How to Buy Gilead Stock in 2020

Gilead Sciences (NASDAQ:GILD) is a hundred-billion-dollar leading biotech company based in the United States. A historical leader in the treatment of HIV and Hepatitis C, Gilead has featured prominently in the news recently following encouraging signs of its Remdesivir drug – proposed for the treatment of Covid-19 symptoms.

Gilead’s history of innovation and its strong financial track record has made it a historically attractive company for investors.

Thinking of buying Gilead stock today? In this guide, we’ll walk you through the process of how to buy Gilead stock and review some elements to consider in your investment decision!

-

-

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.3 Simple Steps to Buy Gilead Stock

Don’t have time to read our guide? Simply follow these 3 simple steps to buy Gilead stock!

[three-steps id=”199298″]Where To Buy Gilead Stock

1. eToro: Best all-around broker for direct and CFD stock trading

eToro has become one of the most popular online brokers in the country. It boasts of over 5 million users and thousands of instruments from Stocks and ETFs to Forex and Cryptocurrencies, directly or via CFDs.

Long and non-leveraged stock orders are executed as direct investments and are commission-free. Short and leveraged trades are made via CFDs, where eToro charges very competitive spreads & fees on overnight position rollover.

Both the eToro web and mobile trading platforms are extremely intuitive and easy-to-use. Its newsfeed, risk management & comparison tools and its handy charting functions make trading stocks on eToro seamless for beginner and seasoned investors alike.

Last, a unique feature of the eToro experience is the CopyTrader system. Users can review the past performance & risk profile of other traders and decide to automatically replicate their trades. This not only allows you to copy experienced traders, but also to get inspiration for your personal investments on eToro!

Our Rating

- Stocks can be bought directly or via CFDs

- No commissions and competitive spreads & fees

- Intuitive and easy-to-use web and mobile platform

- Stock trading unavailable to US customers

- No MetaTrader integration

Disclaimer: 62% of investors lose money when trading CFDs with this provider.2. Stash Invest: Seamless mobile stock trading experience for beginners

Stash Invest is a US mobile app that makes stock investing fun and accessible to beginners and investors on a budget. It allows you to buy hundreds of popular stocks and a wide range of curated ETFs.

Beyond the simplicity of the app, a key perk of Stash is the ability to buy fractional shares starting at $5. For example, instead of investing in a $80 Gilead share, you may simply invest $20 and own a quarter of a share!

Stash does not charge commissions, but offers 3 separate plans ($1, $3 and $9 per month) that all allow investing in full or fractional shares & offer a different panel of options.

Last, Stash Invest offers several handy tools for hands-off investors, including automatic dividend reinvestment, Auto-Stash (you can pre-select how much to automatically invest, when and in what) and additional perks depending on your plan!

Our Rating

- Stocks & ETFs investing made simple for beginners

- No commissions, fractional shares

- Offers automatic investment and dividend reinvestment

- Only available to US customers

- Limited range of ETFs

- Monthly account fees

3. Plus500: Best for CFD trading, offers a wide range of instruments including options

Plus500 is a well-established online broker headquartered in Cyprus. Plus500 Ltd is listed on the Main Market of the London Stock Exchange. It offers a full range of instruments (Forex, Stocks, Commodities etc.) to trade via CFDs, as well as a panel of options on various underlying assets.

Plus500 offers no-commission trades with narrow spreads and low overnight rollover fees. Its proprietary mobile and web trading platforms are well-designed and will suit beginners & experienced traders alike.

Opening an account on Plus500 is quick & seamless, and the broker allows you to trade with leverage from 5:1 for Stocks to 30:1 for Forex.

Last, Plus500 offers great charting tools & a useful economic calendar and lets you set up notifications when prices or sentiment change for instruments in your watchlist!

OUR RATING

- Hundreds of instruments available to trade via CFDs

- No commissions and low spreads & other fees

- Intuitive web platform & mobile app

- Not available to US customers

- Limited customization options vs. peers

- No MetaTrader integration

Disclaimer: 80.5% of retail investor accounts lose money when trading CFDs with this provider.How To Buy Gilead Stock Using eToro

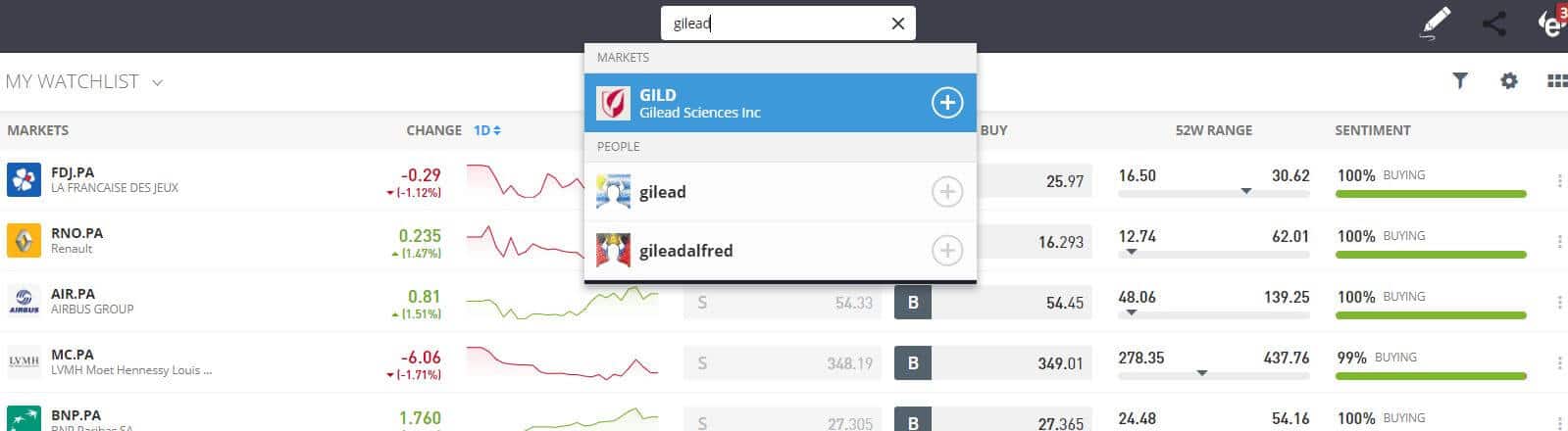

Step 1: Search for Gilead (GILD) stock

Use eToro’s search function to find Gilead stock. While stocks & other traded instruments appear first, you can also use the search bar to look for experienced traders on the platform that may wish to copy (social trading).

Step 2: Click on “Trade”

When you are ready to invest your own money, make sure that you are using your “Real” portfolio and not the “Virtual” free demo account!

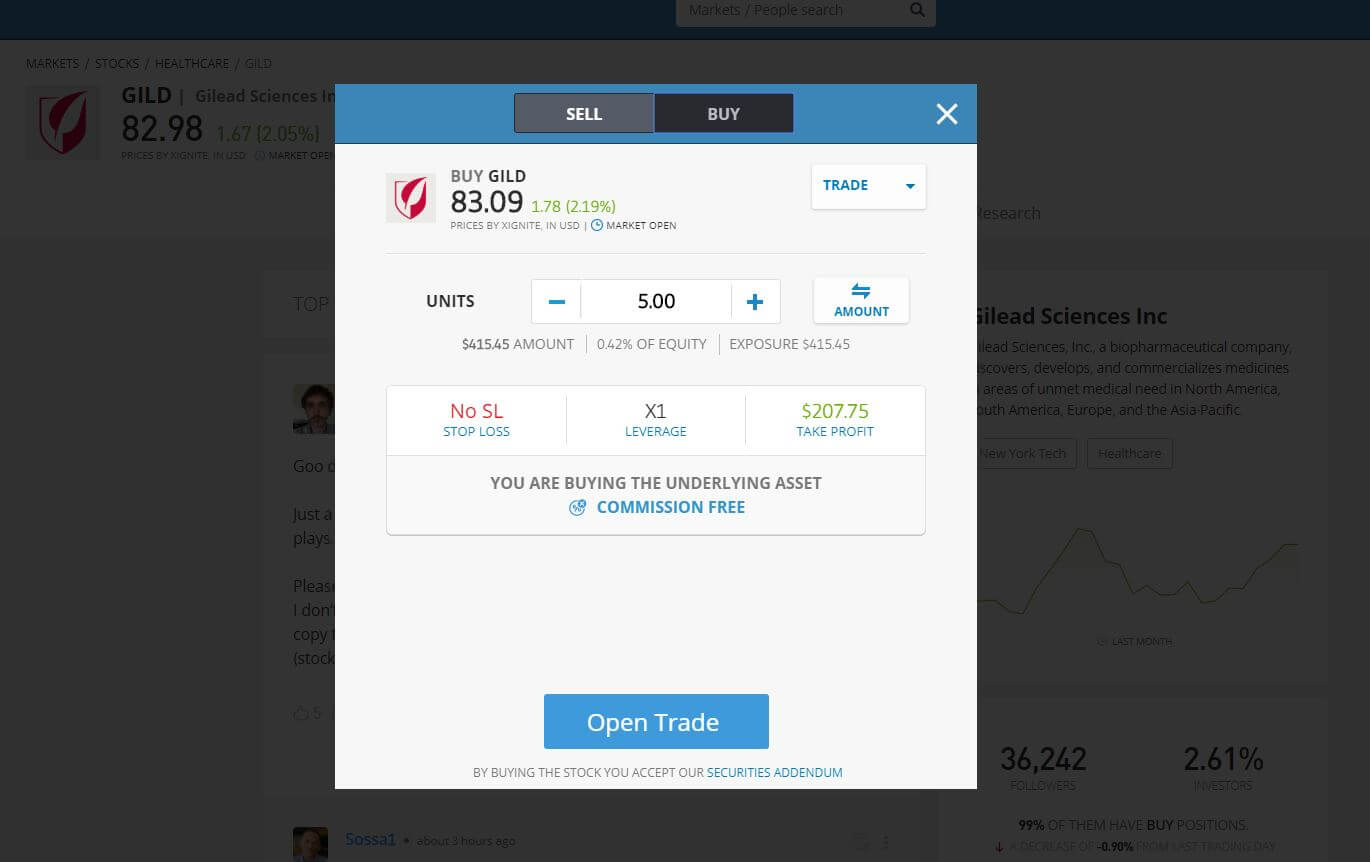

Step 3: Select your order type, the amount and the options you want

Once you’re in the “Trade” menu, you can decide to buy (or sell!) a number of shares or a specific dollar amount. You will then see how much of your equity the trade represents. You can then specify the leverage, the order type and the options you want (if any).

On eToro, long and non-leveraged stock trades are executed directly and short or leveraged trades are made by trading CFDs.

Before buying or selling, make sure to conduct your own thorough research, particularly if you are using leverage!

When you are ready, click “Open Trade”.

Company Background

Gilead Sciences is a leading American pharmaceutical and biotech company. Founded in 1987, it is listed on the NASDAQ exchange and is headquartered in California.

Gilead researches and commercializes a wide variety of drugs used in the treatment of HIV, cancer, hepatitis B and C, hypertension, arthritis, and influenza. More recently, Gilead has grown through acquisitions to strengthen its presence in the highly lucrative immunology and oncology markets.

Several of its blockbuster drugs (Sovaldi and Harvoni for Hepatitis C, Genvoya and Truvada for HIV, etc.) have become market leaders and reached several billion dollars in annual sales.

At the time of writing, Gilead had a market capitalization in excess of $100 billion.

Gilead Stock Performance

Gilead had a strong start for 2020 (over +25% YTD), mostly due to soaring sales in its leading HIV treatment drug Biktarvy and speculation around the effectiveness of Remdesivir. The possible approval of its Filgotinib drug for Crohn’s disease and arthritis, currently in Phase 3 clinical trial, is another source of investor enthusiasm.

Recently, the stock has been very volatile, fuelled by speculation over the effectiveness and approval likelihood of its Remdesivir drug to combat Covid-19 symptoms. While the drug showed promise in a first set of studies, “leaked” recent results may not be as encouraging. Clinical trials are still ongoing, and Gilead has not yet obtained the green light to use it on patients infected with the novel coronavirus.

Gilead still trades below its peak of nearly $120 per share, with upside or downside potential heavily linked to the demand for its existing drugs and the likelihood of success of its new drug pipeline.

At the time of writing, the analyst consensus was split between “Buy” and “Hold”, with price targets from leading equity research analysts between $75 and $89.

Why Invest in Gilead Sciences?

As a biotech company, Gilead’s future depends on its ability to keep selling branded drugs before their patents expire and to obtain approval for marketing new drugs.

The global biotech/biopharma industry is split between 30+ billion-dollar companies, with patented drugs whose annual sales can reach in the billions of dollars, and a myriad of startups and medium-sized companies whose value depends on their ability to discover & market groundbreaking new drugs.

Gilead is a market leader and ranks in the top 15 largest biotech companies by revenues, with both a large portfolio of existing branded drugs and many promising new ones in the pipeline.

Below, we list 4 aspects that make Gilead an attractive stock to buy:

1. Strong & profitable track record

With $22.5 billion in 2019 revenues (+2% year-on-year), Gilead is one of the largest pharmaceutical companies in the world. Two-thirds of its 2019 revenues come from HIV drugs, and ~17% from Hepatitis C drugs, with the remainder coming from other treatments.

In 2019, Gilead Sciences respectively posted 29% and 23% EBITDA and EBIT margins, which are well above the sector median. Its 24% profit margins, 8.6% return on assets and 24.5% return on equity further underline Gilead’s strong profitability and returns.

Last, Gilead in 2019 generated healthy cash flows, with $9.1 billion in operating cash flows, and $2.3 billion in levered free cash flows (i.e. cash flows after interest payments & debt service).

Naturally, Gilead’s profits and cash flows have not been stable over time, primarily because of the expiry of old patents. Nevertheless, Gilead’s track record of innovation gives investors good hopes for future growth.

2. Growth opportunities

While the bulk of Gilead’s revenues come from its existing blockbuster drugs, its own R&D pipeline is robust and it has been partnering with several other biotech firms like Galapagos (NASDAQ:GLPG) to build its immunology offering. This partnership should not only give Gilead access to a new R&D pipeline, but also allow it to participate in the success of Filgotinib, Galapagos’ much-anticipated rheumatoid arthritis drug, and give Gilead better access to the European Market.

Gilead has also made several billion-dollar acquisitions in recent years (Forty-Seven in 2020, Kite Pharma in 2017) to develop a much stronger presence in the highly lucrative oncology drug market. While Gilead is not a historically strong player in this market, these acquisitions should help it diversify and grow.

Last, Gilead recently reported promising early results for Remdesivir as the treatment of a Covid-19 symptom, although the success and timeline of the subsequent trials remain highly uncertain.

3. Strong & growing dividend

Gilead has grown its dividend significantly in the past few years. Today, its dividend yield stands in excess of 3% and is forecasted to keep growing. Although the coronavirus crisis may affect the company’s decision, Gilead most recently announced an 8% increase in its 2020-Q1 dividend.

The dividend payout ratio remains below 60% and does not appear excessive, particularly given Gilead’s strong cash flows and massive cash pile. With $24 billion in cash and cash flow stability & visibility, until its patents expire, Gilead can easily afford its dividend.

4. Low leverage and investment-grade profile

Last, Gilead’s credit is considered safe, which may be of comfort to investors worried about the downside. At the time of writing, Gilead was rated A3 by Moody’s (middle of the investment-grade scale), thanks to its profitability and strong cash-generating abilities.

Thanks to its abundant cash, Gilead has almost no net debt ($24.5 billion in debt and $24.4 billion in cash). Last, its earnings before interests & tax (EBIT) amply cover interest expenses (4.3x).

Should I Buy Gilead Stock?

As discussed above, Gilead is a market leader in the biotech world and has many attractive qualities for the stock investor.

Ultimately, however, we cannot give you investment advice and the decision rests on your shoulders. Before investing, make sure to read carefully Gilead’s financial statements, its press coverage and (if you can!) the analyst commentaries. This way, you will not only understand the company and its prospects better but also properly identify the downside risks of holding the stock.

For more resources, make sure to consult our stock investing and stock trading guides!

Trade with eToro - World Leading Social Trading Platform

Our Rating

- Trade Stocks, Forex, Crypto and more

- 0% Commission on Real Stocks

- Copy Trades of Pro Investors

- Easy to Use Trading Platform

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

Where is Gilead listed and incorporated?

Gilead is incorporated in the United States and is listed on the NASDAQ under the GILD ticker.

What businesses is Gilead primarily in?

Gilead is a biotech company that develops & sells drugs for a variety of ailments. Its main areas of expertise are HIV and Hepathitis C treatments, although it is active in a much wider range of domains.

How risky is Gilead stock?

Risk is very difficult to estimate in the biotech world. While Gilead enjoys strong sales from its existing drugs, these patents will ultimately expire. Gilead’s future stock performance is (among other reasons) a function of existing drug sales performance and its ability to innovate with its R&D pipeline.

What should I do before buying Gilead stock?

This guide is only a start and you cannot base your investment decision on it. Make sure to review Gilead’s financial statements, press coverage and the analyst commentaries to form your own opinion before buying or selling.

Can I buy Gilead stock if I am not a US citizen?

Of course, you will simply need to find a broker that offers Gilead stock. The brokers mentioned in this article all do!

See Our Reviews of Other Stocks to Buy

Adam Green

Adam Green

Adam Green is an experienced writer and fintech enthusiast. He he worked with LearnBonds.com since 2019 and covers a range of areas including: personal finance, savings, bonds and taxes.View all posts by Adam GreenWARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up