The price of Bitcoin kept falling during the weekend while the US dollar is regaining strength as Thursday and Friday’s bearishness seems to be spilling over to this week’s cryptocurrency trading activity.

As of this morning, the value of Bitcoin against the US dollar (BTC/USD) has dropped 15% in just 4 days while losing 1.5% so far during today’s session at $10,126 per coin. Meanwhile, the greenback – as reflected by the US dollar index – is on track to post its five consecutive day of gains as market volatility persists.

Multiple weekend reports indicated that SoftBank – the multinational high-tech conglomerate led by billionaire investor Masayoshi Son – was one of the players behind the seemingly endless tech stock rally that pushed the Nasdaq 100 tech-heavy index to all-time highs after it plunged during the pandemic sell-off of February – March.

These speculative bets consisted of purchasing derivatives including call and put options in high volumes, which ended up forcing brokers to hedge their exposure by buying the underlying assets tracked by the derivatives resulting in a boost for the price of the assets as part of some sort of reinforcing loop strategy pursued by the Japanese firm.

However, the situation seems to have shifted, as investors offloaded a high volume of financial securities during Thursday and Friday – including cryptocurrencies – which triggered a broad-market correction that doesn’t appear to have found a floor just yet.

Where is Bitcoin headed?

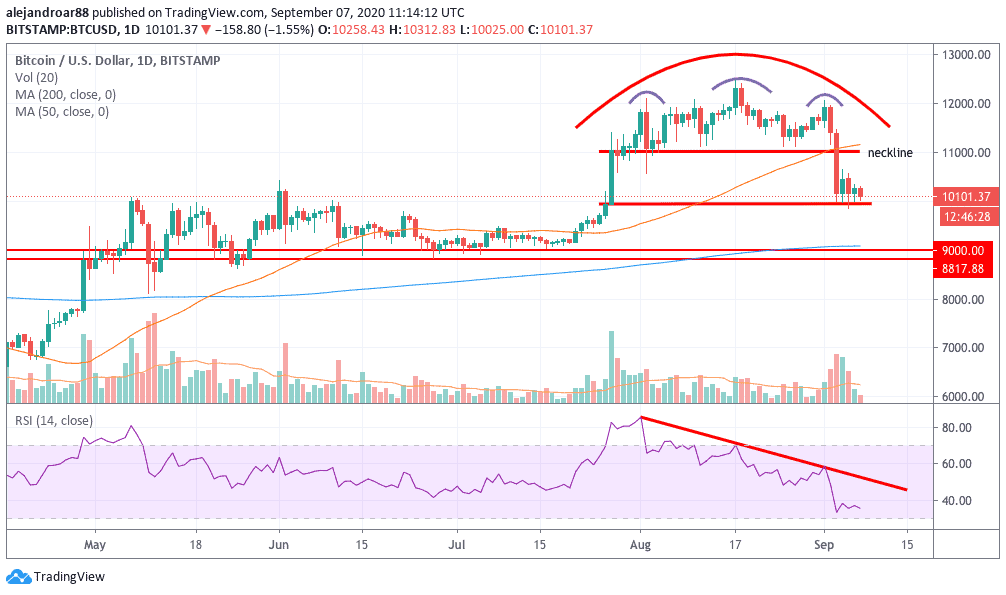

Bitcoin’s latest price action appears to be forming a rounding top pattern after the completion of a head and shoulders pattern as the cryptocurrency failed to go above the $12,000 level twice – the shoulders – although it managed to climb higher to the $12,500 level once – the head.

BTC has already crossed the neckline of that head and shoulders formation, which could be an indication that more pain is ahead for BTC. However, the floor of the rounding top formation is yet to be determined, as it can be argued that it is either at the $9,950 level or at the $9,000 psychological support line.

Meanwhile, Bitcoin’s price has been posting lower highs in the RSI indicator, which indicates a bearish divergence – a signal that points to a weak price strength.

If the price continues to fall to the low $9,000s this bearish momentum could end up plunging the value of the cryptocurrency king even further although the RSI is approaching oversold levels – a space where BTC hasn’t stay for long in the past.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account