AstraZeneca stock was trading higher in the US premarket today after its COVID-19 vaccine candidate got an emergency use approval from Britain. Indonesia has also placed an order for 50 million doses of its vaccine.

There has been a lot of positive development on the COVID-19 vaccine front. India is also expected to soon approve of the AstraZeneca vaccine. It does not need the kind of low storage temperatures that Pfizer and Moderna’s vaccine requires and would suit India’s tropical climate.

The US falls short of vaccination target

The US has already approved the emergency use of Moderna’s and Pfizer’s COVID-19 vaccine candidates and started the inoculation process. However, the current run rate of inoculating Americans is way short of what the country was aiming for. The drive has been named Operation Warp Speed and aims to deliver 300 million doses.

The US is currently vaccinating around 200,000 people on an average per day and at this speed, it would take a decade to reach the 300 million doses. The country might also miss the 20 million vaccination target that the Trump administration was targeting for the year-end.

AstraZeneca joins the list of approved vaccines

Now, AstraZeneca joins the list of vaccines that are getting emergency use approvals. Britain has approved the vaccine as widely expected. “The government has today accepted the recommendation from the Medicines and Healthcare products Regulatory Agency (MHRA) to authorise Oxford University/AstraZeneca’s Covid-19 vaccine for use,” said the UK Health Ministry.

AstraZeneca applauded the move. “Today is an important day for millions of people in the UK who will get access to this new vaccine,” said AstraZeneca CEO Pascal Soriot said. He added, “It has been shown to be effective, well-tolerated, simple to administer and is supplied by AstraZeneca at no profit.”

Indonesia places a big order

Indonesia has placed an order for AstraZeneca and Novavax COVID-19 vaccines. “We’ve secured supplies of vaccines, from AstraZeneca and Novavax, each 50 million doses,” said Indonesia’s foreign minister Retno Marsudi. The country’s health minister Budi Gunadi Sadikin said “Now we can think about phase two, how to distribute the vaccines.” It is worth noting that the Novavax vaccine is expected to be ready only by the spring of 2021. Johnson & Johnson’s vaccine is also expected to be available next year

That said, vaccinating people would be a tough exercise for countries. Such mass vaccinations haven’t happened in our lifetimes and would pose a challenge to the existing health infrastructure.

European Union yet to approve the AstraZeneca vaccine

Meanwhile, the European Medicines Authority (EMA), the governing body in the European Union, might not approve the AstraZeneca COVID-19 vaccine for at least one more month. EMA’s Deputy Executive Director Noel Wathion pointed to the scant data available about the vaccine which he said is “not even enough to warrant a conditional marketing licence.” He added, “We need additional data about the quality of the vaccine. And after that, the company has to formally apply.” Notably, AstraZeneca hasn’t yet formally applied for approval in the European Union so far.

Currently, only the Pfizer/BioNTech COVID-19 vaccine is approved in the European Union. Moderna expects its vaccine to get approval in the region by the middle of January.

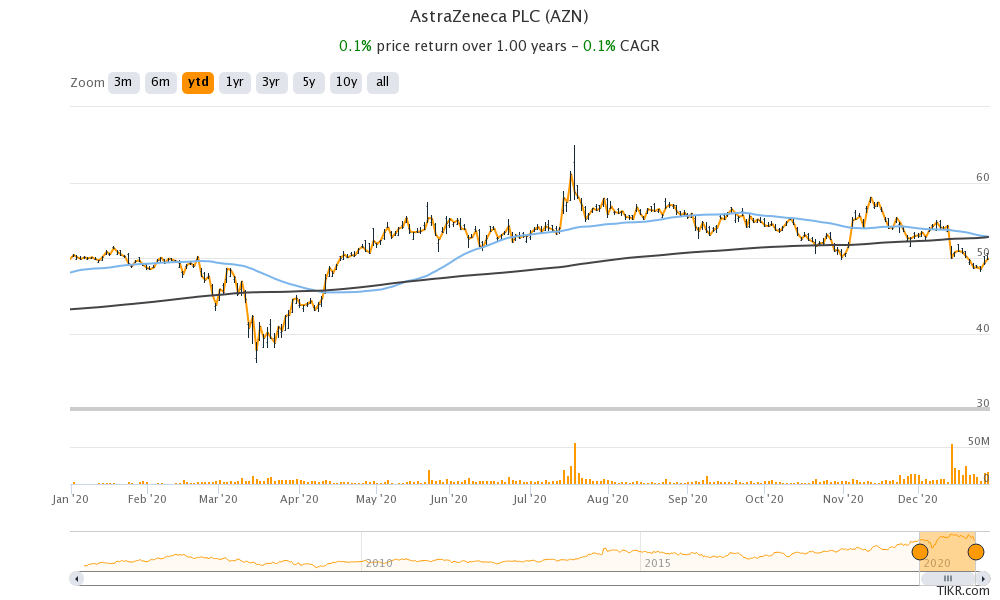

AstraZeneca stock in 2020

AstraZeneca stock is trading flat for the year and is underperforming the S&P 500 that is up in double digits despite the COVID-19 pandemic taking a toll on the US economy. The country has the highest COVID-19 infections globally. Its death toll also exceeds any other country.

Should you buy AstraZeneca stock?

AstraZeneca stock was trading 2.3% higher at $51.05 in US premarket trading today. According to the estimates compiled by CNN, AstraZeneca has a median price target of $64.05 which is a premium of 28.4% over its Tuesday closing prices. Of the 23 analysts covering the stock, 17 have a buy or higher rating while four rates it as a hold. The remaining two analysts rate AstraZeneca as a sell or some equivalent.

The stock could head higher as more countries approve its COVID-19 vaccine. You can buy AstraZeneca stock through any of the reputed online stockbrokers.

An alternative approach to investing in pharmaceutical companies like AstraZeneca could be to invest in ETFs that invest in pharmaceutical companies. Through an ETF, you can diversify your risks across many companies instead of just investing in a few companies.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account