Economic activity in Europe entered contractionary territory in October according to the IHS Markit Purchasing Managers Index (PMI), as the continent’s economy starts to feel the blow of a second wave of the virus.

The Eurozone’s PMI Composite index dropped to 49.4 during the month according to data released by the research firm this morning, which is the lowest level seen by the index since June.

This represents 1 point less than the 50.4 reading the index showed in September, while a figure below 50 indicates that economic activity is now in contraction mode.

The services sector saw the biggest decline in activity during the month, with the Services PMI Activity index plunging to 46.2 down from a previous reading of 48 in September. Meanwhile, the manufacturing sector is surprisingly seeing stronger activity, as it posted a 32-month high during the month at 57.8 – up from a previous reading of 57 .1 in September.

This would the third consecutive month in which the eurozone sees a contraction in its economic activity, a situation that is driven by a strong resurgence of the virus in key countries including France, Italy, and the United Kingdom, which has led to the reintroduction of focalized lockdowns and other similar restrictions.

Germany was one of the bright spots of the region, as the country’s activity continues to expand despite the situation, although the index fell 0.2 points to 54.5 during the month. Meanwhile, France continues to see its activity levels deteriorate, as the country’s PMI Composite Index dropped 1.2 points during October at 47.3.

In regards to this latest data, Chief Business Economist for IHS Markit Chris Williamson said: “The eurozone is at increased risk of falling into a double-dip downturn as a second wave of virus infections led to a renewed fall in business activity in October”.

The economist further highlighted that another downturn in the region’s economy “will exert greater pressure on the ECB to add more stimulus and for national governments to help cushion the impact of COVID-19 containment measures”.

How are the European markets reacting to the news?

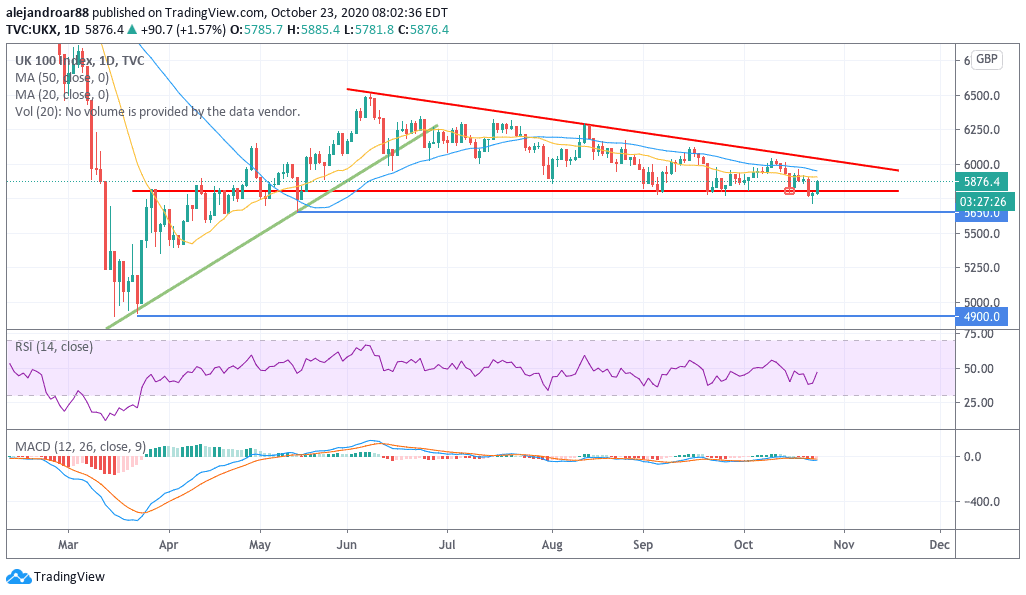

European stock markets are advancing this morning led by the British FTSE 100 index, as Barclays reported stronger-than-expected results during the third quarter of the year.

The UK’s stock index is rising 1.6% so far during mid-day stock trading activity followed by the German DAX and the French CAC 40, which are gaining 1.22% and 1.45% respectively.

The banking sector is leading the rally in the FTSE 100 today, with shares of other financial institutions including HSBC, Lloyds Banking Group, and Standard Chartered advancing strongly as well.

That said, the virus situation and the deceleration seen in the services sector – which accounts for roughly 70% of the region’s economy – continues to reinforce a bearish outlook for the continent’s economy, at least until this second wave of contagions is put under control.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account