How to Buy AstraZeneca Stock: AZN Stock

AstraZeneca is a UK-based multi-national pharmaceutical company. The firm was founded in 1999 as a result of a merger between Zeneca Group and Astra AB of Sweden. As of mid-2020, AstraZeneca has a total market capitalization of just over £115 billion and the AstraZeneca Stock is going from strength to strength.

In this article. we show you how to buy AstraZeneca stock in the fastest, safest, and most convenient way.

-

-

How to Buy AstraZeneca Stock in 3 Quick Steps

Don’t have time to read our guide in full? Below you’ll see three quick steps that you need to follow to buy AstraZeneca stock right now.

[three-steps id=”4866″]Where to Buy AstraZeneca Stock?

Listed on the London Stock Exchange and forming part of the FTSE100 index, AstraZeneca shares can be purchased from dozens of online stock brokers. With this in mind, you need to find a platform that meets your needs. To help you along the way, below you will find our two top-rated UK stock trading sites of 2020. Both platforms are FCA regulated, and allow you to buy AstraZeneca shares with a debit/credit card, e-wallet, or UK bank account.

Plus500 – CFD Broker to Trade AstraZeneca Stock

Plus500 is worth considering if you want to day trade stocks. This is because the broker hosts more than 2,000 companies all in the form of CFDs. Not only does this include UK stocks like AstraZeneca, but heaps of international markets. By opting for the stock CFD route, you will be able to buy and sell shares on a commission-free basis.

Plus500 also permits leverage of up to 5:1 when trading publicly-listed stocks. This means that a £200 deposit would allow a maximum trade size of £1,000. We should also note that Plus500 allows you to short-sell companies. This means that you can profit if you think the price of AstraZeneca shares is likely to go down. In terms of getting started, Plus500 requires a minimum deposit of £100.

There are no fees to deposit or withdraw funds at the platform, and you can use a debit/credit card, bank account, or Paypal. Plus500 also offers a top-rated mobile trading app, which is ideal if you want t buy and sell stocks on the move. Finally, Plus500 has an excellent reputation in the UK brokerage space. Not only is it listed on the London Stock Exchange, but it holds multiple regulatory licenses. This includes the FCA, ASIC, CySEC, and MAS.

Our Rating

- Fast order execution

- No commissions

- Tight spreads

- Stocks only available via CFDs

- Its educational resources are sparse

80.5%% of retail investor accounts lose money when trading CFDsWhy Invest in AstraZeneca?

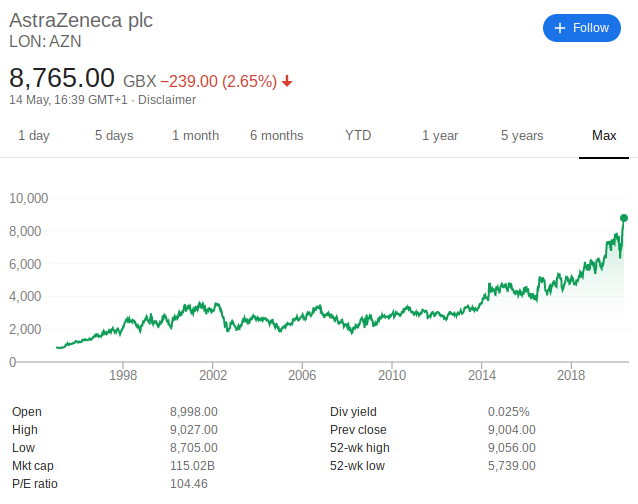

AstraZeneca stock has performed extremely well in the financial markets since the 1999 merger of Zeneca Group and Astra AB. At the time of writing this article in May 2020, the company is at high-time highs.

Will the stock continue its upward trajectory? Below we have listed some of the many reasons that analysts believe it will.

Coronavirus has made Pharma Companies a Buy

Make no mistake about it, the impact of the coronavirus pandemic on the global financial markets could be catastrophic. Whether it’s airlines, hospitality, real estate, construction, or retail, heaps of industries likely have tough times ahead of them.

With that said, the pandemic will potentially have the opposite effect on large-scale pharmaceutical companies like AstraZeneca. At the forefront of this is the firm’s research and development of COVID-19 related treatments. CEO Pascal Soriot recently told the BBC that the company is aiming for a Coronavirus vaccine by the end of 2020.

While there is no guarantee that AstraZeneca will realize this ambitious objective, the key point is that there is no reason to believe that the wider pharma space will be economically impacted by the pandemic. If anything, it’s possible that the opposite will happen.

37% Stock Price Growth and in All-Time High Territory

AstraZeneca stocks have been on fire for some time now. As of May 2020, the company’s shares are up 37% from the prior 12 months. When you factor in the wider economic impact of the COVID-19 pandemic, this once again highlights that pharma stocks are highly sought-after in troubling times.

The Dow Jones index, for example, has dropped 17% in the same period. Even more pertinently, Astazenan stocks are currently in all-time high territory. This highlights that investor sentiment is extremely bullish on the firm.

Huge Portfolio of Approved Treatments

AstraZeneca was able to obtain regulatory approval on over 23 treatments in 2018. This includes everything from kidney and cardiovascular disorders to cancer. The company is also at the final stages of several other new products that it expects to gain approval for within the next 1-2 years. This is one of the key reasons that the company has forecast double-digit growth in 2021.

About AstraZeneca Stock

Company and Stock history

AstraZeneca as a PLC was officially launched in 1999 on the back of a large-scale merger between the UK’s Zeneca Group and Astra AB of Sweden. The firm’s key revenue stream centres on the research, development, and distribution of pharmaceutical and biopharmaceutical products. This includes a range of health care segments, including but not limited to diabetes, cancer, cardiovascular, aesthetic, and infectious diseases.

AstraZeneca is listed on the London Stock Exchange under the ticker symbol AZN, and it is one of the largest constituents of the FTSE 100 index. As of May 2020, the firm has a total market capitalization of £115 billion. Its operations span several continents, which includes a workforce in excess of 61,000 employees.

In terms of the company’s stock price, AstraZeneca shares were priced at 2,721p in 1999. Fast forward to May 2020 and they are at an all-time high 9,056p. This represents a very juicy increase of just over 200% which once again highlights that AstraZeneca has been a strong long-term hold for investors. To complement this, AstraZeneca has a long-standing history of paying healthy dividends. This was exceeding a yield of 4% in 2018, although since then this has been reduced to the 2%-3.5% range.

Should I Buy AstraZeneca Stock?

At current prices, AstraZeneca is trading at just over 5 times its forecast sales for 2020. Although some would argue that this is somewhat expensive, investors seem content to pay a premium for the stock. This bullish sentiment has been reflected in the company’s share price, with AstraZeneca seeing year-on-year gains of 37% in 2020. This is on top of a dividend yield of between 2% and 3.5%, so income seekers have also been catered for.

There is much excitement about the firm moving into the next couple of years. Not only is AstraZeneca confident in its development of a COVID-19 vaccine, but it has also received heaps of regulatory approvals in other health segments. This is why the company is projecting growth of well over 13% in 2021. All in all, pharma companies are often sought after in times of economic uncertainties, which some argue will only push AstraZeneca to new heights.

FAQ

What all-time high share price does AstraZeneca stocks have?

At the time of writing in May 2020 – AstraZeneca is currently at an all-time high stock price of 9,056p. This represents a market capitalization of £115 billion.

Which companies does AstraZeneca own

AstraZeneca has a huge portfolio of subsidiaries within the group. This includes the likes of MedImmune, Pearl Therapeutics, Amylin Pharmaceuticals, and KuDOD Pharmaceuticals. With such a significant amount of cash reserves at its fingertips, it’s likely that we will see many more acquisitions in the coming years.

Does AstraZeneca pay dividends?

Yes, AstraZeneca has a long-standing track record of paying dividends – which it distributes twice per year. This has averaged a yield of between 2% and 3.% over the past couple of years.

What is the minimum amount I can invest in AstraZeneca stock?

AstraZeneca has once of the most expensive stock prices on the FTSE 100 – with a current all-time high pricing the shares at 9,056p (£9.05). Although historically brokers would require a minimum investment of 100 shares, this is no longer the case.

What stock exchange is AstraZeneca listed on?

AstraZeneca is listed on the London Stock Exchange. It is also one of the largest companies that form part of the FTSE 100 index

How much does AstraZeneca make in revenue?

AstraZeneca reported global revenues of jsut over $24.3 billion in the 2019 financial year. This was up from $22 billion in the prior year.

Kane Pepi

View all posts by Kane PepiKane holds academic qualifications in the finance and financial investigation fields. With a passion for all-things finance, he currently writes for a number of online publications.

Latest News

Halifax Share Dealing Review

If you’re looking for a low-cost share dealing platform that makes it super easy to buy and sell stocks, ETFs, and funds, it might be worth considering Halifax. You don’t need to have a current account with the provider, and getting started takes just minutes. In this article, we review the ins and outs of...

UK Banks Approved Nearly 1 Million Mortgages in 2019, 7.4% More than a Year Ago

The United Kingdom’s high street banks approved close to a million mortgages in 2019. Data gathered by LearnBonds.com indicates that 982,286 mortgages were approved in 2019, an increase of 7.4% from 2018’s 909,597. The mortgage approval entails loans for home purchase, remortgaging and other loans. Compared to 2018, the number of mortgages approved for home...

WARNING: The content on this site should not be considered investment advice and we are not authorised to provide investment advice. Nothing on this website is an endorsement or recommendation of a particular trading strategy or investment decision. The information on this website is general in nature, so you must consider the information in light of your objectives, financial situation and needs. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence or obtain advice where necessary. Crypto promotions on this site do not comply with the UK Financial Promotions Regime and is not intended for UK consumers. This website is free for you to use but we may receive a commission from the companies we feature on this site.

Copyright © 2022 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up