Meta Platforms (NYSE: META) stock is up sharply in US premarket price action today after it reported better-than-expected earnings for the first quarter of 2023 and also provided upbeat guidance.

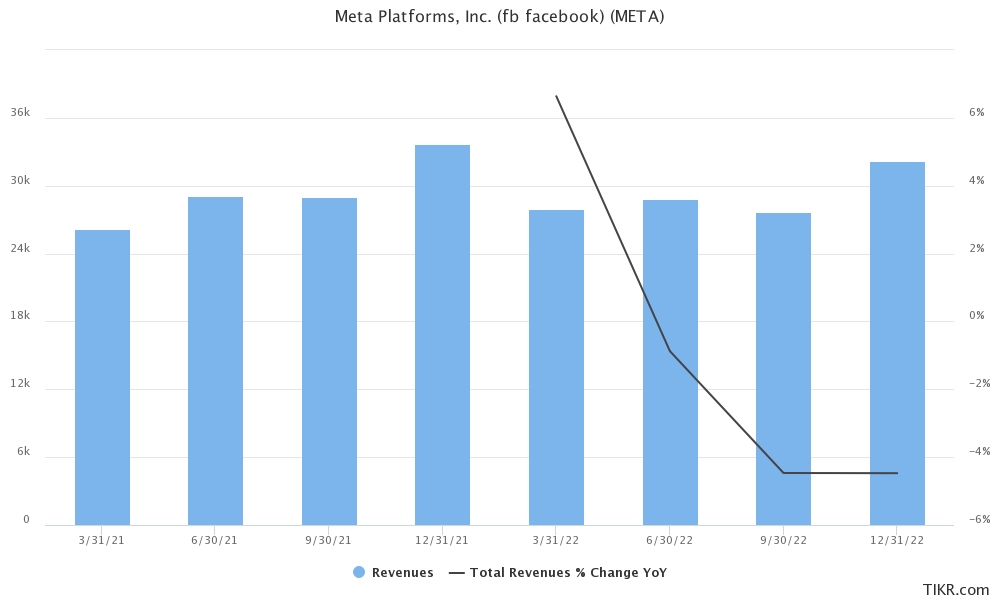

Meta Platforms reported revenues of $28.65 billion in the quarter which was ahead of the $27.65 billion that analysts expected. The revenues rose 3% YoY and were ahead of the company’s guidance.

Also, it was the first time since Q1 2022 that the Mark Zuckerberg-led company posted an annual increase in revenues. The company’s revenues fell YoY in the last three quarters of the last year, eventually leading to its first annual fall in revenues.

Meta Platforms stock rises after Q1 2023 earnings beat

Meta Platforms posted an EPS of $2.20 in the quarter. While the metric fell 19% YoY it was ahead of the $2.03 that analysts expected.

Zuckerburg has touted 2023 as the “year of efficiency” and amid slowing growth, the company has been looking to cut costs. It now expects its total 2023 expenses to be between $86 billion-$90 billion which includes restructuring costs between $3 billion-$5 billion.

Meta has lowered its operating expense guidance multiple times this year thanks to the aggressive cost cuts.

It has laid off thousands of employees and by the time it is done with the planned layoffs, its workforce would be around 25% lower than what it was at the peak in 2022.

Key takeaways from Meta Platforms’ Q1 2023 earnings

Meta Platforms reported DAUs (daily active users) of 2.04 billion in the quarter – ahead of the 2.01 billion that markets were expecting. The ARPU (average revenue per user) came in at $9.62 which was ahead of the $9.30 that analysts were expecting.

Meta is already the second-best performing S&P 500 stock of the year and looks to further extend its lead looking at the monster premarket rally.

Zuckerburg sounded upbeat after the results and said, “This was a good quarter and we’re seeing growing momentum in our products and business. Our community reached the milestone that now more than 3 billion people use at least one of our apps each day.”

He again stressed “efficiency” and added, “The goals of our efficiency work are to make us a stronger technology company that builds better products faster, and to improve our financial performance to give us the space in a difficult environment to execute our ambitious long-term vision.”

Metaverse losses swell

Meanwhile, even as Meta Platforms reported better than expected earnings, its metaverse losses swelled to $3.99 billion – which is slightly below the record quarterly loss of $4.28 billion in the previous quarter. However, the segment’s revenues plummeted to a mere $339 million in the quarter.

Notably, the Reality Labs business, which is building the metaverse posted operating losses of $13.7 billion last year on revenues of a mere $2.16 billion. While the segment’s revenues fell YoY last year the losses ballooned by over $2.5 billion.

While several investors have called on the company to cut its metaverse losses and some recent reports suggested that the company is scaling back on the business, Zuckerburg has defended these investments as key to Meta’s long-term success.

In his prepared remarks, he said, “A narrative has developed that we’re somehow moving away from focusing on the metaverse vision, so I just want to say upfront that that’s not accurate.”

He added, “Building the metaverse is a long term project, but the rationale for it remains the same and we remain committed to it.”

Zuckerburg sees an opportunity in AI

Zuckerburg reiterated his previous views that while AI is a good short-term opportunity for Meta, metaverse would drive long-term growth.

He said, “Our AI work comes in two main areas: first, the massive recommendations and ranking infrastructure that powers all of our main products — from feeds to Reels to our ads system to our integrity systems and that we’ve been working on for many, many years — and, second, the new generative foundation models that are enabling entirely new classes of products and experiences.”

Chinese advertisers helped drive growth

Meta said that the online e-commerce business was the biggest driver of revenue growth in the quarter followed by healthcare and entertainment. It said that its revenues received a boost from Chinese advertisers who tried to reach consumers in other markets.

It, however, said, “other verticals remain challenged, with financial services and technology verticals being the largest negative contributors to year-over-year growth.”

During the quarter, Meta repurchased $9.22 billion worth of its shares and still has $41.73 billion authorized for buybacks. The company ended the quarter with cash and cash equivalents of $37.44 billion while its long-term debt was $9.92 billion.

Meta Platforms provided better-than-expected guidance

Meta Platforms expects to post revenues between $29.5 billion-$32 billion in the second quarter. The guidance was better than expected and even the lower end implies a revenue growth of 2.4%.

While that’s a fraction of the double-digit revenue growth that the company delivered since it went public, it nonetheless signals that the worst is over for the company as far as revenue decline is concerned.

Meta meanwhile expects Reality Labs’ losses to rise YoY in 2023 – just as they did last year.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account