After around a month of rumors, Meta Platforms (NYSE: META) has announced its second round of mass layoffs. Would other tech peers follow suit?

Last year, Meta Platforms laid off 11,000 employees which were 13% of its workforce. Now, the company has said that it would lay off another 10,000 people and close another 5,000 open positions for which it hasn’t yet hired.

In his blog announcing the layoffs, Meta Platforms CEO Mark Zuckerburg said that as part of the “year of efficiency” Meta wants to become a “better technology company.” The second goal per Zuckerburg is “to improve our financial performance in a difficult environment so we can execute our long term vision.”

Meta Platforms announces second round of layoffs

He added, “Here’s the timeline you should expect: over the next couple of months, org leaders will announce restructuring plans focused on flattening our orgs, canceling lower priority projects, and reducing our hiring rates.”

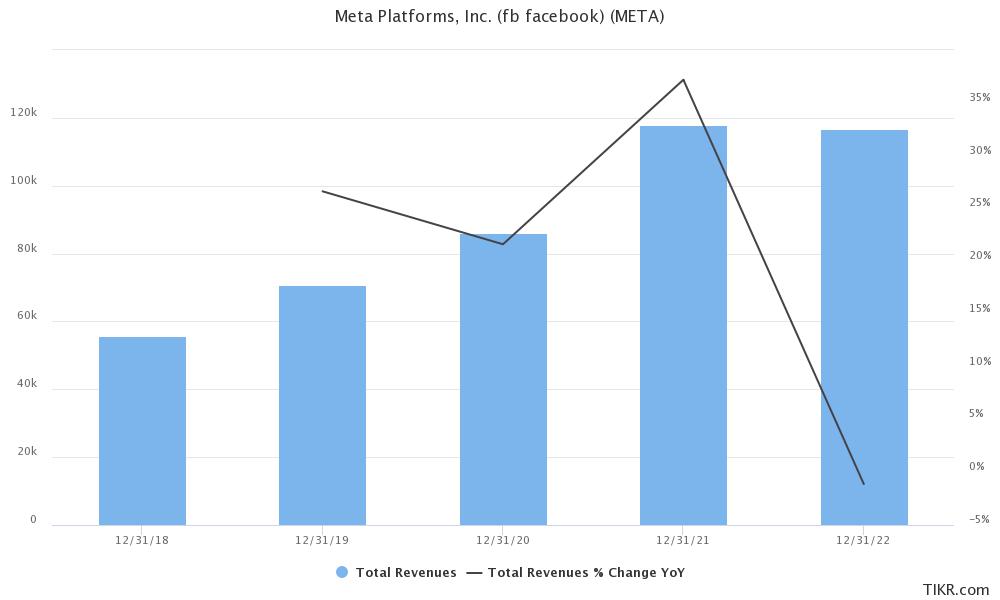

Zuckerburg warned of troubles ahead and said that the slowdown might continue for years. Notably, Meta Platforms’ revenues fell YoY in the last three quarters and 2022 was the first time in history that its revenues fell on a YoY basis.

Also, the lower end of its Q1 2023 guidance implies another quarter of falling revenues. The top end however implies a slight rise in revenues.

Meta Platforms’ revenues were hit by Apple iPhone privacy rules

Meta Platforms is facing multiple headwinds like the Apple iPhone privacy rules which it estimates shaved off nearly $10 billion from its 2022 revenues. To make things worse the global digital ad market is slowing down. Facebook is also facing competition from players like TikTok and last year the combined market share of Google and Facebook in the US digital ad market fell below 50% for the first time since 2014.

Also, Facebook has reached saturation in many markets and has also been losing popularity among teens. Zuckerburg talked about saturation during the Q3 2022 earnings call. He said, “Across the family, some apps may be saturated in some countries or some demographics, but overall, our apps continue to grow from a large base.”

Zuckerburg blames higher interest rates and geopolitical tensions

In his blog, Zuckerburg said, “Higher interest rates lead to the economy running leaner, more geopolitical instability leads to more volatility, and increased regulation leads to slower growth and increased costs of innovation.”

Meanwhile, after the current rounds of layoffs, Meta Platforms’ headcount would be over 20% lower than it was in October 2022.

Altimeter Capital wrote a letter to Meta Platforms

Last year, Altimeter Capital Chair and CEO Brad Gerstner wrote an open letter to Zuckerburg and Meta Platforms’ board calling upon the company to slash the workforce by 20%.

In the letter Gerstner wrote, that the 20% headcount reduction that he proposed “merely takes the company back to mid-2021 levels of employee expense — and I don’t think anybody would argue that Meta wasn’t sufficiently staffed in 2021 to tackle a business that looks similar to how it looks today.”

He added, “It is a poorly kept secret in Silicon Valley that companies ranging from Google to Meta to Twitter to Uber could achieve similar levels of revenue with far fewer people.”

Meta Platform stock soared after announcing layoffs

Meanwhile, Meta Platforms stock soared over 7% yesterday and has now more than doubled from its recent lows. In 2022, Meta Platforms was the worst-performing FAANG stock as it lost around 65%.

However, things have been different in 2023 and not only is Meta Platforms the best-performing FAANG stock by a wide margin but is also among the top five S&P 500 gainers.

Tech layoffs have mounted

The overall US job market has been quite strong and the US economy added 504,000 and 311,000 jobs in January and February respectively. The jobs report shattered estimates for both months especially January where even the revised rating shows over half a million new jobs.

However, it has been a different story when it comes to tech companies. Among FAANG peers, barring Apple all the others have announced mass layoffs. Earlier this year Amazon said that it is eliminating 18,000 positions which were significantly higher than what it was previously contemplating.

In the tech space, companies ranging from Uber, Microsoft, Salesforce, Dell, HP, Twitter, Twilio, Snap, and Snap have announced mass layoffs.

While Apple hasn’t yet announced layoffs it has slowed the pace of hiring. The iPhone maker was the best-performing FAANG stock of 2022 and the only one among the once-coveted group to outperform the Nasdaq.

Recession fears have increased

Meanwhile, recession fears have risen amid the regional bank crisis. Commenting on the collapse of SVB, Jim Cramer said markets “dodged a major bullet” amid the quick action by federal agencies. Cramer added that the US might have headed for a “full blown” recession if not for the timely intervention.

Notably, recession fears have risen and Jeffery Gundlach said that a recession looks “imminent” looking at the steepening of the yield curve. Incidentally, the US yield curve has now been inverted for months which many see as a recession warning.

Ad spending invariably falls in an economic slowdown. In his blog, Zuckerburg said, “Operating our business more efficiently will give us the resources and confidence to achieve our long term vision by delivering sustainable financial results that make us an attractive company to work at and invest in.”

All said, after Meta Platforms’ recent round of layoffs, all eyes would be on other tech majors many of which have already announced one round of layoffs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account