Airline stocks have taken a beating this week, after JP Morgan analyst Jamie Baker outlined four reasons why the recent rally seen by US carriers will run out of fuel.

Baker said in a Wednesday note to clients: “We do not believe the current pace of equity ascent can be potentially maintained for much longer, for four reasons”.

The analyst for the US bank wrote: “First, TSA [Transportation Security Administration] recovery rates are likely to moderate this fall as corporate demand inadequately backfills pent-up summer leisure travel.”

Next, Baker said: “Valuation [a term that hasn’t been a significant part of our lexicon as of late] is beginning to stretch for some.”

The analyst argued: “Third, Treasury loan decisions are believed to be imminent, and may prove the last easily identifiable near-term catalyst, potentially followed by dilutive equity raises.”

Then Baker wrote: “Lastly, to the extent that bolstered summer schedules helped stoke the recent rally, we worry as to the market’s reaction should airlines begin trimming autumnal schedules once they become responsible for labor costs (recall the government is effectively picking up the tab for wages) and furlough activity crescendos.”

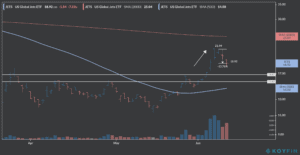

After six consecutive days of gains that pushed its value to the highest level since the 14 May bottom, the popular US Global Jets (JETS) exchange-traded fund, which holds a large portion of major US airline stocks, fell during the past two sessions by 13.8% and it is currently sliding by 9.9% so far during pre-market stock trading activity, trading at around $17 per share.

An increased number of day traders have been reportedly speculating with the ETF recently, in hopes that the economic recovery and the easing of lockdown measures could push airlines back to their pre-pandemic levels.

However, the JP Morgan report along with other bad news, including signs of a second wave of the virus in many states in the country, have caused a panic sell-off that is pushing down airline stocks back to their 50-day moving average, an indicator of their short-term strength.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account