China is likely to fall far short from the near $200bn worth of goods it has pledged to buy from the US as part of the ‘phase one’ trade deal the two countries agreed, according to a US think tank.

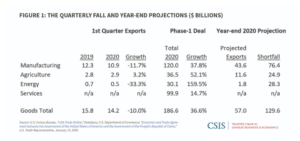

Exports from the US to China during 2020 may end up the year at roughly $60bn, 68% lower than the $186bn established in the January agreement, said the Washington-based Center for Strategic International Studies (CSIS).

The study blames, in part, the economic effect of the coronavirus for the shortfall.

The report, released on Friday, emphasized a steep decline of 11.7% and 33.3% respectively in US manufacturing and energy commodities exports to the Asian country during the first quarter of 2020, while it anticipates that the bulk of the $130bn shortfall will come from manufacturing, predicting $76.4bn less in actual exports versus the $120bn landmark set out in the trade deal.

However, senior adviser and trustee chair in Chinese business and Economics at CSIS Scott Kennedy, told CNBC: “The targets were never realistic; they were just gaudy numbers meant to impress. The pandemic made the unrealistic the impossible”.

However, the think tank added that these forecasts were “a worst-case scenario”, even though it added that any unanticipated positive developments “will not change the overall picture, just the details”, says the report.

The relationship between the two countries has deteriorated in recent weeks, after US President Donald Trump last month publicly accused China of being responsible for the coronavirus outbreak, alleging that there is evidence about the virus being developed artificially in a Wuhan laboratory, the Chinese province where the outbreak started.

China responded to these accusations at the weekend by releasing an 11,000-word long document that counters these allegations, pointing to “24 lies” that US politicians have spread about the country’s involvement in the health emergency.

Despite these controversies, both countries signed the phase one deal which was meant to end two years of trade conflicts that ramped up tariffs for hundreds of billions of dollars in imported goods and increased political tensions between the superpowers.

The deal contemplates the purchase of $200bn of manufacturing, agriculture, and energy goods from the US by China, along with tariffs cuts applicable to Chinese imports ranging from 25% to 50%. The agreement also includes foreign currency, intellectual property, enforcement, and financial services clauses.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account