Fast5kLoans Loan Review 2020 – READ THIS BEFORE Applying!

If you’re looking for a loan – whether that’s on a short-term or long-term basis, finding the best deal possible can be a laborious task. By searching for deals directly, not only can this be time consuming, but you stand the chance of missing the best rates in the market.

That’s where the likes of Fast5kLoans comes in. The online platform is a third party marketplace that aims to find you the best loan deals on offer, all through a single search. If you’re thinking about using the platform for your lending needs, be sure to read our Fast5kLoans review. We’ve covered everything from eligibility, how much you can borrow, fees, and more.

Apply for a Payday Loan Now! | Best Payday Lender 2020

- Loans From $100 to $15,000

- Instant Application & Approval

- Bad Credit Considered

- Lenders From All 50 US States Onboard

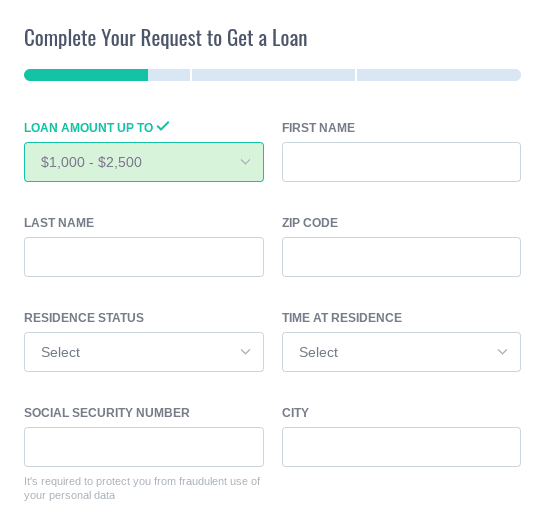

Fast5kLoans is an online comparison-style platform that aims to match you up with loan providers. The platform allows you to enter your loan requirements in to a single search form, and then you will be presented with a list of offers based on the details you enter. In terms of the fundamentals, Fast5kLoans has one of the most comprehensive network of lenders at its disposal. In fact, you can borrow from as little as $1,000, up to a maximum of $5,000. This can be taken out from just 6 months, all the way up to 6 years. In this sense, Fast5kLoans deals with lenders in both the short-term and installment loan space. It is also worth noting that the platform has partnered with a number of bad credit lenders. As such, if you’re in the look-out for a loan but your credit is less than ideal, you might still find a suitable lender. Fast5kLoans Pros: ✅Extensive number of lenders within its network ✅Loans range from $1,000 – $5,000 ✅Loan terms of between 6 months and 6 years ✅Suitable for all credit scores ✅Find the best loan deals through a single search ✅No fees Cons: ❌ Not a direct lender ❌ Very outdated website with lots of spelling errors Fast5KLoans is not a direct lender but a loans marketplace dedicated to bringing together lenders and borrowers. It boasts of a wide range of lenders offering multiple types of loan products with fairly extended loan repayment periods and favorable loan terms. But how does it compare to similar online lending platforms and direct lending loan companies? We compared it against LendUp, Ace Cash Express and Check ‘n’ Go and here is how it faired: First5KLoans Ace Cash Express LendUp Check N Go The Fast5kLoans platform operates much in the same way as any other comparison-style loan website such as LendUp, CashUSA, or MoneyMutual. When you first visit the Fast5kLoans homepage, you will need to click on the Apply button. Once you do, you will then need to fill out a form. Initially, this includes the amount you want to borrow, alongside some personal information such as your full name, home address, how long you’ve lived at the address, and your residence status. Moreover, you will also need to enter your social security number and date of birth. On the next page, you will then need to provide some information about your financial profile. This includes your employment status, your monthly income, where you work, and your current credit score. Finally, you’ll need to enter the checking account that you want the funds paid in to. Once you’ve completed the application form, the Fast5kLoans engine will then perform its magic. You’ll see a list of suitable lenders that are able to loan you money based on the information you entered in your application. At this point, you’re under no obligation to proceed. If you do, you’ll then be taken to the lender’s website, and thus, you’ll no longer deal with Fast5kLoans. Fast5kLoans does not charge you anything to use its search service. This is standard in the online comparison space, as platforms will make their money directly from the lenders themselves. Nevertheless, as you will be dealing directly with the lender in question, you need to assess how much you are going to pay on your loan. Unfortunately, there is no one-size-fits-all answer to how much your loan is going to cost. Not only will this be determined by the state you live in and the amount you want to borrow, but ultimately, your rates will be based on your individual credit profile. In other words, the better your credit is, the better the APR rates will be. Nevertheless, we have listed the key drivers that Fast5kLoan lenders will be looking for when assessing your APR rate. ✔️ Monthly income ✔️ Employment and home ownership status ✔️ FICO score ✔️ Your history with debt ✔️ How much you want to borrow and for how long On top of the APR rates you are presented with after you complete the Fast5kLoans application, it is also crucial that you make considerations regarding a potential origination fee. For those unaware, an origination fee is often charged by lenders as a way of “covering the costs” of arranging the loan. Although Fast5kLoans won’t charge you an origination fee (as they are not a lender), the lender you decide to proceed with might. In fact, although this rarely exceeds 5% of the loan amount, some lenders have been known to charge as much as 20%! As a comparison platform that seeks to service credit profile of all types, the eligibility requirements are actually very low at Fast5kLoans. The reason for this is that the platform has a highly extensive number of lenders in its network. While some lenders will specializes in bad credit loans, Payday loans or no credit check loans, others will focus on providing low interest loans to those with excellent credit. Nevertheless, you still need to make sure that you meet the requirements set out by Fast5kLoans, which we have listed below. ✔️ Be a permanent resident or citizen of the US ✔️ Aged 18 years and above ✔️ Have a valid social security number ✔️ Have a regular source of income ✔️ Be in employment ✔️ Have a valid checking account As you will see from the above criteria, as long as you have bank account, are aged 18 or over, live in the US and have an income of some-sort, then you will likely qualify for a loan. What you will also notice is that you don’t need to have a minimum credit score to apply. While most lenders will check your FICO score, some will look at your income instead. Once again, as Fast5kLoans is not a direct lender, the funding process will vary from lender-to-lender. However, and as is common with the vast majority of loan providers operating online, it’s likely that you will receive your money the next working day after you are approved. In terms of the approval process itself, this can usually be completed in a matter of minutes if the lender is able to electronically verify your identity. If they can’t, and they need you to upload supporting documents, then this can delay the funding process. Much like in the case of the funding process, how you end up paying your loan back will depend on the specific lender you go with. Nevertheless, in the vast majority of cases, you will need to set-up an automatic debit via your checking account. In fact, even if other options do exist, we would suggest going the automatic debit route. The reason for this is that you can ensure that you never miss a payment. Alternative options that might also be available are debit card payments, money order, check, and even Money Gram. Take note, these options will require you to make manual payments at least a couple of days before the due date. It is important to remember that when using the Fast5kLoans platform, you are NOT getting a loan with Fast5kLoans. Instead, the platform is merely connecting you with lenders that meet your individual requirements. As such, any missed payments MUST be taken up with the lender, as opposed to Fast5kLoans. Nevertheless, if you do think that you are going to miss a payment, you should contact the lender at the first possible opportunity. Ultimately, if you do miss a payment, then it’s all-but certain that you will be charged a late payment fee. In most cases, you will also need to pay interest on the late payment fee alongside the principal loan amount. This can consequently add hundreds of dollars on to your loan, so it is important that you avoid missing a payment at all costs. Fast5kLoans does list its contact details on its main homepage, meaning that we had to perform a Google search to find them. Nevertheless, you can contact the team at Fast5kLoans on the details below. 📱 Phone: Not Provided 📧 Email:[email protected] ✍️ In Writing: Fast5kLoans, 7050 West Palmetto Park Road #15-345, Boca Raton, FL 33433 On the one hand, Fast5kLoans is not a lender, and thus, you don’t need to worry about the company utilizing unethical lending practices. However, the platform itself is not only super outdated, but it is riddled with spelling mistakes. Moreover, there is no information available on the website other than the homepage itself. What we should also note is that Fast5kLoans is not overly selective on the lenders that it accepts into its network. This opens up the doors to potential scam lenders. Don’t forget, Fast5kLoans will pass all of your details on to the lenders in its network, meaning that you might receive unwanted telephone calls. Moreover, the Fast5kLoans website does not have a secure SSL security certificate, and one of the links on the homepage takes you to a third party lender that looks ultra-suspicious. In summary, if you’re looking to find some of the best loan deals in the market, then Fast5kLoans allows you to do this via a single search. However, we would suggest proceeding with extreme caution. The platform itself is massively outdated, lacks material and important information, contains a number of spelling mistakes, and ultimately, looks too unprofessional for our liking. Moreover, and perhaps, most importantly, Fast5kLoans also makes it unclear as to whether or not the search will have an impact on your credit score. There are heaps of alternative loan comparison websites that allow you to find the best deals via a soft credit check, meaning that the search won’t impact your score. Apply for a Payday Loan Now! | Best Payday Lender 2020What is Fast5kLoans?

What are the Pros and Cons of Fast5kLoans

Fast5KLoans marketplace vs popular online lenders, how does it compare?

How Does Fast5kLoans Work?

How Much Does Fast5kLoans Cost?

Other Fees to Consider

Am I Eligible for a Fast5kLoans?

When Will I Receive my Funds?

Paying Your Loan back

What if I Miss a Payment?

Customer Service at Fast5kLoans

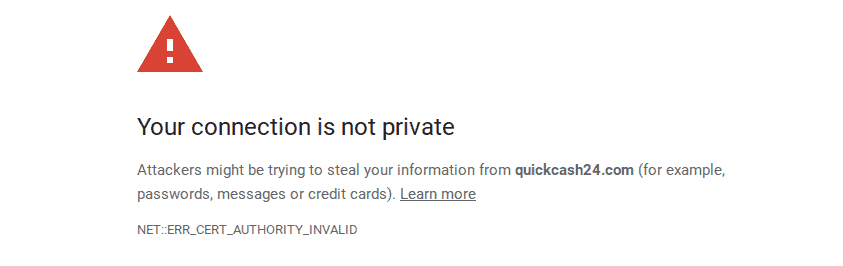

Is Fast5kLoans Safe?

Fast5kLoans Review: The Verdict

FAQ:

What credit score do I need to have to use Fast5kLoans?

Do I need to be employed to get a loan via Fast5kLoans?

Does Fast5kLoans charge any fees?

How much do Fast5kLoans loans cost?

Does Fast5kLoans perform a soft credit check?

US Payday Loan Reviews – A-Z Directory