How to Buy Costco Stock for Beginners

Between the inexpensive gas, the free food samples, and the treasure hunt feeling of finding your favorite product, Costco inspires a loyalty that few other grocery stores command. It’s perhaps the only grocery store that doubles as the site of a family outing on weekends. Plus, the parking lot is reliably full; a good sign for anyone thinking about investing in Costco stock.

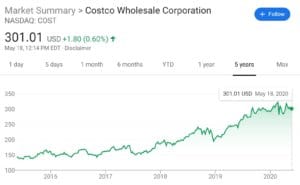

Costco’s stock price has largely mirrored the rise of this warehouse giant. It’s up more than 560% in the past decade, and Costco’s membership base only continues to grow.

So, is right now the best time to buy Costco stock? In this guide, we’ll walk you through the process of adding this stock to your portfolio and compare several featured brokers. We’ll also take a closer look at the bull’s case for why Costco stock could be a worthwhile investment.

-

-

Buy Costco Stock in 3 Quick Steps:

Can’t wait to get your hands on Costco stock? You can buy shares by following these three steps:

[three-steps id=”203001″]Where to Buy Costco Stock?

In order to buy Costco stock, you’ll need a brokerage that lets you trade shares on the NASDAQ stock exchange. Finding the right broker is key, since that will determine how much you’ll pay to trade stocks, whether you’re eligible to collect dividends from Costco, and what kind of analysis tools you have access to.

With that in mind, here are our top three recommended brokers that you can use to buy Costco shares:

RECOMMENDED BROKER

What we like

- 0% Commission

- Trade Stocks Via CFDs

- Authorized & regulated by the FCA

Min Deposit

$100

Charge per Trade

Zero Commission

Available Assets

- Total Number of Stocks & Shares+2000

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Future

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- Dax Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire transfer

- Credit Cards

- Bank Account

- Paypal

- Skrill

How to Buy Costco Stock from eToro

Now that you’ve chosen a brokerage, we’ll demonstrate how you can place a trade and buy shares of Costco.

We’ll use eToro for this example. eToro is one of our favorite brokers for buying Costco because the trading platform allows you to buy shares directly, making you eligible to collect any dividends that the stock pays out.

If you chose a different broker, though, don’t worry. The process for ordering shares is similar across most online brokerage platforms.

Step 1: Search for Costco Stock

In order to find Costco stock on eToro’s platform, you’ll need to search for it in the box at the top of the page. Enter ‘Costco’ or ‘COST’ and click on the stock when it appears in the drop-down menu.

Step 2: Click on ‘Trade’

From the Costco stock page, click on the ‘Trade’ button to be taken to an order form to buy stocks.

Step 3: Buy Costco Stock

eToro’s order form has a couple of important options that you’ll need to decide on before buying Costco shares. First, you must decide how many shares you want to buy. By default, this is specified in dollars. But you can also select a specific number of whole shares by clicking the ‘Units’ button.

Second, you must decide what price you want to pay for the stock. You can buy Costco at the current market value by setting the rate to ‘Market’. Alternatively, you can enter the maximum price you’re willing to pay for Costco shares. Your buy order will then only be executed if the price of Costco stock drops below this specified price.

Finally, you can decide whether or not to set a stop loss. This is a price below that at which you’ll buy Costco shares. If the price of the stock drops below your stop loss value, eToro will automatically sell all of your shares and close your position. Setting a stop loss is good practice since it ensures that you can never lose more than a certain amount if a trade goes poorly.

Why Invest in Costco?

Now that you know how to invest in Costco, let’s turn to the question of whether you should right now. Costco has been on a historic growth spurt, so investors may be wary whether the stock price can rise much further.

But, as high as Costco’s stock price has gotten, it may be far from overvalued. In fact, many analysts and experts believe that this company still has plenty of room to expand and grow its profits into the future. So, let’s dive into the bull’s case for why you might want to invest in Costco stock.

Count on Reliable Growth

Costco’s popularity has exploded in recent years, and the stock price more than reflects that. Over the past decade, share value has grown a whopping 564% and their earnings preview shows higher sales but tighter margins.

A big reason why Costco stock is so loved by investors is that this company seems to mint money. It charges a pricey membership subscription that shoppers don’t seem to bat an eye at. In fact, membership revenue increased 6.3% in the first quarter of 2020 and the company retains close to 90% of its members every year. Together, that means that Costco can continue bringing in increasingly large amounts of revenue from memberships for years to come.

Costco has also seen massive sales increases year-over-year. The company reported 9.1% growth in comparable sales for the first three months of 2020 compared to last year. Meanwhile, it’s closest competitors, BJs and Sam’s Club, each reported less than 2% sales growth for the same quarter.

To be fair, Costco’s sales dropped for the first time in more than a decade in April as panic buying in response to the coronavirus pandemic slowed down. But, this is unlikely to be more than a blip in the company’s broader growth trend since it’s a direct result of people stocking up on groceries at Costco in March. Plus, revenue-generating parts of the warehouses like the food court, photo desk, and optical department will open back up in coming months.

Collect a Decent Dividend

Costco pays out a quarterly dividend of $0.70 per quarter, amounting to a yield of around 0.9% at the current share price. That’s not all that impressive on its face—Walmart pays out a dividend yield of more than double as much. But, for a stock with as much growth potential as Costco, collecting a 0.9% dividend yield is certainly nothing to sneeze at, especially if you’re looking for passive income.

On top of that, Costco has a history of paying out special dividends on top of its regular dividends. The company paid out a special dividend of $5 per share in 2016 and another of $7 per share in 2018. While investors can’t count on future special dividends, these past payouts bring Costco much more in line with what high-dividend competitors are offering.

It’s a Safe-haven Stock

One of the best things about Costco is that, as far as stocks go, it’s something of a safe-haven asset. During recessions, consumers flock towards Costco rather than away from it. They see the company’s membership pricing in exchange for access to wholesale goods as a bargain during times when money is tight. For families, there are few less expensive options for eating out than a visit to Costco’s food court.

This safe-haven dynamic has certainly been true during the coronavirus pandemic. Although Costco’s stock price initially fell at the beginning of March with the rest of the market, it quickly ricocheted back up to challenge its all-time high. Even now, in the midst of the pandemic, Costco is trading at a higher price than it did for most of 2019.

That’s a huge plus if you’re looking to diversify your portfolio. Adding Costco shares not only brings reliable dividends but also offers the promise that you’ll find a bright spot in your investments even in the midst of a recession.

About Costco Stock

Costco was founded in 1976 and opened its first member-only warehouse in Seattle in 1983. By 1990, the company was doing $3 billion in annual sales and had expanded to nearly 200 locations around the US. Today, Costco has 785 locations in multiple countries and does over $35 billion in business every quarter.

Costco’s business model is built on a few unique pillars. First, the company makes most of its money through its membership fee rather than through markups. Costco charges shoppers for the privilege of shopping at the company’s warehouses, and in exchange, it limits its markup on all products to around 10% or less.

That means that Costco provides value to consumers by charging far less than grocery store prices. In fact, Costco sells most name-brand products at cost and makes the majority of its sales revenue on its own Kirkland brand items.

In addition, Costco limits its overhead as much as possible. The company’s warehouses are bare-bones establishments with boxes stacked to the ceiling to eliminate extra storage costs. Costco stocks relatively few items compared to traditional grocery stores, which in turn means it has less ordering and tracking to deal with and can force suppliers to bid for shelf space.

This wholesale, membership-driven business model has been extremely successful. Although Costco went public in 1982, the company gained investor’s attention in the midst of the 2008 recession. Since 2010, the stock price has grown steadily from less than $50 per share to over $300 per share, a gain of more than 560%.

Costco’s stock set a new all-time high of $325 per share in February, just before the coronavirus pandemic rocked the US stock market, but despite a sudden sell-off, Costco shares have consistently traded above $300 per share and remain above the level they traded at for the majority of 2019.

Should I Buy Costco Stock?

There’s no doubt that Costco is an extremely high-quality company that has more than justified its current price of $300 per share. But, is the stock a buy at that price and is it a fit for your portfolio?

That depends on your investing goals. Costco stock probably isn’t going to rise another 500% in the next decade. Realistically, there’s only so much growth to be had in the retail space. However, analysts largely agree that Costco still does have room to steal customers from competitors like Sam’s Club and BJ’s and to convert more grocery store shoppers to its membership-wholesale model. Costco stock may not appreciate at an eye-popping rate, but may turn out to be a solid long-term investment.

On top of that, the dividend is a plus. Even if Costco never pays out another special dividend, a 0.9% dividend yield from a stock that could return several per cent per year in price appreciation is significant. If Costco does pay out special dividends in the future, it could be on the same yield footing as premium dividend stocks like Walmart.

Last, but certainly not least, Costco is worth considering as an investment to diversify your portfolio. When the market tanks, Costco stock tends to hold its ground or even increase in value. That’s a major asset for investors who want to protect their portfolio against the next recession, especially if you want to invest $10,000 or more in the stock market.

Conclusion

Costco has been on a historic run for the past 10 years, consistently and rapidly expanding its member base and geographic footprint. The company charges a premium for entry to its warehouses, but at the same time boasts a nearly 90% member retention rate. That, along with the fact that Costco brings in more customers during hard times, speaks to the company’s enduring allure.

This stock’s most significant growth may be behind it, but it’s still an extremely attractive option for investors. Costco is still a growth stock, while the potential for special dividends makes it something of a dividend pick as well. The share price is unlikely to dip much given the company’s resilience to market volatility, so now is as good a time as any to buy Costco stock.

Our Recommended Stock Broker - 0% Fees

Our Rating

- 0% Commission on Stocks

- Trade Stocks, Forex, Crypto and more

- Only $200 Minimum Deposit

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.FAQs

What is the ticker symbol for Costco stock?

Costco trades on the NASDAQ stock exchange under the symbol ‘COST’.

When does Costco pay dividends?

Costco pays dividends once each quarter, in February, May, August, and November. In order to receive the upcoming dividend, you must be a shareholder on the ex-dividend date (usually several weeks earlier). Special dividends are not regularly scheduled and may be announced without warning.

Does Costco have any major competitors?

Costco’s main competitors are Sam’s Club, which is owned by Walmart, and BJ’s. These wholesalers operate on the same membership model as Costco. Both of these competitors have fewer members than Costco, although memberships are slightly cheaper. That said, the price-to-earnings ratios for Walmart and BJ’s stocks are much lower than that for Costco stock.

What countries does Costco operate in?

Costco has 785 locations, 546 of which are in the US and 100 of which are in Canada. The remaining Costco locations are spread across Mexico, the UK, Japan, South Korea, Taiwan, Australia, and Spain. The company also has a single location in each of China, Iceland, and France.

Our Full Range of “Buy Stocks” Resources – Stocks A-Z

Michael Graw

View all posts by Michael GrawMichael is a writer covering finance, new markets, and business services in the US and UK. His work has been published in leading online outlets and magazines.

WARNING: The content on this site should not be considered investment advice. Investing is speculative. When investing your capital is at risk. This site is not intended for use in jurisdictions in which the trading or investments described are prohibited and should only be used by such persons and in such ways as are legally permitted. Your investment may not qualify for investor protection in your country or state of residence, so please conduct your own due diligence. Contracts for Difference (“CFDs”) are leveraged products and carry a significant risk of loss to your capital. Please ensure you fully understand the risks and seek independent advice. This website is free for you to use but we may receive commission from the companies we feature on this site.

Copyright © 2026 | Learnbonds.com

We use cookies to ensure that we give you the best experience on our website. If you continue to use this site we will assume that you are happy with it.Scroll Up