The price of gold has advanced more than 5% since the month started as investors appear to be more concerned than ever about the possibility of a sharp spike in inflation rates in the United States in the near future.

Last week, the US Bureau of Labor Statistics reported a strong advance in the nation’s consumer price index (CPI), surpassing analysts’ estimates of 3.6% during April to land at 4.2% – the highest annualized rate registered in the country since 2011.

Meanwhile, the producer price index (PPI), a measure that tracks the evolution of prices higher in the supply chain, also shattered Wall Street’s consensus by 30 basis points to land at 6.2%.

These higher inflation readings appear to be triggering strong inflows toward gold, as reflected by the advance of the spot price of the precious metal since the month started, moving 5.5% higher from $1,771 per troy ounce to $1,866 during today’s early commodity trading action.

Meanwhile, gold mining stocks – as tracked by the VanEck Gold Miners ETF (GDX) – have also moved higher during that period, with the price of the exchange-traded fund (ETF) reporting a 15.5% jump to close yesterday’s session at $39.82 per share.

Data from ETF Database shows that the largest gold ETF, the SPDR Gold Trust (GLD), has received a total of $167 million in net positive inflows in the past 30 days, which is a major turning point for a fund that has been reporting consistent outflows since October last year.

These could be early signs that investors are silently piling on gold as a result of inflation worries and this view is reinforced by the latest release of the Inflation Expectations survey from the University of Michigan (UoM), which shows that investors expect inflation to remain high for the next 12 months at least, with the current estimate being 4.6% for the period.

This view is shared by a handful of fund managers from Wall Street including the famous head of Scion Asset Management, Dr. Michael Burry, as its fund’s 13-F SEC Filing shows that he placed a massive bet on inflation by using options and ETFs tracking the price of US Treasury Bonds.

The successful investor who became popular after reaping billions during the financial crisis, as portrayed by the movie “The Big Short”, appears to believe that higher inflation will cause a massive move out of government bonds as investors will run from negative real interest rates, which will result in a spike in yields (yields move inversely from bond prices).

Based on his fund’s latest filing, Burry’s bet is not just some small wager as he has committed a total of $240 million to this thesis, which represents almost 18% of his fund’s assets under management by the end of March 2021.

Although Burry may have already closed this position profitably if he placed the trades at the beginning of the year – 10-year yields advanced 75 basis points in the first three months of 2021 – the next quarter may tell if he is in for the long haul or if this was just a short-term bet.

What’s next for gold?

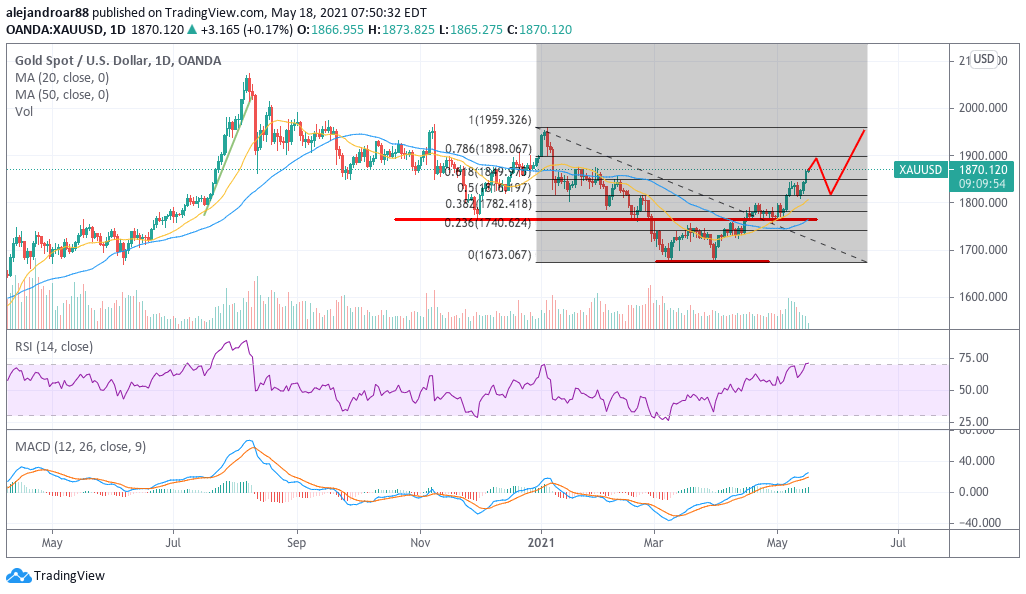

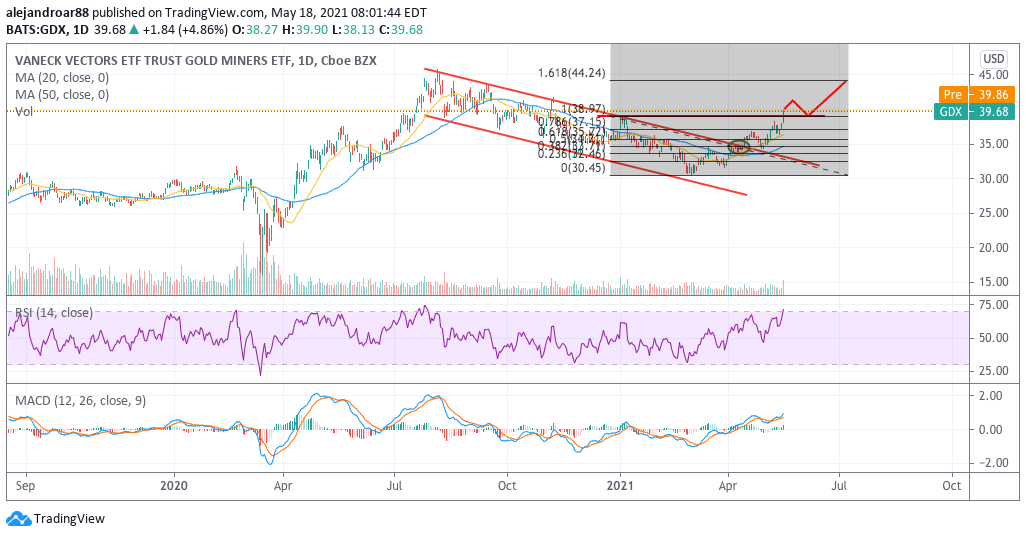

In the meantime, the technical setups seen in the charts of both spot gold and gold mining stocks are particularly bullish and this means that we could see the precious metal moving even higher in the following weeks.

In regards to spot gold, the yellow metal has seen gains in 9 of the past 10 gold trading sessions while it has broken above the 0.618 Fibonacci retracement level, which reinforces the view that the uptrend is accelerating and could soon hit a first target of $1,960 – gold’s 2021 high.

That said, the latest uptrend could be due for a short-term pullback now that indicators are entering overbought territory. Yet, as long as the 0.5 Fibonacci holds at $1,816 chances are that the uptrend will be resumed shortly afterward.

For gold mining stocks, the situation looks promising as well, as the chart shows that the VanEck ETF has broken above its January 2021 high already and could be in for a 10% upside if it continues to move higher to the 1.618 Fibonacci extension highlighted in the chart at $44.2 per share.

Similar to gold, a pullback might take place in the following days due to some overheating in the technicals but, as long as the price remains above $39, GDX’s uptrend would remain intact.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account