This week, US stock markets rose sharply. The S&P 500 hit a new closing high and is less than a percent below its all-time highs. Would the Santa Claus rally take the stock markets even higher?

The S&P 500 rose 3.8% last week and had its best week since February. The price action of US stocks might seem at odds with some of the economic data points. While the November jobs report was mixed, the CPI rose to an almost 40-year high. Notably, even Fed Chair Jerome Powell now thinks that the work “transitory” has outlived its utility. For the most part of 2021, the US central bank referred to inflation as transitory and expressed hope that it would soon wither away.

The rising global cases of the omicron variant of the COVID-19 virus have also created some uncertainty. However, reports that Pfizer/BioNTech COVID-19 vaccine is effective against the variant with a booster dose helped calm investor nerves.

What’s a Santa Claus rally all about?

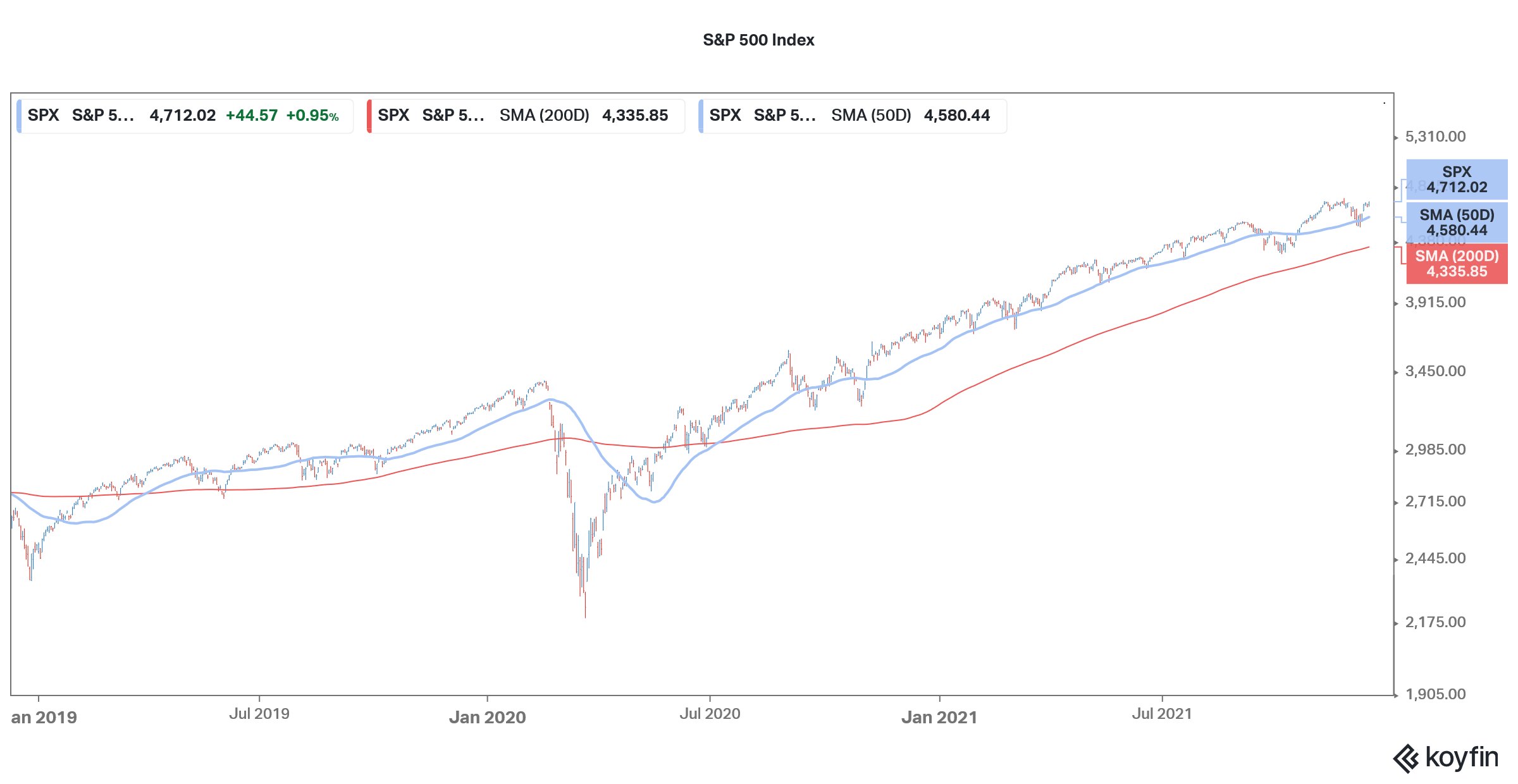

US stock markets tend to rise towards the end of the year which is known as the “Santa Claus” rally. Before this week, many observers were expecting a pullback in the US markets. S&P 500 had also fallen below the 50-day SMA (simple moving average) which further added to the bearishness.

However, Sam Stovall, chief investment strategist at CFRA was among those who were bullish on US stock markets in December. According to Stovall, “December is the second-best month of the year, second only to April. On average, the S&P 500 rises 1.6% and is up an average 76% of the time.” Pointing to historical data, he said that when stocks fall in November, as they did in 2021, on average the S&P 500 rises 2.8% in December and closes with gains 88% of the time.

S&P 500 is headed for a third consecutive year with double-digit returns

The S&P 500 saw strong double-digit returns in both 2019 and 2020. Unless something catastrophic happens over the next three weeks, markets should deliver another year with double-digit returns. It is quite rare for the S&P 500 to deliver three straight years of double-digit returns and the law of averages finally catches up with stock markets. Looking at the current momentum in markets, the Santa Claus rally might continue as 2021 draws to a close.

S&P 500 2022 target

Meanwhile, after a strong 2021, brokerages are quite circumspect about the 2022 outlook for S&P 500. The average 2020 target for the S&P 500 is 4,712 which is less than 5% upside over current prices. Goldman Sachs expects the S&P 500 to rise to 5,100. It believes that while the valuations would be capped amid the rise in real interest rates and there would be sector rotation among stocks, profit growth would drive markets higher, just as they did in 2021. Consensus estimates call for an 8.8% increase in S&P 500 profitability in 2022.

JPMorgan predicts the S&P 500 index to hit 5,050.

JPMorgan Chase expects the S&P 500 to hit 5,050 in 2022. “Our view is that 2022 will be the year of a full global recovery, an end of the global pandemic, and a return to normal conditions we had prior to the Covid-19 outbreak,” said JPMorgan analysts led by Marko Kolanovic, the chief global markets strategist.

The note added, “In our view, this is warranted by achieving broad population immunity and with the help of human ingenuity, such as new therapeutics expected to be broadly available in 2022. While JPMorgan is bullish on risk assets like equities and commodities, it is bearish on bonds.

The Fed might spoil the party

Notably, in a rising interest rate scenario, bonds underperform. Bond prices and yields are negatively correlated and rising interest rates lead to a fall in bond prices. Meanwhile, if the Fed takes a hawkish than expected approach towards hiking rates, it might put pressure on markets.

Growth stocks are especially at risk of a faster than expected tightening. To be sure, we’ve already seen a sell-off in growth stocks, especially the stay-at-home names. While the S&P 500 has marched towards all-time highs, some of the stay-at-home names are trading near their 52-week lows.

Cathie Wood’s funds have especially been negatively impacted amid the sell-off in growth stocks. The flagship ARK Innovation ETF is also underperforming the S&P 500 this year. The ETF’s top holding Tesla has been a savior the stock is up sharply for the year. Wood expects Tesla stock to triple by 2025.

Wood believes the bubble is in S&P 500 and not her names

Meanwhile, while many believe that her funds have scope to fall more, and Michael Burry recently bet against ARKK, Wood says that her names are not in a bubble. “We are not in a bubble. Our strategies would be flying if we were. I think we have not begun rewarding innovation for what’s about to happen and so that’s where our conviction comes from,” said Wood speaking with CNBC.

She added that the benchmark stocks are in a bubble instead. “The other side of [disruptive innovation] is creative destruction, and we do believe that traditional benchmarks are where that’s going to take place,” added Wood.

Investors should have muted expectations from S&P 500 in 2022

All said, investors should have muted expectations from the S&P 500 in 2022. However, if you want to have long-term exposure to US stock markets, it is always prudent to invest in S&P 500 ETFs. Berkshire Hathaway chairman Warren Buffett also advises investors to invest in S&P 500 funds.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Over the long-term stock markets are the best asset class. For more information on trading in stocks, please see our selection of some of the best online stockbrokers. If you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account