chase, Citibank, Bank of New York Mellon, and Bank of America would release their third quarter earnings. Bank stocks have looked weak this year. The S&P 500’s financial subsector is down almost 19% in the year and is the second worst performing sub-sector of the index.

The energy subsector is the worst performer this year led by the sharp fall in oil prices. Rising waves of bad loans and consequent provisions have put pressure on US banks.

Bank of America’s third quarter earnings

According to the data compiled by FactSet, Bank of America is expected to make a loan loss provision of $2.23 billion in the third quarter. It made a loan loss provision of $5.12 billion in the second quarter. However, it made a provision of only $779 million in the third quarter of 2019.

According to the data compiled by Tikr, Bank of America is expected to post revenues of $20.8 billion in the third quarter, down 9% as compared to the corresponding quarter last year. Its normalized earnings per share are also expected to plummet 35% year over year to $0.49.

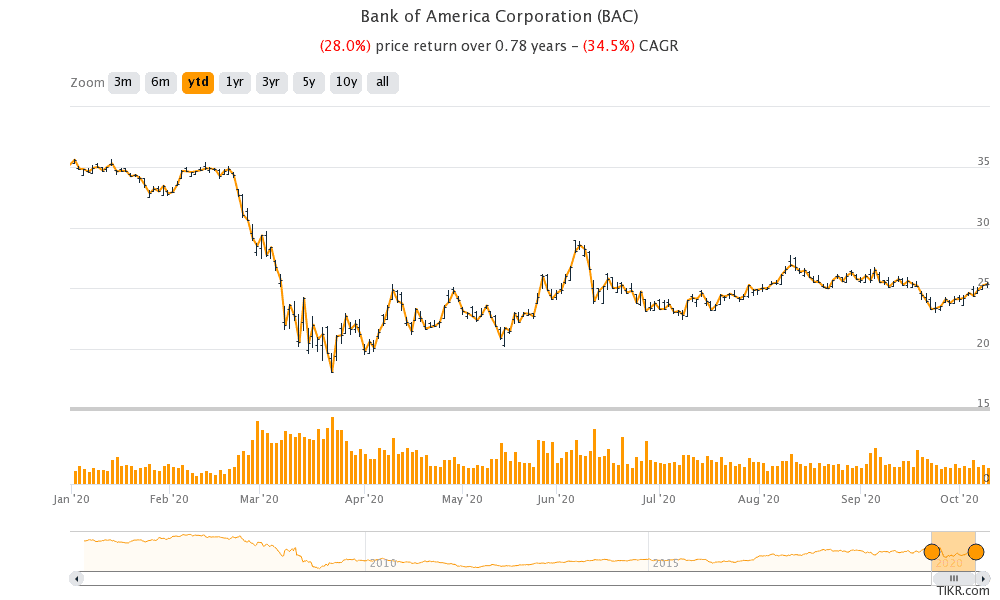

Bank of America shares in 2020

Bank of America shares are down 28% so far in 2020. It has fared slightly better than the bank subsector of the S&P 500 that is down over 33% for the year. Bank of America stock made a 52-week high of $35.72 in December and fell to a 52-week low of $17.95 in March as the US stock markets plunged that month. Currently, Bank of America stock is up almost 41% from its 52-week highs. However, it is still far below its 52-week highs.

Banking recovery would take time

Analysts do not see a quick recovery for the troubled banking sector. “You’re looking at years for this sector to make a full recovery. It will take a lot of positive things to happen in the U.S. economy for it to get back to the type of performance we are seeing in the broader S&P,” said Rick Meckler, partner, Cherry Lane Investments, a family investment office in New Jersey.

The fortunes of US banks including Bank of America would also depend on the stimulus package. Currently, there is a stalemate between Democrats and Republicans on the next stimulus bill with President Trump calling off talks last week.

“There is an emerging view that a Democratic sweep would mean more stimulus for longer, which would help banks’ credit profile, and would have ramifications for inflation, which would push up [long] rates,” said Scott Siefers of Piper Sandler.

Warren Buffett is bullish on Bank of America

Berkshire Hathaway is Bank of America’s largest shareholder holding 12.9%. Apple is Berkshire Hathaway’s biggest holding. It also holds Amazon and Coca-Cola in its portfolio. Generally, Warren Buffett has tried to limit his stakes in banks below 10% and has been gradually selling shares in banks to keep the stake below 10%.

However, the Oracle of Omaha, as Buffett is known as, seems to have made an exception for Bank of America. Interestingly, while Buffett has old stakes in other banks like JP Morgan Chase and Wells Fargo this year, he has added more Bank of America shares this year.

Bank of America’s valuation

Bank of America currently trades at an NTM (next 12-month) price to earnings multiple of 13.73x. Its price to book value multiple, which is the preferred valuation metric for banks, stands at 0.91x. Typically, price to book value multiple below one is a sign of undervaluation of a bank. However, the low valuation multiple should be seen in the context of the expected increase in bad loans that would hit bank earnings and asset quality in the short to medium term.

According to the estimates compiled by MarketBeat, of the 22 analysts actively covering Bank of America stock, 14 have a buy rating while one has a sell rating. The remaining seven analysts have a hold or equivalent rating on the stock. Bank of America’s average price target of $29.50 is a premium of 16.3% over current prices. $39 is Bank of America’s highest price target while $21 is its lowest price target.

You can buy Bank of America stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account