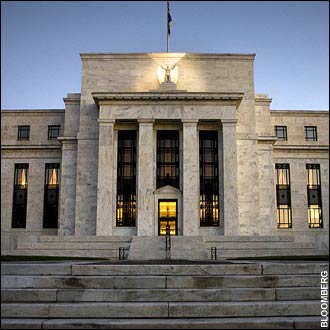

Though it isn’t for certain, analysts expect the Federal Reserve to cut interest rates in an attempt to protect the economy from possible problems in the future. This, of course, would affect how much both companies and citizens borrow from each other, reports MarketWatch.

Federal Reserve Is Preemptively Prepping

What’s odd about this is the fact that the economy is performing quite well, with stock market day trading at record numbers and unemployment at a 50-year low, and it is incredibly rare to have both situations at once.

However, the decision isn’t as much about the economy as we may think. That’s even with a 2.1% growth last quarter and a 3.1% growth in quarter one.

Instead, the Federal Reserve is trying to prepare the United States for the results of the upcoming trade talks between China and other countries. As you may know, recent developments have resulted in tariffs from both spaces, which is bad for the world’s economy as a whole.

Think of this rate cut as sort of a set of armor in case things go south in the talks and get even worse.

As the publication claims, many reports this week point to the economy staying good and in fact getting better. In June, citizens reported spending more on themselves, meaning an increase in financial security, even if this growth is slow.

Of course, that was last month. While these positive numbers are unlikely to have changed in a 30 day period, we see July’s employment numbers next Friday. This is two days after the Federal Reserve enforces its decision. We’ll then have more insight on if it was the right one or not.

On top of this, MarketWatch polled different economists to talk about job increases. They found that there were around 170,000 new jobs brought in this month. That’s less than the 224,000 from June, but still notable in and of itself.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account