The Trump Administration announced the finalists for Operation Warp Speed to develop the Coronavirus vaccine to Americans by the end of the year. AstraZeneca, Merck, Pfizer, Johnson & Johnson and Moderna are the pharmaceutical companies that will receive additional government funding, clinical trial assistance and manufacturing help, the Times reports, citing senior administration officials.

President Trump has previously stated that the U.S. Military would help deploy over 300 million doses of a Coronavirus vaccine later this year.

Pfizer and Merck already have a successful track record with products with sizzling sales, with Pfizer reporting the first positive data coming our of Operation Warp Speed. The company has been developing a coronavirus vaccine with the German firm BioNTech as the U.S. government has been trying to speed up the development, testing and production of multiple coronavirus vaccines. “I’m really happy Pfizer took the initiative to publish it, whereas the others haven’t. I think we need to see more of this.” said Peter Jay Hotez, dean for the National School of Tropical Medicine at Baylor College of Medicine.

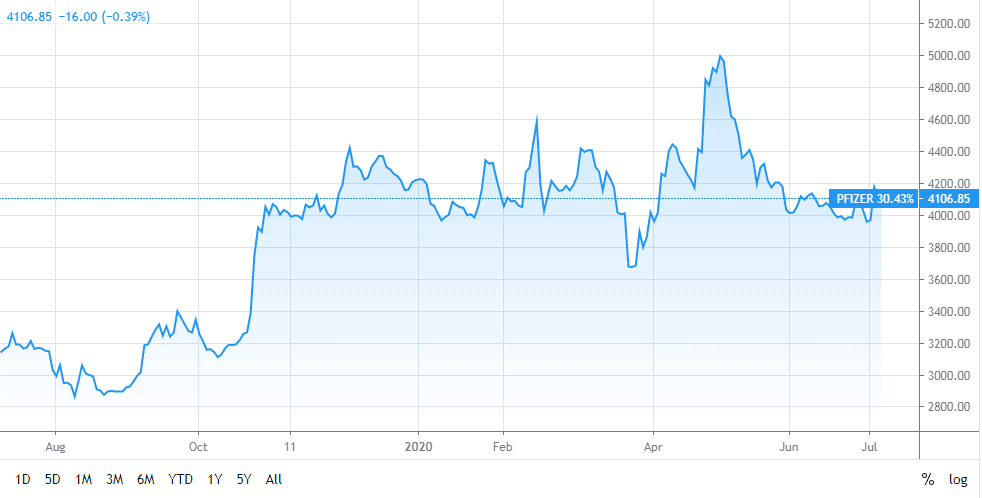

Shares of Pfizer (PFE) were up 2.4% Thursday morning, after climbing 3.2% on Wednesday. Shares of BioNTech (BNTX), Pfizer’s partner on the program, were up 7.3% Thursday morning, after falling 3.9% on Wednesday.

Biotech firm Moderna Inc is another pharmaceutical company that could potentially reap tens of billions of dollars in sales and stock appreciation as one of the participants in Operation Warp Speed.Moderna is expected to ultimately get the deal for the U.S. Coronavirus due to its ties to Dr. Anthony Fauci and the National Institute of Allergy and Infectious Diseases. Meanwhile, the firm’s chief executive is profiting by selling shares that have tripled in price on news of Moderna’s development progress, a Reuters analysis of corporate filings shows. The sales – by CEO Stéphane Bancel, his children’s’ trust and companies he owns – amount to about $21 million between January 1 and June 26, including $6 million in May.

The company’s chief medical officer, Tal Zaks, has cashed out the majority of his available stock and options, netting over $35 million since January, the filings show.

So far, the positive data and preliminary clinical results “amplify a catalyst for stocks that have seen a pullback” according to RBC Capital Markets analyst Randall Stanicky.

The FDA released guidance early this week for vaccine developers that some analysts had taken to indicate that the agency would be unwilling to even give emergency-use authorization to a vaccine before next year. This leaves a window of opportunity for investors to buy stock of the Operation Warp Speed-enrolled pharmaceutical companies that can potentially earn billions from their government contract.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account