The first coronavirus treatment in the world to get official approval, remdesivir, may not result in a financial windfall for its developer Gilead Sciences, according to analysts.

Its recent emergency use approval, granted by the US Food and Drug Administration (FDA) on Friday, made remdesivir the pioneer drug to treat the novel coronavirus, but analysts warned investors not to get their hopes up about the financial uplift this will have for the American biotech firm.

The drug knocks around three to four days off a two-week recuperation period after falling seriously ill from coronavirus.

The improvement in recovery times “doesn’t seem like a knockout 100 percent,” Dr Anthony Fauci, America’s top virus expert, conceded, but “it is a very important proof of concept, because what it has proven is that a drug can block this virus.”

A note released last Wednesday by SVB Leerink, an investment bank specialized in the health care sector, emphasized that the drug would have “limited economic value to the company and the stock”.

Analysts from Bank of America (BofA) and Morgan Stanley have also categorized the financial impact of remdesivir as “not that impressive”, after considering the cost of the treatment, the potential size of the market, and the development of competing drugs.

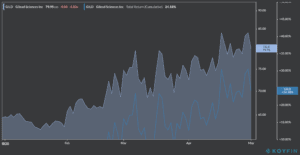

Gilead Sciences (GILD) shares closed the week at $79.95 after sliding 4.8%, following the comments of the firm’s chief executive Daniel O’Day, who anticipated an increase of $100m in research and development costs for 2020 as a result of remdesivir’s drug trials. Meanwhile, the company’s stock has gained 24.2% this year.

Remdisivir, a drug that was initially developed to treat ebola patients, has gained popularity after a clinical trial conducted by the US National Institutes of Health (NIH) showed that it led to significant improvements in patients who were facing severe respiratory issues related to the virus.

At the time, Fauci recently said the drug demonstrated “a clear-cut, significant, positive effect in diminishing the time to recovery”.

According to a report from the Journal of Virus Eradication, the cost of producing an entire treatment course of remdesivir should be around $9, while the final price for consumers is yet to be determined. Analysts’ estimate that the price of a 10-day course will be around $260.

The biotech firm has already committed to donating over 1.5 million vials of remdesivir while it expects to have over 140,000 treatment courses ready to be delivered by the end of May.

You can buy shares of Gilead Sciences and other biotech firms by using one of our preferred free stock trading apps or you can buy an ETF that tracks the biotech industry.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account