Earnings season is starting with banks and airlines lined up to report their performance during the third quarter of the year and US stock futures are trading higher this morning ahead of it with both the S&P 500 and the Nasdaq breaking above key levels.

S&P 500 E-mini futures are up 0.43% so far during the European futures trading session at 3,488.25, while the E-mini futures of the Nasdaq 100 tech-heavy index are surging 1.4% as well at 11,888.25. Futures of the Dow Jones remain barely unchanged at 28,540.

Companies in the financial sector will be the first to report their earnings this week, with Goldman Sachs (GS), Blackrock (BLK), JP Morgan Chase (JPM), Citigroup (C), and Charles Schwab (SCHW) lined up in first place between Monday and Tuesday, along with other important companies like Delta Airlines (DAL) and Johnson & Johnson (JNJ).

Estimates from FactSet for the third quarter indicate that earnings from companies within the S&P 500 index will decline 20.5% during this three-month period amid the pandemic although the figure was revised positively, up from a previously forecasted decline of 25.3% analysts had anticipated by the end of June.

Meanwhile, the research firm highlights that out of 285 companies that typically provide EPS guidance for their full fiscal year, at least 50% were reluctant to follow through with this practice during the second quarter of the year.

This gloomy outlook does not seem to be discouraging investors this morning, nor is the volatility that typically accompanies the US Presidential election, which is scheduled to take place only a few weeks from now.

In fact, this morning is turning out to be a bullish one ahead of earnings season, with both the S&P 500 and the Nasdaq 100 breaking above key levels.

Are US stock futures pointing to a positive week for Wall Street?

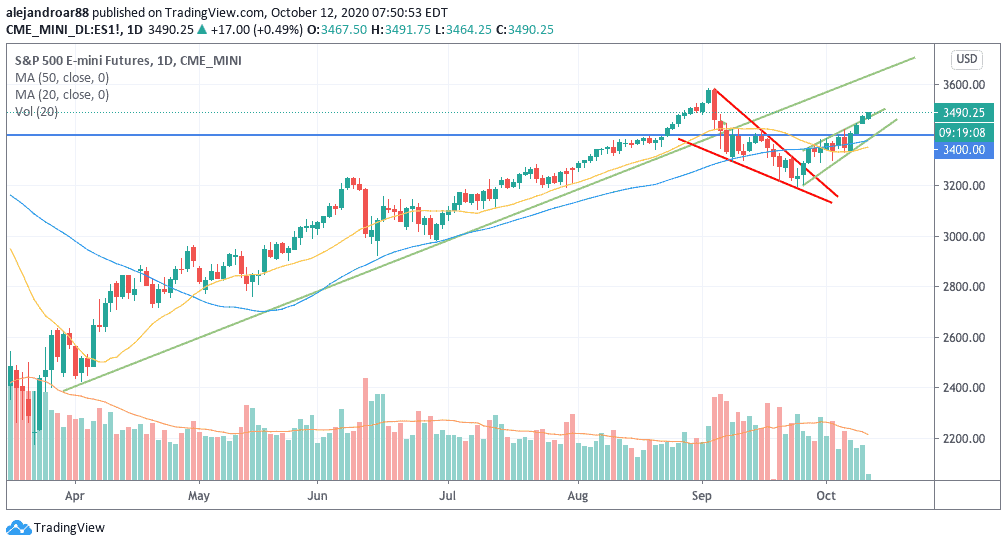

The E-mini futures of the S&P 500 are opening higher this morning while also attempting to break above what seems to be a rising wedge formation that emerged off the lows seen after the September tech sell-off.

A successful break above that upper trend line could invalidate this pattern – which is usually a bearish reversal formation – and would put the instrument on course to retest the lower trend line that emerged off the March lows.

This move is being accompanied by a strong buy signal on the MACD, with both the oscillator and the signal line already climbing to positive levels on strong momentum.

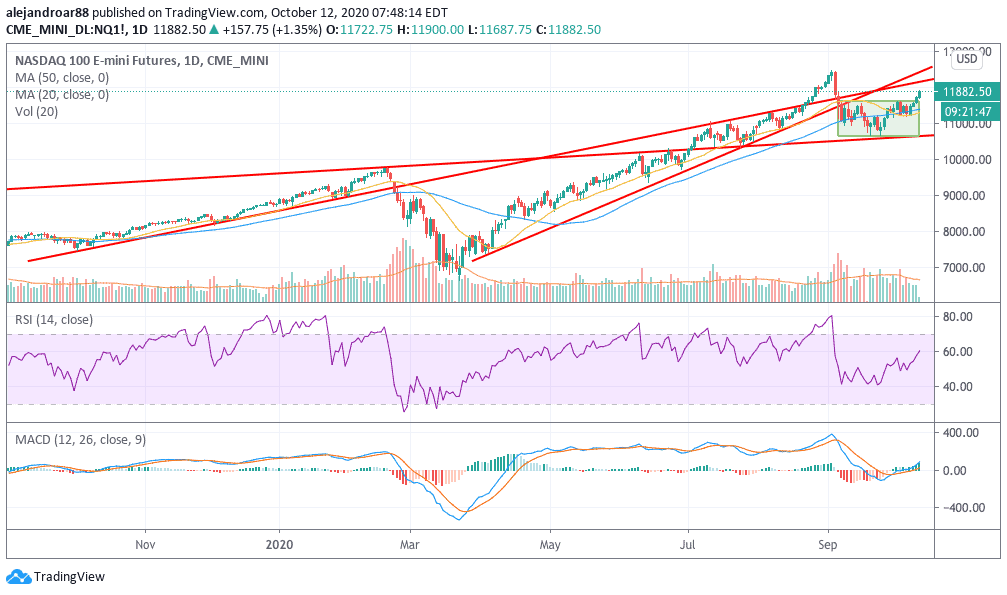

Meanwhile, the E-mini futures of the Nasdaq 100 index are surging above a sideways consolidation seen since the sell-off as well, with the index possibly headed to retest a lower trend line that served as support before the pandemic crash.

The MACD indicator is also flashing a strong buy signal at the moment and a move above the 12,250 level would put the price of the futures contract on course to all-time highs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account