The US Fed would begin its two-day meeting today post which it would announce the rate hike decision. Markets expect Fed to raise rates by 50-basis points at the meeting but could chair Jerome Powell surprise markets?

The Fed has been on a rate hiking spree not seen since the 1980s. It has raised rates at every meeting since March after previously ending its monthly bond-buying program, widely referred to as tapering.

The US central bank started with a 25-basis point rate hike but raised rates by 50-basis points at the May meeting. Since then, it has raised rates by 75 basis points at every meeting.

The rate hikes were mostly in line with what the markets were expecting. US inflation surged to a multi-decade high of 9.1% in June but has since tapered down to 7.7%. Today, the November CPI data would be released which would be the last key economic indicator before the Fed’s policy decision.

Fed has been on a rate hike spree

In 2021, even as many economists were worried about inflationary pressures, the Fed took a controversial stance and said that inflation is transitory and is due to supply chain issues. There indeed were crippling supply chain issues last year as the world economy started to recover from the COVID-19 pandemic.

However, soon it became evident that inflation is not exactly transitory and was here to stay. Even Powell admitted later in the year that the term transitory needs to be retired. Many economists believe that the Fed misread inflation and ended up being too dovish last year.

Now, it has embarked on aggressive tightening in order to tame inflation. While the Fed went the extra mile in 2021 to support the economic recovery, now it is willing to risk a recession in order to lower sky-high prices.

Powell has indicated that the Fed might slow down the pace of hikes

Towards the middle of the year, many analysts said that the Fed would soon pivot from rate hikes to rate cuts. Powell however dashed those hopes and warned against premature easing. More than the rate hikes, Powell’s hawkish comments have spooked markets this year.

However, he has made some dovish remarks of late. At the Brookings Institution earlier this month, he said, “The time for moderating the pace of rate increases may come as soon as the December meeting.”

Powell admitted that the US central bank has been “pretty aggressive.” He added, “We wouldn’t…try to crash the economy and then clean up afterwards. I wouldn’t take that approach at all.”

Powell has made dovish comments recently

Powell talked about the lag impact of monetary policy actions. He said, “Thus, it makes sense to moderate the pace of our rate increases as we approach the level of restraint that will be sufficient to bring inflation down.”

Powell however expressed concerns over the strong wage growth and said that it’s a dampener for lowering inflation.

He said, that the US job market “shows only tentative signs of rebalancing, and wage growth remains well above levels that would be consistent with 2% inflation.”

Despite layoffs at several companies, the US job market has been quite strong. In November, the US economy added 263,000 jobs which were ahead of estimates. The unemployment rate is 3.7% which is low by historical standards.

While Powell admitted that strong wage growth “is a good thing” he added, “For wage growth to be sustainable, it needs to be consistent with 2% inflation.” Meanwhile, many economists disagree with Powell on wage growth and point out that in real terms wage growth is actually negative as it is below the rise in inflation.

Many business leaders want Fed to cut rates

While Powell has said that the Fed is looking to slow down the pace of tightening, Tesla’s CEO Elon Musk wants the US central bank to immediately cut rates in order to avert a recession. Musk has warned of a recession previously also and also cut Tesla’s workforce. He also fired half of Twitter’s employees after he acquired the company. He recently tweeted that a Fed rate hike in December would only amplify a recession.

Tesla stock meanwhile has been in a freefall since Musk acquired Twitter. Surveys show that Tesla brand has taken a hit after Musk’s Twitter acquisition.

Some analysts see US stocks falling in 2022

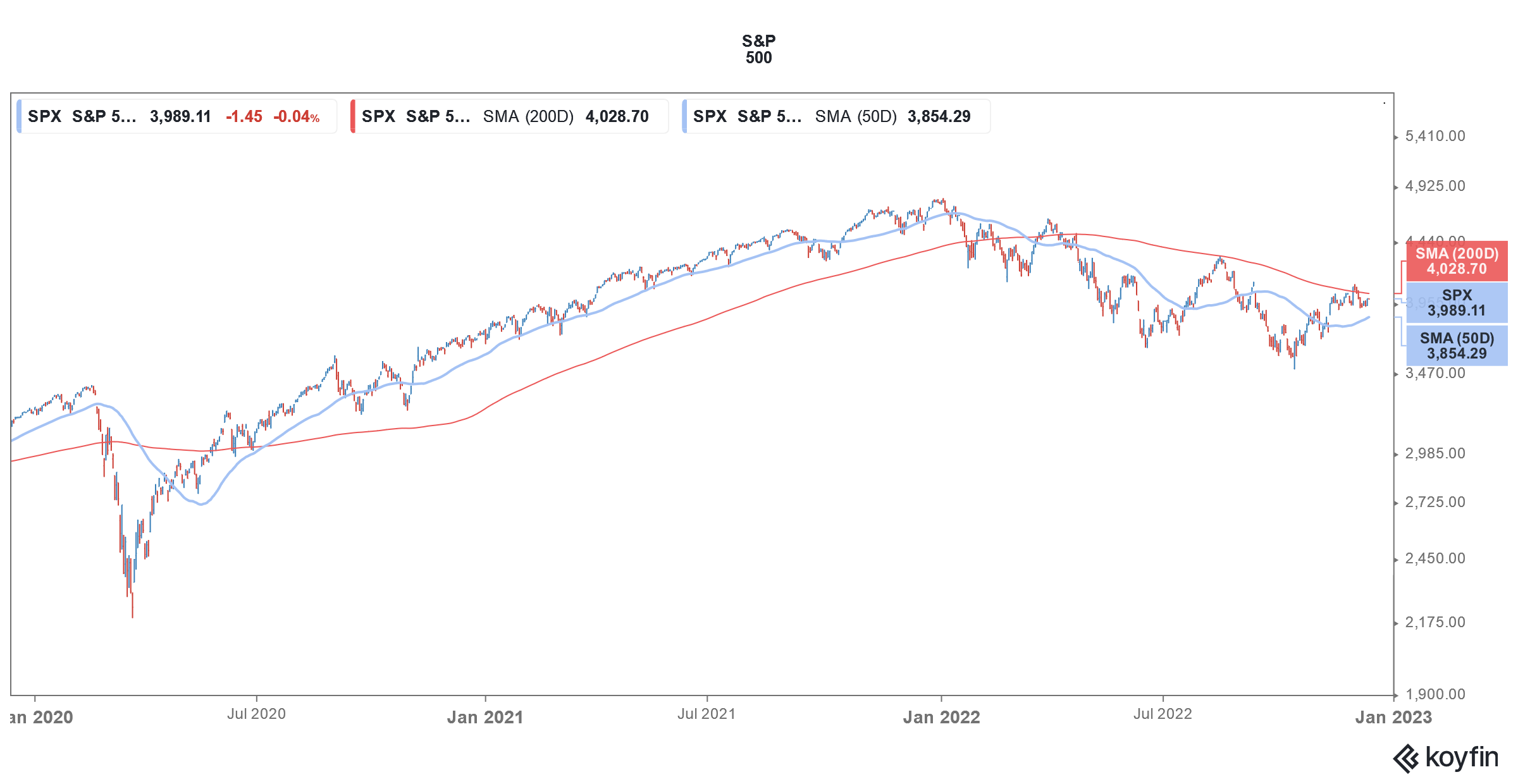

Fed’s rate hikes have taken a toll on US stock markets this year and some analysts believe that 2023 would be no better. Hedge fund manager Dan Niles whose long-short fund is outperforming the markets in 2022 sees US stocks hitting new lows in 2023.

Niles listed high inflation, rising interest rates, high inflation, and a slowdown in earnings as a bearish driver for US stocks.

Niles is not alone in predicting a new low for US stocks in 2023. Mike Wilson, Morgan Stanley’s chief US equity strategist, who correctly predicted the 2022 stock market crash, is not too bullish on the markets heading into 2023.

Wilson sees the S&P 500 falling to as low as 3,000 in the first four months of 2023. He said, “That’s when we think the deacceleration on the revisions on the earnings side will kind of reach its crescendo.”

He said that the bear market is still not over and “We’ve got significantly lower lows if our earnings forecast is correct.”

US stocks rise before Fed meeting

US stocks closed in the gains yesterday in an otherwise volatile session. However, US stocks could be volatile this week as markets brace for the November CPI report and the all-important Fed meeting.

Whether US stocks see a Santa Claus rally this year would largely depend on the Fed’s action at the next meeting. Could Powell come up with a surprise tomorrow? We’ll have to wait and see.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account