Coinbase (NYSE: COIN) released its earnings for the first quarter of 2022 yesterday. The stock whipsawed in post-market trading after the earnings release.

Coinbase reported revenues of $629 million in the quarter which was ahead of the $590 million that analysts were expecting. The company’s revenues rose from the $576 million that it posted in the third quarter. However, they were significantly below the $2.49 billion that it posted in the fourth quarter of 2021.

Coinbase posted a per-share loss of $2.46 in the quarter which was also narrower than the $2.55 that analysts were expecting. It was nonetheless the fourth consecutive quarter where the crypto exchange posted a loss.

In the full year, COIN reported a net loss of $2.62 billion compared with a net profit of $3.15 billion in 2021. Last year, the company posted an adjusted EBITDA loss of $371 million. In 2021, it posted an adjusted EBITDA of $4.09 billion.

Coinbase reported mixed earnings for Q4 2022

Meanwhile, while Coinbase reported better-than-expected revenues and profits, its user base fell short of estimates. It had 8.3 million MTUs (monthly transacting users) in Q4 2022 which was below the 8.5 million that analysts were reporting.

The company’s MTUs have been falling over the last few quarters. In the first quarter of 2022, Coinbase had 9.2 million MTUs which fell to 9 million in the second quarter. The metric fell further to 8.5 million in Q3 2022.

Its trading volumes also fell 9% to $145 billion. Assets on the platform also tumbled 71% YoY to $80 billion. The fall in crypto assets is also taking a toll on the assets that Coinbase holds for its users.

The company’s financial performance is no different from Robinhood whose revenues and user base are a fraction of their 2021 highs.

COIN management on the results

In the shareholder letter, Coinbase said, “to state the obvious, 2022 was a challenging year for crypto markets and our transaction revenues. As macroeconomic indicators like inflation remained high and interest rates rose throughout the year, crypto market cap declined along with broader equity markets.”

The company listed the depegging of LUNA and the collapse of FTX as the two key headwinds for the crypto industry in 2022.

Coinbase on crypto regulation

Coinbase has long been advocating for a regulatory and legal framework for cryptocurrencies. When FTX collapsed, it tried to pitch itself as a better alternative that is better governed. It also touted its publicly available financials by virtue of being a listed company.

In the shareholder letter, Coinbase said, the crypto industry is “at an important period of transition.” It added, “That is more true now than it has ever been, and we expect 2023 to be a significant year for crypto policy in the United States and abroad. This could pave the way for crypto to realize its full innovative potential, but could also result in further actions by policymakers and regulators that would have a negative impact on the industry. We are preparing for both eventualities.”

Regulators got into action after the FTX collapse

Coinbase said that after the FTX collapse, regulators got into action. It however added, “Coinbase has concerns about those actions that appear more designed to be punitive and reactive than to address actual consumer interests and the realities of how crypto works.”

Notably, last year President Joe Biden released the long-awaited White Paper on crypto. A lot of countries are looking to regulate cryptos to protect the interest of all stakeholders.

However, Coinbase does not seem too happy with the evolving regulatory environment in the US. The shareholder letter said, “Disappointingly, we are not seeing regulators necessarily welcoming transparency and public participation in their rule-making. United States’ agencies, in particular, are demonstrating a disjointed stance regarding crypto that is pushing the industry overseas.”

During the company’s earnings call, CEO Brian Armstrong said, that policy is his “top priority” for 2023 and he has been “spending a lot of time in D.C.”

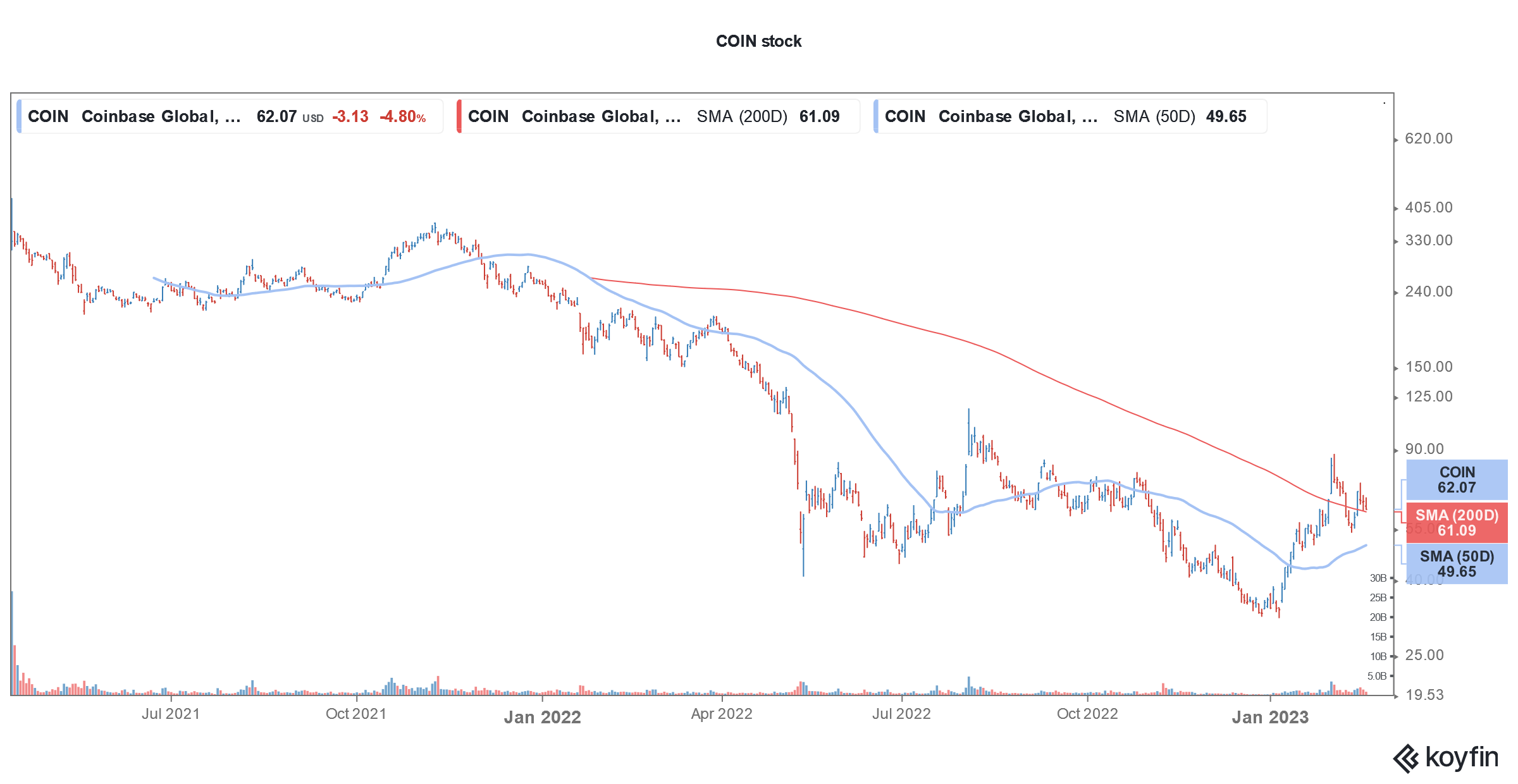

Coinbase stock has rebounded from its lows

Meanwhile, amid the rise in cryptocurrency prices, Coinbase stock has rebounded sharply this year. Cathie Wood of ARK Invest who is among the well-known Coinbase bull bought the dip in COIN stock. She also added more Tesla shares. Both these stocks are outperforming the markets by a wide margin in 2023.

Coinbase stock listed in 2021 through a direct listing. The company kept the reference price at $200 and eventually went on to hit a high of $368.90. The stock fell towards the end of 2021 as cryptocurrencies crashed. The slump continued in 2022 and the stock fell to all-time lows.

Coinbase provided Q1 2023 guidance

Coinbase said that it generated transaction revenues of $120 million in January. While the run rate is higher than the fourth quarter, the company cautioned against extrapolating the revenues.

For Q1 2023, COIN expects transaction and services revenues to be between $300 million to $325 million. It expects transaction expenses to be in the mid-teen percent of the revenues. The company forecast sales and marketing expenses between $60 million-$70 million and expects a restructuring charge of $150 million in the quarter.

The company expects to achieve breakeven on adjusted EBITDA in the full year and said that its cost cuts would help it achieve the goal. Notably, amid the continued crypto winter, Coinbase has announced two mass layoffs over the last year. It did not rule out more layoffs in the future.

COIN stock whipsawed after the earnings release

The company has around $5.5 billion of cash and cash equivalents on the balance sheet. The cash is crucial as the company copes with a prolonged crypto winter and competition from other low-cost crypto exchanges.

COIN stock rose after the earnings release but then turned negative. The stock is nonetheless up 75% so far in 2023 and is outperforming the markets by a wide margin.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account