We’re now approaching the end of the first quarter. Soon, electric vehicle (EV) companies like Tesla, NIO, Li Auto, and XPeng would release their delivery numbers. Here’s what to watch in these companies’ delivery numbers.

While Tesla releases the quarterly production data and provides annual guidance, Chinese electric car companies like NIO, XPeng, and Li Auto provide monthly delivery data and give quarterly guidance.

Tesla reported record deliveries in 2020

Tesla delivered almost half a million cars in 2020. It managed to almost achieve its original guidance despite its Freemont plant being closed for a few days due to the COVID-19 pandemic. Meanwhile, Tesla’s CEO Elon Musk cajoled the authorities to get the plan reopened soon.

During their fourth quarter 2020 earnings call, Tesla said that it expects its deliveries to rise at a CAGR of 50% over the long term and expects the growth rate in 2021 to be “materially higher” even as the company did not provide a hard guidance for 2021. It added, “As we increase production rates, volumes will skew toward the second half of the year, and ramp inefficiencies will be a part of this year’s story and are necessary to achieve our long-term goals,” the company said in its release.

Meanwhile, the first quarter is seasonally slow for Tesla. RBC Capital Markets analyst Joseph Spak expects Tesla to deliver 170,000 cars in the first quarter—a year-over-year rise of 92%. Meanwhile, UBS expects Tesla to be the joint market leader with Volkswagen and is forecasting that the two companies would deliver 1.2 million electric cars each in 2022. Volkswagen has said that it expects to be the market leader in the electric vehicle industry by 2025.

NIO’s March deliveries

NIO expects its electric car deliveries to be between 20,000-25,000 in the first quarter. The company has delivered 12,803 cars in the first two months of 2021 which would mean that it expects to deliver between 7,197-12,197 cars in March. Earlier this month, NIO said that it had to temporarily halt production due to chip shortage. Several other automakers like General Motors, Ford, and Volvo have had to curtail production due to the chip shortage.

Tesla and NIO raised capital

Like Tesla, NIO has raised capital by selling shares multiple times over the last year. The capital raise has strengthened these companies balance sheet and Tesla is now a net debt negative company. Earlier this year, Tesla invested $1.5 billion in bitcoins as it apparently does not has other avenues to profitably invest its massive cash pile.

Earlier this year, NIO provided more details about its upcoming sedan ET7. Because of the better battery pack, NIO EC7 would have a range of over 621 miles. The car, which NIO’s CEO William Li termed a “cozy living room” would cost between $69,185 and $81,230 depending on the configuration that a user chooses. The model’s launch will help up NIO increase its product portfolio and deliveries.

The ET7 model would feature lidar sensors as part of its autonomous driving system. Notably, lidar stocks had surged late last year amid reports of Apple launching an electric car. Gene Munster, who expects Tesla’s market capitalization to soar to $2 trillion over the next three years, sees Apple’s entry into electric vehicles as the biggest risk for Tesla.

Li Auto and XPeng delivery forecast

XPeng expects to deliver around 12,500 EVs in the first quarter of 2021 while Li Auto expects to deliver between 10,500-11,500 cars in the first quarter. XPeng’s forecast implies deliveries of 4,262 cars in March.

Why are electric vehicle stocks falling?

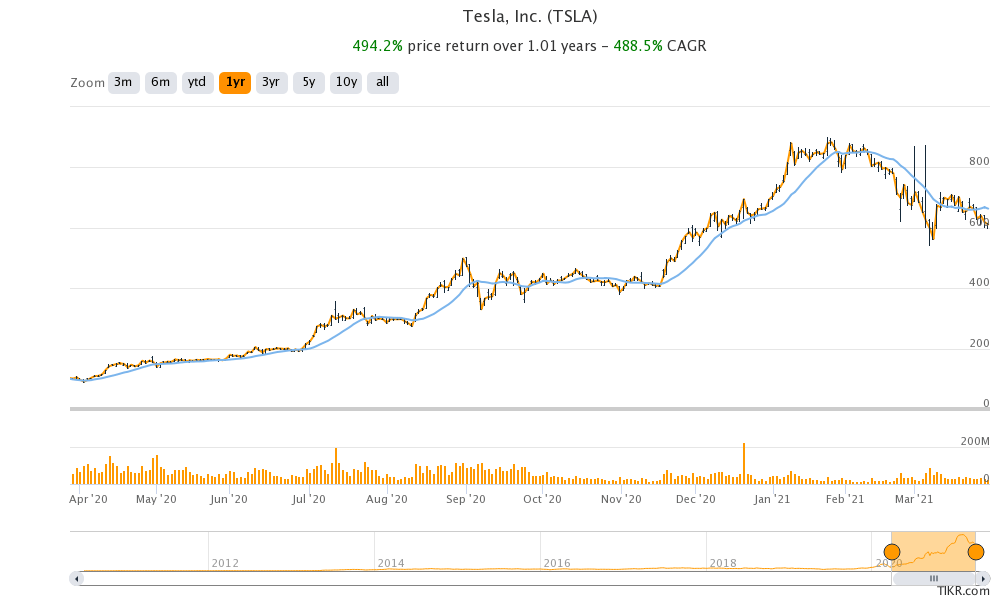

After a solid 2020 where Tesla soared over 740% and NIO gained more than 1,100%, electric vehicle stocks have come under pressure this year. On the other hand, legacy automakers like Ford and General Motors are outperforming.

Markets seem impressed with the vehicle electrification plans of legacy automakers and investors have been buying them expecting them to give a tough fight to pure-play electric car companies.

Also, legacy automakers have seen interest from investors amid the shift from growth to value stocks. Legacy automakers were trading at tepid valuations and seemed to offer good value as compared to pure-play electric vehicle stocks that were trading at exorbitant valuations.

How to invest in electric vehicle stocks

You can invest in electric vehicle stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in green energy stocks. By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account