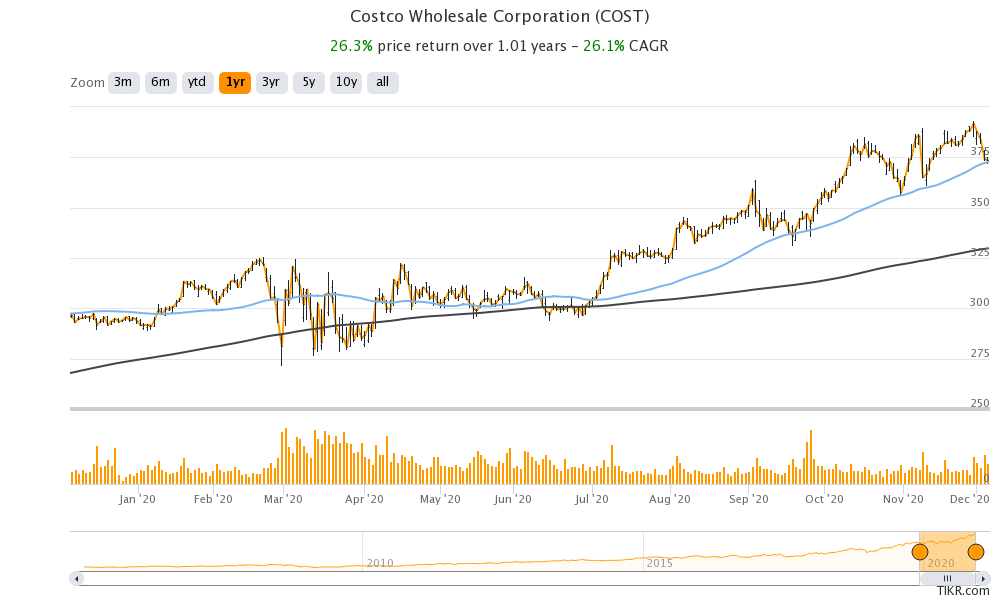

Costco has scheduled its fiscal first quarter 2021 earnings for Thursday, December 10. The stock is up over 31% so far in 2020 outperforming the S&P 500. What’re analysts projecting for Costco’s earnings and can the stock continue to rise after the earnings release?

In the fiscal year 2020, Costco reported a net income of $4 billion. This was a new record for the company and before the fiscal year 2020, it had never posted an annual net profit of $4 billion. The company managed to deliver record earnings despite higher COVID-19 related costs.

Costco’s earnings

In the previous quarter, Costco reported $281 million as COVID-19 related costs which were almost thrice of what it had guided. Costco is paying a $2 per hour premium wage to its employees due to the pandemic. According to the company, higher costs add up to $14 million every week. It also said that it expects to keep paying higher wages for the time being which would mean that it incurred these charges in the fiscal first quarter of 2021.

Analysts estimates

According to the estimates compiled by Tikr, analysts expect Costco to report revenues of $42.2 billion—a year over year rise of 14.1%. In the previous quarter, Costco’s sales had risen 12.3% led by an 11.4% increase in same-store sales. That was the highest same-store sales that it had reported in its two-decade history. Analysts expect Costco to report adjusted EPS of $2.04 in the quarter, a year-over-year increase of 17.8%. In the previous quarter, it had posted an EPS of $3.04.

Costco special dividend

Last month, Costco announced a $10 per share special dividend. The special dividend had a record date of 2 December and would be paid on 11 December. The company would spend around $4.4 billion towards the special cash dividend. Notably, Costco announced a special dividend at a time when many retail companies suspended their dividends.

Retailers have been in a trouble in 2020

Nordstrom, Estee Lauder, Dick’s Sporting Goods, and Macy’s are the retailers that have suspended dividends this year. J.C. Penney’s had to file for bankruptcy as the COVID-19 pandemic amplified its woes. However, Costco and Walmart are among the brick-and-mortar companies that have seen higher sales this year. Markets have also rewarded these companies sending their stocks north even as some of the other retail stocks fell to multi-year lows.

Meanwhile, Warren Buffett’s Berkshire Hathaway exited its position in Costco in the third quarter of 2020. Costco’s soaring valuations could be among the reasons Buffett exited the company.

Costco’s valuation

Costco shares trade at an NTM (next-12 months) enterprise value to revenue multiple of 0.90x and an NTM PE multiple of 38.1x. The valuation multiples are higher than its historical trading multiples as well as those of other retailers including Walmart. However, Costco’s earnings are growing at a fast pace. The troubles at other retail companies would lead to more revenues for Costco as many struggling retail companies might need to eventually shut down amid tough competition from low-cost retailers like Costco and eCommerce companies like Amazon.

How are analysts rating Costco stock?

According to the data compiled by CNN Business, Costco has a median price target of $395 which is a premium of 5.8% over its current stock price. Its highest price target of $435 is 16.5% above its current stock price while its lowest price target of $235 is a discount of 37% over current price levels.

Of the 34 analysts covering Costco stock, 21 have a buy or equivalent raying while 11 have a hold rating. The remaining two analysts have rated it as a sell.

Costco technical analysis

On Friday, Costco stock closed at $373.43, slightly above its 50-day SMA (simple moving average) of $372.75. The 50-day SMA has acted as a strong support line for Costco stock since July. Costco shares need to break above the 50-day SMA to signal an uptrend. However, if its earnings fail to cheer markets, watch out for the 50-day SMA as falling below the line could trigger more sell-off in the stock.

Costco shares were trading % lower in pre markets at $373 and have a 52-week trading range of $271.28-$393.15.

How to buy Costco stock?

Over the long term, stock markets deliver the highest returns. Warren Buffett and Dave Ramsey advocate putting money in stock markets for the long term. For more information on trading in stocks, please see our selection of some of the best online stockbrokers.

If you are not well versed with investing in stocks and yet want to have exposure to the markets, you can consider one of the ETFs like those that track the S&P 500. The S&P 500 is the world’s most popular stock index with over $4.7 trillion indexed to it. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account