The Walt Disney Company stock was trading lower in pre markets today after the company announced massive layoffs. The company blamed California for the decision as the state hasn’t opened theme parks yet. Disney stock is down almost 13% so far in the year as the pandemic has taken a toll on the entertainment industry.

Walt Disney announced 28,000 layoffs

The Walt Disney Company would lay off 28,000 employees in what would amongst the biggest layoff during the pandemic. Almost two thirds of the affected employees are part-time workers. Travel and tourism and entertainment stocks have been among the worst hit during the pandemic. Last month, American Airlines said that it would lay off 19,000 employees by 1 October unless it gets Federal help. Engine maker Rolls-Royce has also announced massive layoffs as demand for its aircraft engines has cratered due to the pandemic.

In an internal memo, Disney’s Head of Parks Josh D’Amaro talked of “some difficult decisions that we have had to make regarding our Disney Parks, Experiences, and Products organization.”

Management views on the decision

“Earlier this year, in response to the pandemic, we were forced to close our businesses around the world. Few of us could have imagined how significantly the pandemic would impact us — both at work and in our daily lives,” said the note.

It added, “We initially hoped that this situation would be short-lived, and that we would recover quickly and return to normal. Seven months later, we find that has not been the case. And, as a result, today we are now forced to reduce the size of our team across executive, salaried, and hourly roles.” The positions would be spread across the company’s Parks, Products, and Experiences segments.

The note also said that “We’ve cut expenses, suspended capital projects, furloughed our cast members while still paying benefits, and modified our operations to run as efficiently as possible, however, we simply cannot responsibly stay fully staffed while operating at such limited capacity.”

California has not reopened theme parks

Talking of Disney, while its theme parks in China, Hong Kong, Japan, and France have opened, both its parks in California are still closed. However, the company’s theme park in Florida is open. While Florida’s Republican governor Ron DeSantis allowed theme parks to open, California’s Democratic Governor Gavin Newsom hasn’t allowed them to open in the state.

US President Donald Trump has been a champion of reopening the economy even as most health experts warned against hasty reopening.

Disney blames California for the job losses

Disney has been calling upon the state to allow the reopening of theme parks citing the massive employment that they generate. Last week, D’Amaro said, “To our California government officials, particularly at the state level, I encourage you to treat theme parks like you would other sectors.”

He added: “Help us reopen. We need guidelines that are fair and equitable to better understand our future and chart a path towards reopening. The longer we wait, the more devastating the impact will be to the Orange County and Anaheim communities. “We’re ready and, more importantly, it’s time,” summed D’Amaro.

Disney stock outlook

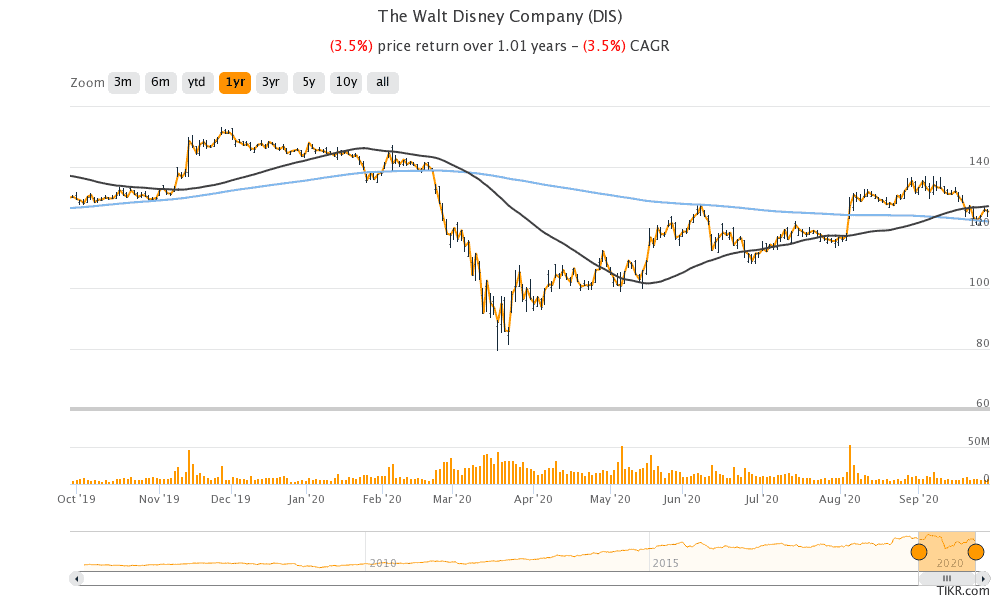

Looking at technical levels, Disney stock closed at $125.4 yesterday which is above its 200-day moving average (DMA) of $122.11. The 200 DMA has been strong support for Disney stock. Earlier this month, there was a Golden Cross formation in Disney stock after its 50 DMA crossed above its 200 DMA. Yesterday, Disney’s 50 DMA was $127.16. In the past, Golden Cross formation has taken Disney stock higher.

According to the estimates compiled by TipRanks, 11 out of 18 analysts actively covering Disney have a buy or equivalent rating on the stock while six rate it as a hold. The remaining one analyst has a sell rating on Disney stock.

Analyst price target

Disney’s average price target of $133.29 is a premium of 6.3% over yesterday’s closing prices. The highest price target is $164 while $97 is the Street low price target. Disney shares trade at an LTM (last 12-month) price to earnings multiple of 43.5x. However, the NTM (next 12 months) multiple is 125x as the company’s earnings would take a hit due to the closures.

Disney shares were trading 2.7% down at $122.05 in pre markets today. The stock made a 52-week high of $153.41 in November and fell to a 52-week low of $79.07 in March as stock markets tumbled amid uncertainty over the pandemic.

You can buy Disney through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account