Fundrise Review 2021 : READ THIS Before Investing

Can you really make money with Fundrise? Is Fundrise a safe investment or a realtor scam?. These are possible questions you may have. Read this detailed Fundrise review before you sign up !!

Chances are that you have ever thought of investing in real estate, but for some reason,  you can’t seem to realize your dream. Traditionally, to access the real estate market, you had to have a large amount of money and had to bear all the risks in it yourself.

you can’t seem to realize your dream. Traditionally, to access the real estate market, you had to have a large amount of money and had to bear all the risks in it yourself.

For man holding phone alongside the many years, real estate has been considered as the go-to investment for millions of people looking for consistent wealth and long-term appreciation. For others, it’s the idea of a physical investment that interests them most. Depending on the location of your property, you can make sizeable returns on your investment. However, many people still miss the opportunity to invest in real estate. As already indicated, you require a lot of money to invest in the market yourself, and even if you can get a mortgage, the 20%-30% deposit required is not easy money to come by.

Others are intimidated by the thought of finding and analyzing their own real estate opportunities. The fact is, not everyone has enough time for that, especially if you are working or raising kids or even both.

In this Fundrise Review 2021, we look at a real estate investment platform that allows you to invest as little as $500 and make your dream a reality.

Invest In A P2P Business Loan With Fundrise

Our Rating

- Steady and regular incomes

- Constantly reviewed share investments help you understand your current stand

- Provides sufficient grace period for an enthusiast trader to test their systems

- 10% passive income stream

-

-

What is Fundrise? Can you really make money with Fundrise?

The Fundrise Starter portfolio is a real estate investment platform that allows accredited and unaccredited investors to pool money together and invest in real estate projects. The company was founded in 2010 by brothers Ben and Dan Miller. However, it wasn’t launched until 2012, right before the passing of the Jumpstart Our Business Startups Act (JOBS Act) which eased many of the country’s securities regulations in a bid to encourage funding of small businesses. One of the act’s titles is the Crowdfund Act, which streamlines the process of equity crowdfunding.

Our Fundrise Video Review : Fundrise Starter Portfolio

When Fundrise launched in 2012, real estate developers would apply for loans directly on the platform and investors were able to invest directly into the loans. However, only accredited investors were allowed. Meaning only those with a net worth of over $1 million or an income of over $200,000+. This left out many potential investors. However, this did not last for long. On March 25th, 2015, the Securities and Exchange Commission adopted final rules to implement the JOBS Act by expanding Regulation A into two tiers. Tier 1 for securities offering of up to $20 million in a 12-month period and the second tier of up to $50 million.

The regulations came into effect in June 2015, private companies now could raise up to $50 million per project via crowdfunding from both accredited and unaccredited investors. In December 2015 Fundrise used the Regulation A+ rules to raise capital for the World’s first online Real Estate Investment Trust (eREIT) with an initial offering of $50 million as per the regulations. It was the first company to issue and raise $50 million allowed under regulation A+. Fundrise announced another portfolio in June 2017. The eFund. Read on and find out more about Fundrise’s eREIT and eFund offerings and if they are suitable for you.

Fundrise Pros and Cons Review.

Pros- It has a 90 days money-back guarantee – Fundrise will buy back your investment at the original price you paid for the investment if you are unhappy about the platform or just want out. The only catch to this is the 60 day waiting period after submitting your request

- No income or accredited investor requirements – the platform is open to all investors

- Low starting minimum investment of $500

- Access to more diverse investments through the eREITs and eFunds

- Access to commercial real estate – Fundrise Company allows you to access high dollar investments with as low as $500

- The fees are seemingly lower than competing platforms (Fundraise charges a total of 1%, 0.15% investor advisory fee and 0.85% asset management fee)

- You can re-invest your earnings using the auto-invest or ‘DRIP’

Cons- Limited liquidity – Fundrise eREITs are not publicly traded and are therefore illiquid investments. You may be required to pay a penalty of up to 3% if you want your money back. Therefore, you should only invest with money that you don’t need in the near future.

- Tax liability – the income you earn is taxed as ordinary income, this means higher tax rates than qualified dividends that are taxed at 15%

- You can’t choose the projects you invest in individually – the platform does not give investors much control on what they invest in

- Distributions are quarterly but not guaranteed.

Invest In A P2P Business Loan With Fundrise

Our Rating

- Steady and regular incomes

- Constantly reviewed share investments help you understand your current stand

- Provides sufficient grace period for an enthusiast trader to test their systems

- 10% passive income stream

How Fundrise works ? How do I get my money out of Fundrise?

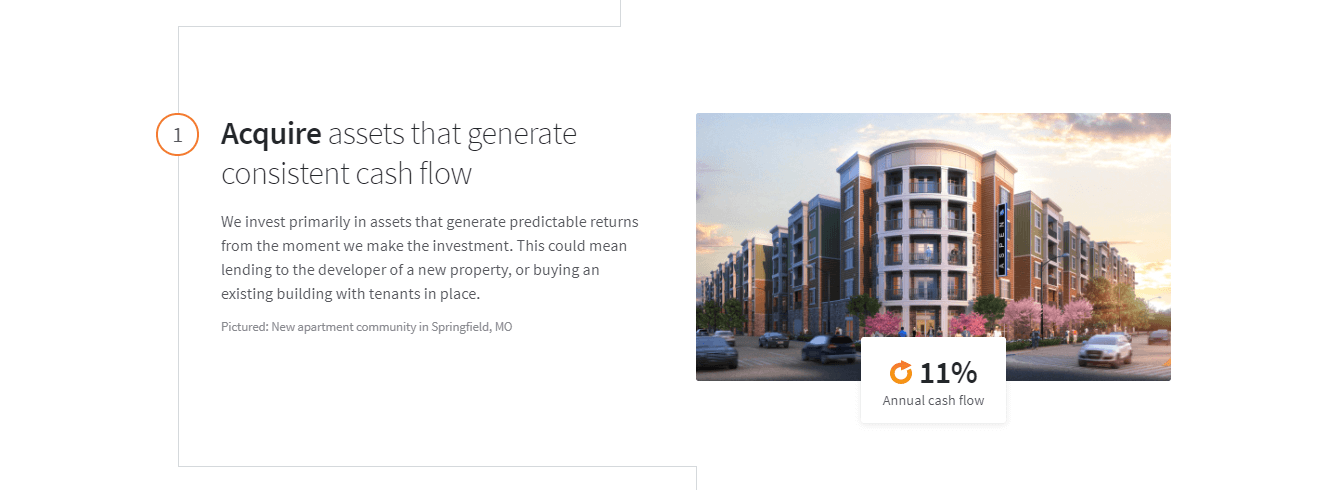

The Fundrise issues loans to commercial real estate buyers, therefore, the projects are already funded by the time they appear on the platform. The platform takes a risk that the projects will be a success and that the investors will accept them. Because of that, the platform has a very strict underwriting process that includes digging into the sponsor’s credentials and analyzing their credit and financial history and examining their track record. The platform only works with well-capitalized and successful sponsors.

If the sponsor passes the vetting, their project is subjected to a preliminary scrutiny just to ensure it is within their guidelines. The project is then assigned a lead underwriter for an extensive analysis. Only a few projects are approved on the platform. The approved ones are bundled into eREITs. The eREITs’ shares are then sold on the platform to the investors.

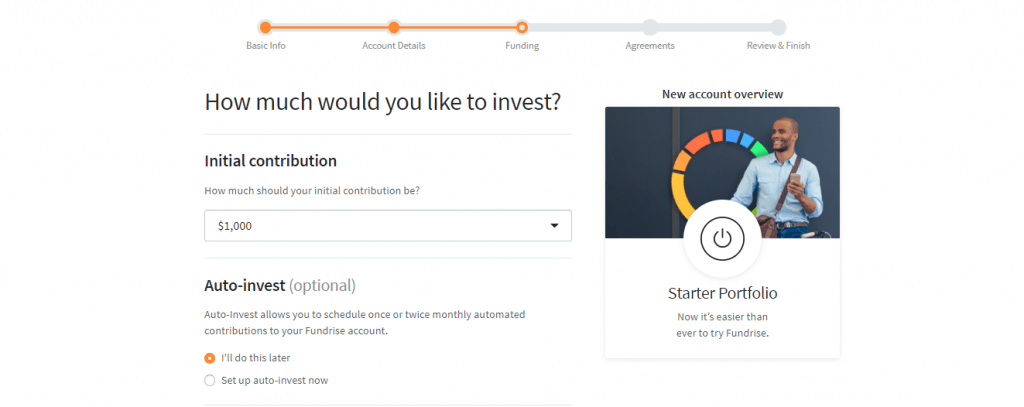

When you sign up on the platform, the platform gives you a starter plan, the one with a $500 minimum investment, after investing a $1,000 you can upgrade to any one of the advanced plans offered. You can also choose a plan from the start although the minimum for that will be $1000. The advanced plans offer greater customization to your goals and more diversity.

Any potential returns on your investments are paid in two ways. Via quarterly distributions, where you receive the dividends from the rental income that the properties generate. These can be directly deposited into your bank or automatically reinvested. The second way is via appreciation in asset value at the end of the investment term.

Getting Started on Fundrise Realtor Investment .

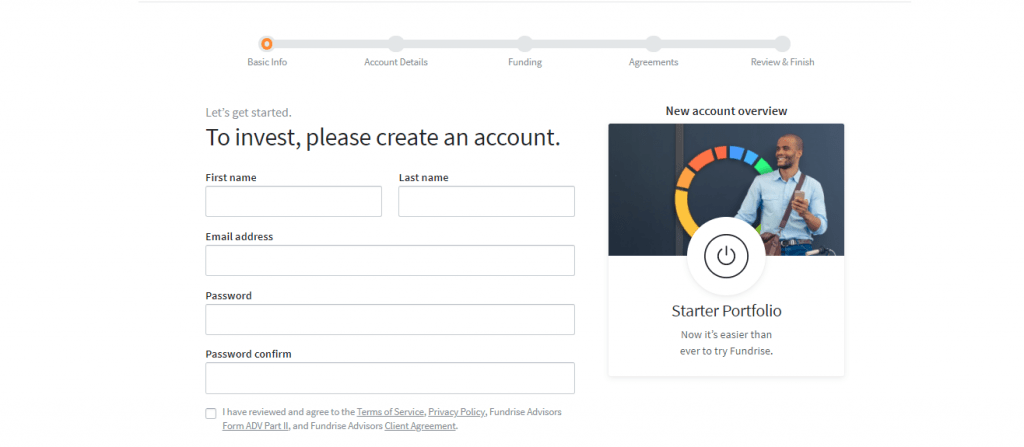

Any US resident over the age of 18, accredited or unaccredited can open an account and invest on the platform. To open an account, select ‘Get Started’ from the top menu. You will be asked to select the level you would like to begin at, Starter, Core or advanced. Fill in your name, email address and password to create an account. Confirm that you are a US citizen and resident and continue. Currently, the platform only accepts US residents.

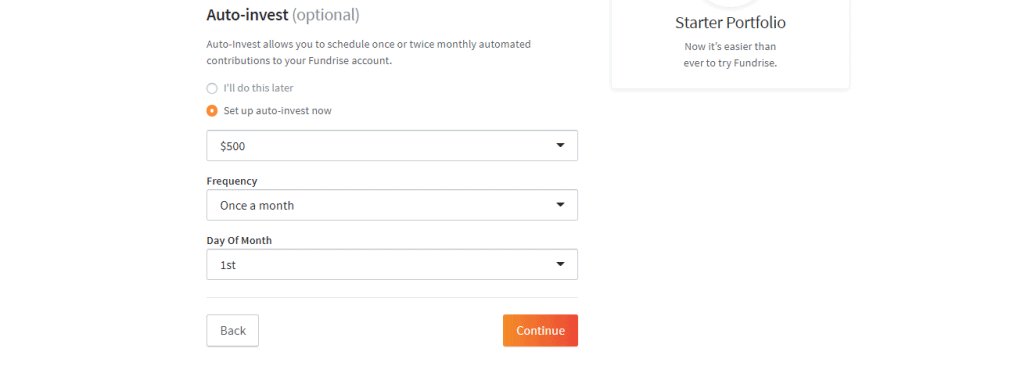

The second step. Select the type of account you are opening. Individual or an entity account. You will also be required to provide contact information and the address used for tax purposes. This is also the step you will provide your social security number as required by the IRS. Select how much your initial contribution should be and set up auto-invest.

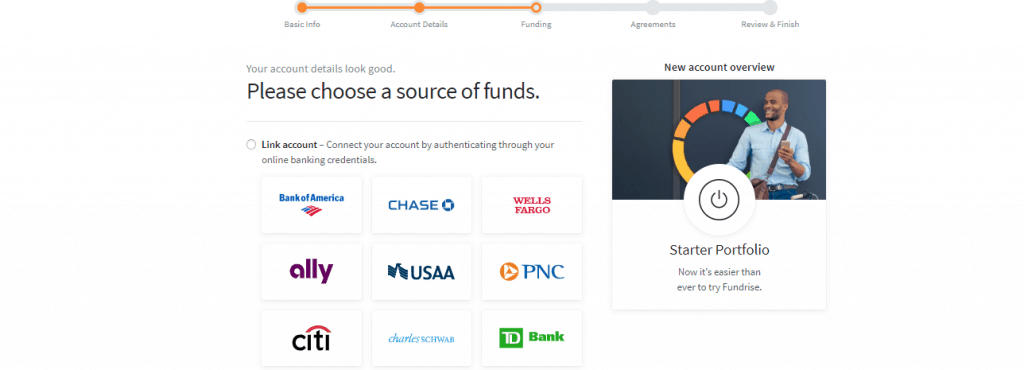

The third step is funding. Select the source of your funds and link account or manually enter your banks routing and accounting numbers.

Indicate agreement with the terms and conditions set, Select what happens to dividends (distributed to the bank or reinvested). Review your information and continue. Fundrise will send a verification email to your email. Click on the link to verify and your account will be ready. The whole process takes less than 10 minutes.

Invest In A P2P Business Loan With Fundrise

Our Rating

- Steady and regular incomes

- Constantly reviewed share investments help you understand your current stand

- Provides sufficient grace period for an enthusiast trader to test their systems

- 10% passive income stream

Types of accounts :

Currently, the platform supports three types of accounts.

- Personal Investment accounts

- Joint accounts

- Entity accounts (Trusts, Limited Liability Companies, Limited partnerships C & S corporations)

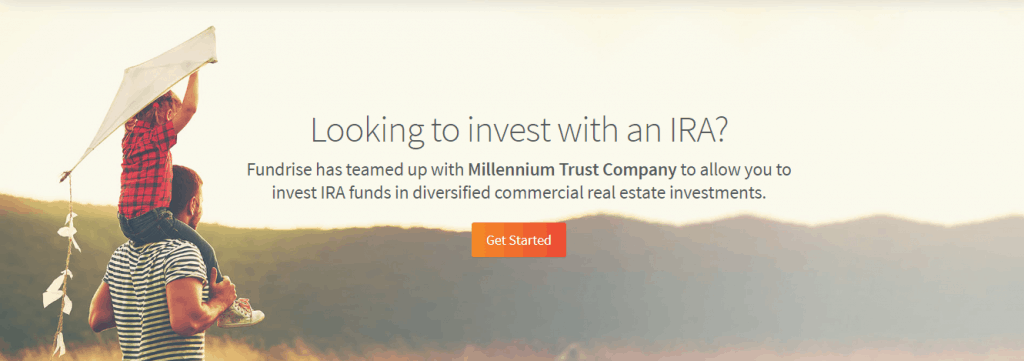

- Self-directed IRA – Fundrise partners with Millennium Trust Company to allow users to invest IRA funds in diversified commercial real estate.

You can select the type of account you want to open during the signup process as described above.

How to invest in Fundrise : How much does Fundrise cost?

Investing in real estate projects through Fundrise is easy as the platform does everything for you, including Screengrab of Fundrise an an dning the investments, underwriting, and even diversification. You just need to fund your account and select the plan that suits you best. If you are not sure about this, Fundrise can help you select one by asking you several questions about your goals and assessing your risk tolerance. This investment approach may be the best for new investors or those who just want a passive income without putting in much effort. However, for experienced investors, you have to give up control to the platform.

The company’s main products are eREITs, which you buy shares of on the platform. They invest in income-producing real estate. The platform also offers eFunds where investor’s funds are used to buy land and develop houses which are later sold to homebuyers generating a return for the investors. Currently, the company offers goal-based investments where you invest based on your financial goals and not where the properties are located or the type of return you would like to see on your investment.

Even if you cannot invest in individual projects, the platform provides you with details on the projects you are investing in and their risk rating, projected return, loan structure, total size, status and market analysis.

Fundrise Account Levels Reviewed:

The platform has three accounts you can choose from as a new investor. They include:

- Starter Portfolio – this has the lowest amount you can invest with on the platform, $500. However, after investing $1,000 or more, you can upgrade up to a core plan free of charge. In this account level, you cannot invest in individual funds directly. Your investment is diversified across 5 to 10 properties in the three plans. 50% in the income eREIT 3, 25% in the growth eREIT 2021 and the other 25% in the growth eREIT. In case you are dissatisfied with the results, you can sell your investment back at the original price to Fundrise within the first 90 days.

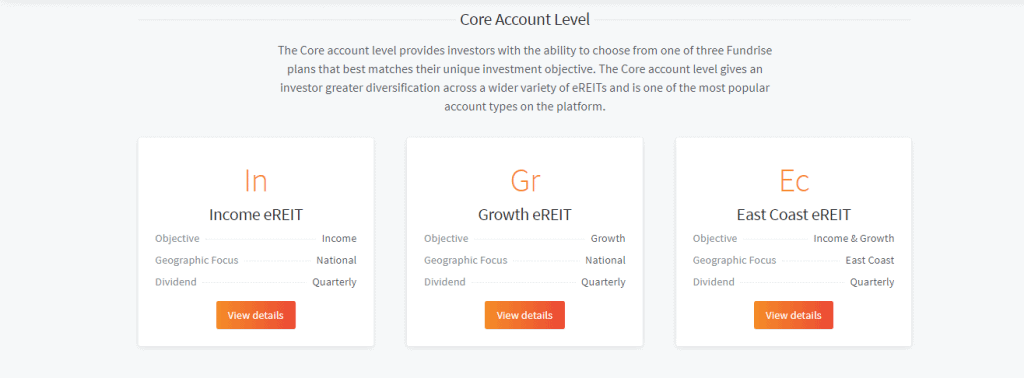

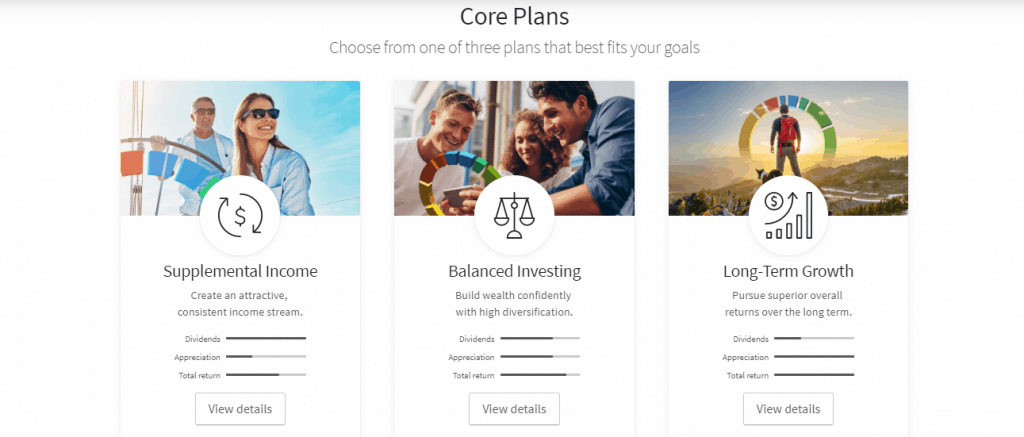

- Core Account level – the core account gives the investors the ability to choose from one of the three Fundrise Review plans that best matches their financial goals. It also gives the investors greater diversification across a wider variety of eREITs. This account requires an investment of between $1,000 and $10,000.

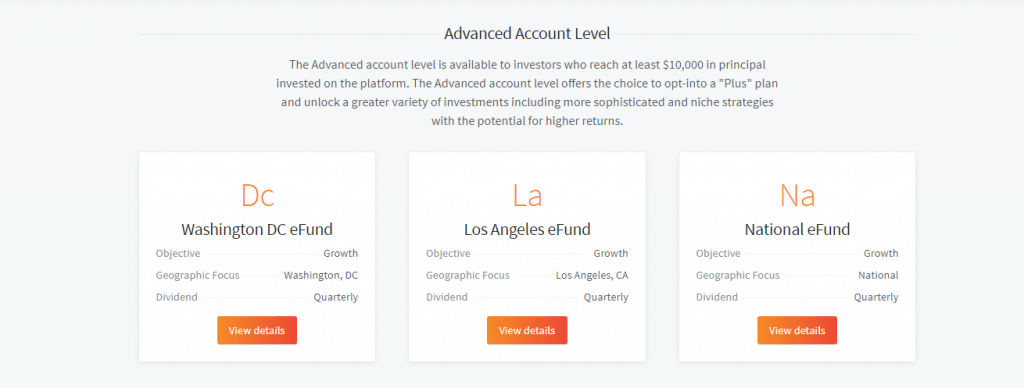

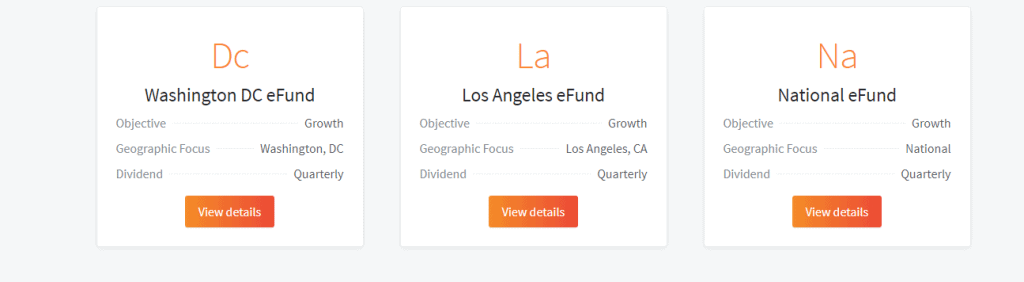

- Advanced account level – This is available to investors with at least $10,000 principal investment on the platform. It offers a plus plan and unlocks a greater variety of investments. Including niche strategies with higher returns potentials. It includes the DC eFund, the LA eFund and the national eFund.

Invest In A P2P Business Loan With Fundrise

Our Rating

- Steady and regular incomes

- Constantly reviewed share investments help you understand your current stand

- Provides sufficient grace period for an enthusiast trader to test their systems

- 10% passive income stream

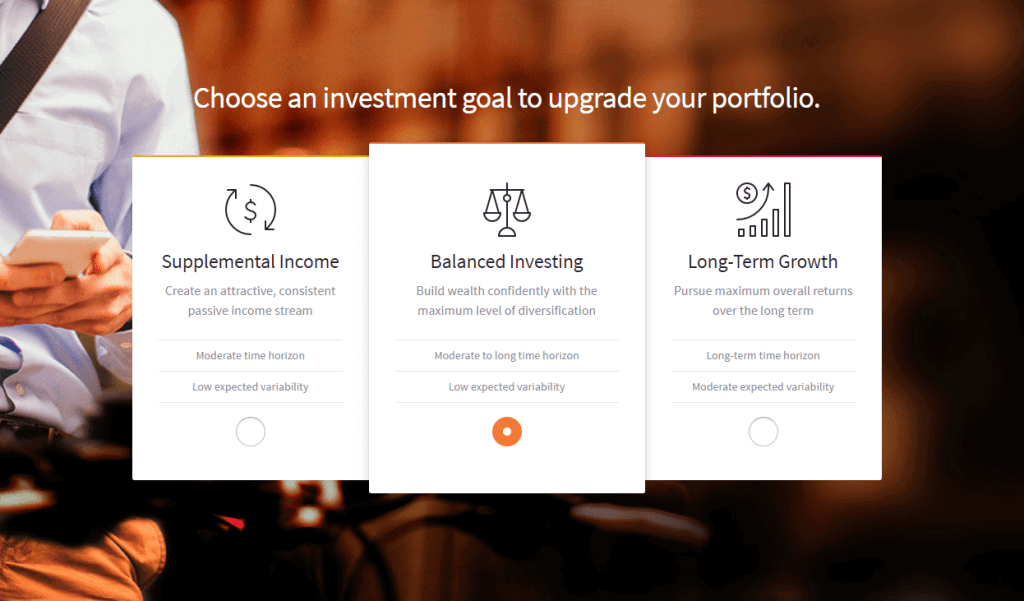

The Fundrise Investment Plans

Fundrise uses three investment strategies in the Core account level.

- Supplemental Income – this aims to create an attractive and consistent income stream. Therefore, the portfolio is allocated largely to debt real estate that generates consistent cash flow. The main goal is to earn returns via quarterly dividends and not so much via appreciation. The dividends are 8.1-9.0% of your return while appreciation is 0.2-0.9%. the projected annual return is 8,3% – 9.8%

- Balanced Investing – this plan seeks to build wealth with high diversification. The aim is to earn via a blend of dividends and appreciation. It is, therefore, a balanced mix of the income and growth strategies. The projected annual return is 5.4% – 6.0% on the dividends and 3.3% – 4.0% on appreciation. The total is 8.7-10.0%.

- Long-term growth – this plan aims for higher overall returns, therefore the portfolio is primarily allocated to real estate with high potential growth. With this plan, you earn higher returns through appreciation. The projected annual return on dividends is 3.0-3.3% and appreciation is 6.1-7.3%. the total is 9.1-10.6%.

Fundrise Products : Starter Portfolio Review

Each of the plans invests in a different combination of eREITs and eFunds. Currently, the platform has 11 eREITs and three eFunds.

eREITs

This is an option that lets you invest into commercial real estate assets such as shopping centres, office buildings, hotels and apartments across the country. It is similar to a mutual fund or an ETF but it is exclusively real estate. This enables you to invest across many properties at once, reducing the costs. However, the investments are very illiquid and you will be penalized for withdrawing your money before maturity.

- Income eREIT 1, 2 and 3, Income eREIT 2021 – their main objective is cash flow. They, therefore, focus on making debt investments in commercial real assets that generate steady cash flow.

- Growth eREIT 1, 2 and 3, Growth eREIT 2021 – the main objective is appreciation. They, therefore, focus on acquiring and owning commercial real estate assets that have the potential to appreciate over time.

- East Coast eREIT – This focuses on a balanced approach of debt and equity investments in commercial real estate located in the East Coast region. New York, New Jersey, Georgia, Florida, DC, Philadelphia, South and North Carolina.

- West Coast eREIT – Deals with acquiring debt and equity investments in commercial real estate located specifically in the West Coast region. LA, CA, Seattle

- Heartland eREIT – balanced approach of acquiring both equity and debt investments in commercial real estate located in the Midwest region. Including Houston, Dallas, Chicago and Denver.

eFund

Fundrise’s eFunds invest in the acquiring, development and sale of residential-only real estate in major cities in the US. The eFunds targets debt and equity investments n homes, condominiums and townhouses in the specified areas. Fundrise eFunds target first time, move up and active adult homebuyers. The available eFunds are only available using Advanced accounts. They include:

- Washington DC eFund – Focuses on developing houses for homebuyers in the Washington DC metropolitan statistical area (MSA). It also plans to capitalize on the growth spurred by Amazon’s announcement of its HQ2 in Northern Virginia.

- Los Angeles eFund – it plans to acquire properties for the development of For-Sale housing targeted at first time, move up and active adult homebuyers in the Los Angels metropolitan statistical area (MSA).

- National eFund – Plans to invest in housing in major US cities specifically targeting first-time homebuyers.

Investing with an IRA

Fundrise Products allows you to invest IRA funds in real estate through its partners Millennium Trust Company in a tax-efficient way for retirement. Currently, the IRA accounts are only eligible to invest in the eREIT products, therefore, you can only invest in commercial real estate.

Fundrise iPO

In 2017, Fundrise offered an ‘Internet Public Offering directly to its customers. To invest, users had to purchase at least 200 shares or $1,000. This was also offered again in 2019. However, there are scant details on the iPO.

Fundrise Auto Invest (DRIP)

Fundrise Real Estate provides an auto investment service called Fundrise Dividend Reinvestment Program (DRIP). It allows you to reinvest your dividends back into open offerings on the platform according to the plan you choose. You can set the amount, Bank account, Investment days and frequency (monthly or bimonthly) for recurring investments. You can also adjust or opt out of the DRIP program at any time.

Fundrise fees

Fundrise charges 0.15% annually for investment advisory services and 0.85% annually for asset management. The total is 1.0% annually. The borrower or property entity pays asset origination/acquisition fees of 0-2%. However, there are other potential charges that may not be transparent hidden within specific eREITs.

Fundrise Review 2026: Verdict

Fundrise Group provides a great way to start investing in real estate. The low minimum investment of $500 makes it accessible for most people, as you don’t have to be an accredited investor. Fundrise reduces the risk for you and the burden of actively dealing with tenants. The platform also has reasonable historical returns.

Before you invest, take into consideration the long term model used by the platform. The investments are illiquid so do not invest with money that you may require in the near future. That aside, Fundrise is worth looking into if you want to invest in real estate passively with less cash.

Invest In A P2P Business Loan With Fundrise

Our Rating

- Steady and regular incomes

- Constantly reviewed share investments help you understand your current stand

- Provides sufficient grace period for an enthusiast trader to test their systems

- 10% passive income stream

Glossary Of Investment Terms

BondsA bond is a loan made to an organization or government with the guarantee that the borrower will pay back the loan plus interest upon the maturity of the loan term. It can be advanced to the national government, corporate institutions, and city administration. It is an investment class with a fixed income and a predetermined loan term.

Mutual FundA mutual fund is a professionally managed investment vehicle that pools together funds from numerous investors and invests it in such securities as stocks, bonds, and other money market instruments. They are headed by portfolio managers who determine where to invest these funds. They are highly regulated and invest in relatively low-risk money markets and in turn post lower rates than other aggressive managed funds.

P2P LendingPeer-to-peer lending (p2p lending) is a form of direct-lending that involves one advancing cash to individuals and institutions online. A P2P lending platform, on the other hand, is an online platform connecting individual lenders to borrowers.

BitcoinBitcoin is the legacy cryptocurrency developed on the Bitcoin Blockchain technology. It is a new form of money primarily developed to solve some of the inherent challenges associated with fiat currencies like inflation and over-production. It is virtual (online) cash that you can use to pay for products and services from bitcoin-friendly stores.

Index FundsAn index fund refers to the coming together of individuals to pool in funds that are then invested in the stock and money markets by professional money managers. The only difference between an index fund and a mutual fund is that the index fund follows a specific set of rules that track specific investments and index stocks.

ETFsAn Exchange-traded fund refers to an investment vehicle that is publicly traded in the stock exchange markets – much like shares and stocks. The fund is expert-managed and its portfolio comprises of such investment products as stocks, bonds, commodities, and more money market instruments like currencies.

RetirementRetirement refers to the time you spend away from active employment and can be voluntary or occasioned by old age. In the United States, the retirement age is between 62 and 67 years.

Penny StocksPenny Stocks refer to the common shares of relatively small public companies that sell at considerably low prices. They are also known as nano/micro-cap stocks and primarily include any public traded share valued at below $5.

Real EstateReal Estate can be said to be the land and buildings on a given property as well as other rights associated with the use of the property like the air rights and underground rights. Real estate can be either commercial if the land, property, and buildings are used for business purposes or residential if they are used to non-business purposes – like building a family home.

Real Estate Investment Trust (REIT)REITs are companies that use pooled funds from members to invest in income-generating real estate projects. While a REIT may specialize in one real estate niche, most diversify and invest in as many high-income real estate projects as possible. They are especially interested in commercial real estate projects like warehouses, prime office buildings, residential apartments, hotels, timber yards, and shopping malls.

AssetAsset simply refers to any resource of value or a resource that can be owned and controlled to produce positive value by an individual or business.

BrokerA broker is an intermediary to a gainful transaction. It is the individual or business that links sellers and buyers and charges them a fee or earns a commission for the service.

Capital GainCapital gains refer to the positive change in the price of a capital asset like shares and stock, bonds or a real estate project. It is the difference between the current selling price of the asset and its lower original buying price and it is considered a taxable income.

Hedge FundA hedge fund is an investment vehicle that pools together funds from high net worth individuals and businesses before having professional money managers invest it in highly diversified markets. The difference between mutual and hedge funds is that the later adopts highly complicated portfolios comprised of more high-risk high-return investments both locally and internationally.

IndexAn index simply means the measure of change arrived at from monitoring a group of data points. These can be company performance, employment, profitability, or productivity. Observing a stock index, therefore, involves measuring the change in these points of a select group of stocks in a bid to estimate their economic health.

RecessionA recession in business refers to business contraction or a sharp decline in economic performance. It is a part of the business cycle and is normally associated with a widespread drop in spending.

Taxable AccountsTaxable Account refers to any investment account that invests in shares and stocks, bonds and other money market securities. The account is offered by a brokerage company and you are obliged to report and pay taxes on the investment income each year.

Tax-Advantaged AccountsA tax-advantaged account refers to savings of investment accounts that enjoy such benefits as a tax exemption or deferred tax payment. Roth IRA and Roth 401K are examples of tax-exempt accounts whose contributions are drawn from after-tax incomes with the yields generated from investing funds therein being tax-exempt. Traditional IRA, 401K plan and college savings, on the other hand, represent tax-deferred accounts. Their contributions are deductible from your current taxable incomes but you get to pay taxes on their accrued incomes.

YieldYield simply refers to the returns earned on the investment of a particular capital asset. It is the gain an asset owner gets from the utilization of an asset.

Custodial AccountsA custodial account is any type of account that is held and administered by a responsible person on behalf of another (beneficiary). It may be a bank account, trust fund, brokerage account, savings account held by a parent/guardian/trustee on behalf of a minor with the obligation to pass it to them once they become of age.

Asset Management CompanyAn Asset Management Company (AMC) refers to a firm or company that invests and manages funds pooled together by its members. Like mutual or hedge funds, the AMC creates diversified investment portfolios that comprise of shares and stocks, bonds, real estate projects, and other low and high-risk investments.

Registered Investment Advisor (RIA)A registered investment advisor is an investment professional (an individual or firm) that advises high-net-worth (accredited) investors on possible investment opportunities and possibly manages their portfolio.

Fed RateThe fed rate in the United States refers to the interest rate at which banking institutions (commercial banks and credit unions) lend - from their reserve - to other banking institutions. The Federal Reserve Bank sets the rate.

Fixed Income FundA fixed-income fund refers to any form of investment that earns you fixed returns. Government and corporate bonds are prime examples of fixed income earners.

FundA fund may refer to the money or assets you have saved in a bank account or invested in a particular project. It may also refer to the collective basket of resources pooled from different clients that are then invested in highly diversified income-generating projects.

Value InvestingValue investing is the art of using fundamental analysis to identify undervalued shares and stocks in the market. It involves buying these shares at the current discounted prices and hoping that a market correction pushes them up to their intrinsic value effectively resulting in massive gains.

Impact InvestingImpact investing simply refers to any form of investment made with the aim of realizing financial returns while positively impacting the society, environment or any other aspect of life in the process. Investment in solar projects and green energy, for instance, posts profits and helps conserve the environment.

Investing AppAn investment App is an online-based investment platform accessible through a smartphone application. It lets you save and invest your funds in a preset portfolio that primarily consists of shares and stocks, bonds, ETFs, and currencies based on your risk tolerance.

Real Estate CrowdFundingReal Estate crowdfunding is a platform that mobilizes average investors – mainly through social media and the internet – encourages them to pool funds, and invests them in highly lucrative real estate projects. It can be said to be an online platform that brings together average investors and lets them enjoy real estate projects previously preserved for high net worth and institutional investors.

FAQs

Can international Investors invest in Fundrise?

Can international Investors invest in Fundrise?

What is the minimum I can add to my investment?

You can add a minimum of $100 from your investor dashboard.

What am I investing in, specifically?

When you make an investment on the platform, your funds are allocated across a diversified mix of eREITs and eFunds (eDirect offerings). The eDirect offerings are portfolios of private real estate assets spread across the US.

How will the return on my investments be distributed?

Any potential returns are paid out either via quarterly distributions or dividends. Or via appreciation in asset value at the end of the investment term. Distributions may be more or less frequent depending on the market conditions, overall portfolio allocation among other factors.

Can I redeem my shares?

Yes, each investment has an adoption plan where an investor can obtain liquidity. However, there is a minimum waiting period of 60 days after submitting the request and you may be subject to a penalty of up to 3% depending on how long you held the investment.

Can I reinvest my dividends?

Yes, you can automatically reinvest the dividends you earn by activating the platform’s DRIP program.

George Gacheru

George Gacheru is a finance and tech writer and currently working on a Masters in Business Information. He has developed a keen interest in all things finance and technology and loves to write about it.View all posts by George GacheruWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up