US stock futures are pointing to a higher open for today’s shortened stock trading session, as vaccine optimism keeps market sentiment on an upbeat tone.

Futures of the tech-heavy Nasdaq 100 index (NQ) are leading the uptick today, advancing 0.3% at 12,192 while they accumulate a 2.4% gain since the week started, followed by the E-mini futures of the S&P 500, which are up 0.17% so far in early futures trading activity – also set to end the week with 2.2% in gains based on their current quotation.

Dow Jones futures, on the other hand, are up 2.3% since the week started, while trading 0.2% higher this morning at 29,888 as vaccine optimism keeps the stock market pushing higher.

Today’s trading session will ultimately determine the faith of US stock futures, as the past session took place while markets remain closed during Thanksgiving holidays. Meanwhile, equity markets will close earlier today at 1:00PM ET on the day of the popular ‘Black Friday’ shopping spree.

Markets appear to have shaken off a recent questioning of the results announced by British vaccine developer AstraZeneca by the head of the White House Operation Warp Speed program Moncef Slaoui, who recently expressed his concerns about the relevancy of the firm’s interim analysis, which, according to Slaoui, focused on low-risk age groups.

AstraZeneca (AZN) pushed back these criticisms by warning that these were only preliminary results – same as with the interim analysis conducted by other firms like Pfizer (PFE) and Moderna.

To address these concerns, the company said it is now planning to launch another trial, as during the first one a half dose of the vaccine was given to patients first – by mistake – instead of the full-dose that they were supposed to take – a situation that actually resulted in unexpectedly higher levels of immunity by pure chance.

What’s next for US stock futures?

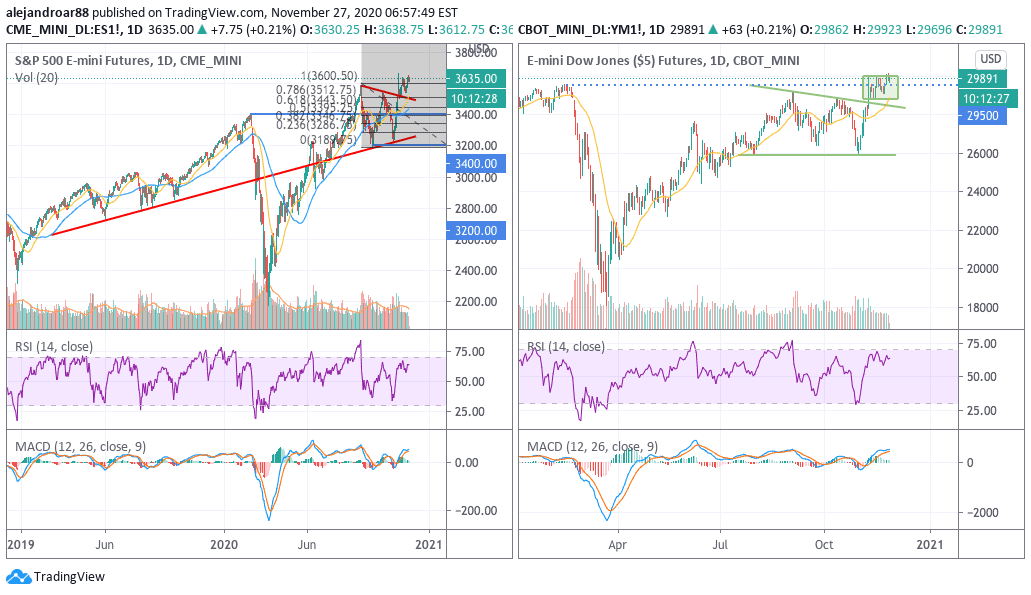

US stock futures have continue their advance this week on the back of vaccine optimism, with E-mini futures of the S&P 500 trading at all-time highs today on thin volume.

Meanwhile, Dow Jones futures have struggled to stay above the 30,000 all-time high they reached in the past two days, with the benchmark settling below that level in both occasions.

Traders appear to be hesitant to push these indexes any higher in the absence of strong catalysts, as the momentum prompted by vaccine headlines along with the prospect of a peaceful transfer of power in the US appears to be fading.

For now, the short-term outlook for the three major indexes continues to be bullish as the S&P 500 just made a cross above its all-time high after breaking past a consolidation phase that started in September. A similar situation is unfolding for the Dow Jones index.

As for the Nasdaq, although the latest price action seems to point to a bullish break above a symmetrical triangle, the next few sessions will be crucial to see if a reversion to the mean takes place now that sector rotation appears to have started.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account