TikTok videos about trading strategies on free trading app Robinhood have notched up more than 3 million views, as millennials hunt for stock tips from social media influencers.

The Chinese social media network, better known for viral videos of teenage girls dancing to pop tunes, currently has 3.1 million views under the tag #robinhoodstocks.

Young traders are attracted to the site because they want to learn about stock trading and want to see other young people explaining how the market works.

Ben Pryor, a 22-year-old financial influencer, said that seeing a young man talk about stocks “makes other people feel like, ‘hey, I can do this stuff too,’” he told Bloomberg News.

Rise of stock trading apps in lockdown

Lockdown measures around the world have given hundreds of thousands of young investors the time to try and boost their income by day trading on free or low-cost stock market apps.

TD Ameritrade leapt 249%, in the quarter to the end of March. Others have reported a surge in new accounts, including E*TRADE, Freetrade, and Charles Schwab. At eToro, new accounts are up 300% this year.

Robinhood, founded by engineers Baiju Bhatt (pictured) and Vladimir Tenev, hosted 4.3 million daily average revenue trades in June. In total, the Menlo Park, California-based startup, founded in 2013, has 13 million customers.

One market influencer on TikTok is Errol Coleman with almost 158,000 followers on the network and another 5,000 YouTube subscribers.

Coleman provides video explainers on features such as resistance levels, trading penny stocks and discussions on exchange-traded funds.

Millennial market influencers rack up millions of views

But Coleman is not an investment professional — he is senior at Adams State University in Colorado studying business marketing.

However, the business student is not unusual most market influencers on TikTok have little or no qualifications.

Coleman said he is just happy to pass on whatever he knows to others, saying “the more I give, the more I get.”

But he like the many other market influencers on TikTok are also busy promoting posts on other networks because of the uncertainty hanging over the head of TikTok, which is used regularly by more than 800 million people, including some 100 million users in the US.

The social media network owned by Chinese tech group ByteDance is in talks to sell its US, Canada, Australia and New Zealand after US President Donald Trump said the app is a national security concern and must be sold by mid-September.

Trump signed an executive order on 6 August giving Americans 45 days to stop doing business with TikTok’s parent ByteDance.

Microsoft’s stock rises as it chases TikTok

Microsoft, Oracle are among the suitors for these operations. Investors behind ByteDance value the whole of TikTok at $50bn, significantly more than rival Snapchat, valued at around $33bn.

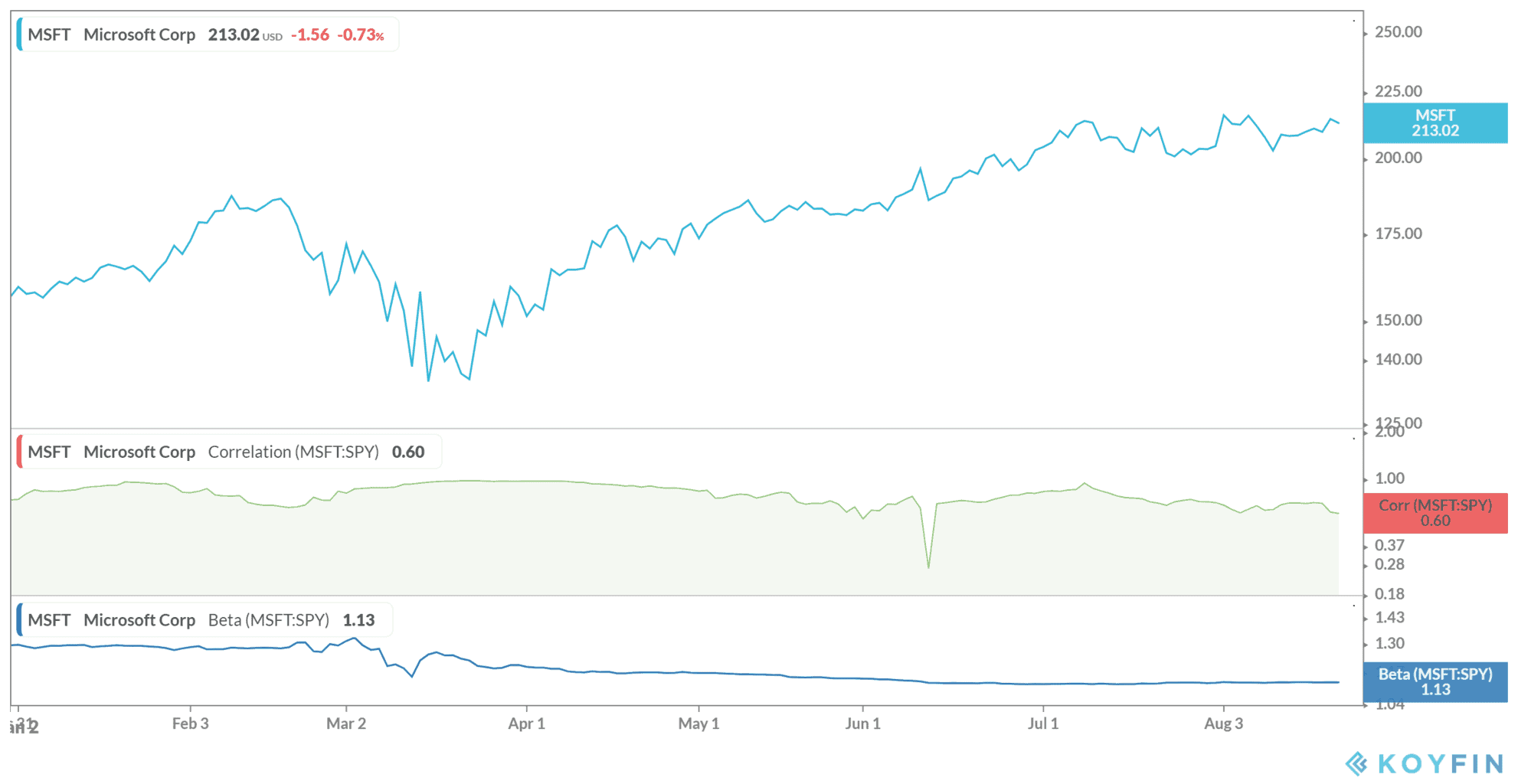

Microsoft stock has jumped 32% this year, giving the business as $1.6bn valuation. Like other Big Tech rivals Amazon, Google and Facebook, its revenues have been boosted by lockdown measures that have seen consumers and firms rely on their services for shopping and for work.

Microsoft’s stock relative strength index (RSI) score is 54.39 over a 14-day average, which suggests the company is trading in technically neutral territory. RSI scores range from 0 to 100, where the stock is considered overbought when the index is above 70 and oversold when below 30.

However, the TikTok sale has been thrown into doubt after ByteDance said on Saturday it would challenge the White House crackdown in court.

“To ensure that the rule of law is not discarded and that our company and users are treated fairly, we have no choice but to challenge the executive order through the judicial system,” the group said in a statement.

ByteDance said it would file the lawsuit against the Trump administration on Monday.

Meanwhile, last week, Robinhood saw its valuation leap to $11.2bn following a $200m investment from New York-based hedge fund D1 Capital Partners.

Previously, the trading platform was valued at $8.6bn in July, according to the data provider PitchBook.

Trading in options can be risky and investors can lose more than their initial capital. We have made a guide on trading in binary options. There is a separate list of some of the best online stockbrokers

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account