US stock futures are retreating slightly this morning in early futures trading action ahead of a week that will offer lots of data to digest including earnings from hundreds of publicly-traded companies, readings from the housing market, and comments from the Federal Reserve’s Open Market Committee (FOMC).

US Treasury yields are possibly contributing to today’s slight drop in future contracts of the three major US indexes, as the benchmark rate is advancing 3.5 basis points to 1.6% after consistently dropping during the past four trading sessions.

Last week, indexes had a choppy performance and ended up settling on negative territory after a report from Bloomberg revealed that President Joe Biden is preparing to hike the capital gains tax for America’s wealthiest cohort from 20% to 39.6% soon – a situation that depressed market sentiment despite positive developments on the corporate earnings and post-virus economic recovery front.

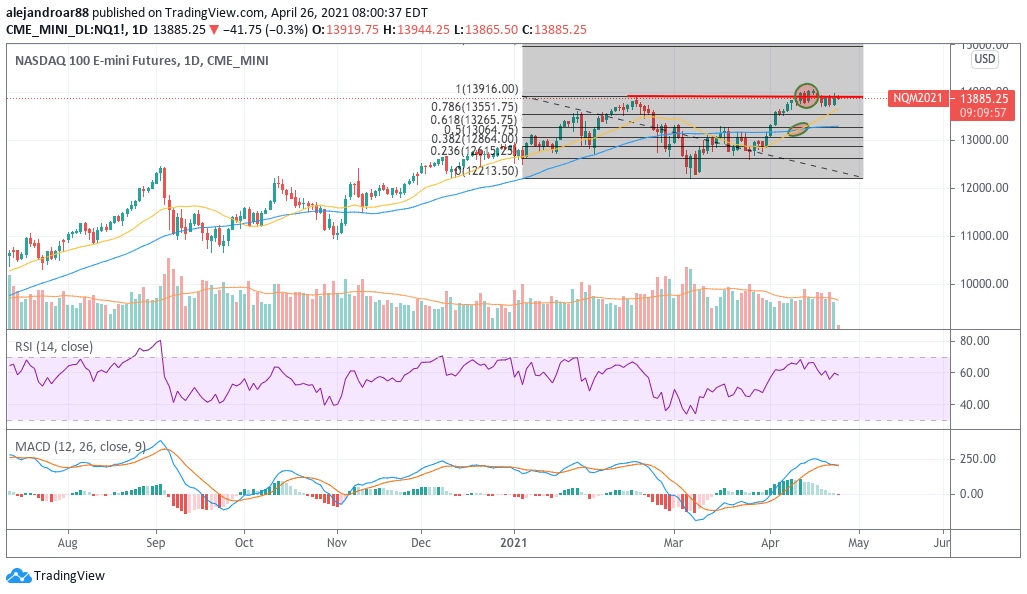

So far this morning, E-mini futures of the tech-heavy Nasdaq 100 (NQ) index are leading the retreat by dropping 0.36% at 13,879, followed by futures of the S&P 500 index (ES), which are down 0.06% at 4,169. Meanwhile, futures of the Dow Jones Industrial Average (DJIA) are up 0.09% at 33,974.

The market will possibly have its eyes set on the outcome of US Treasury bond auctions scheduled to take place between today and tomorrow, especially those concerning the sale of $183 billion in long-dated 2-year, 5-year, and 7-year notes as weak demand could push yields higher.

Moreover, earnings season continues with many popular companies set to disclose their financial results for the first three months of 2021 including big tech firms such as Amazon (AMZN), Microsoft (MSFT), and Google’s parent company Alphabet (GOOG).

Meanwhile, the head of the Federal Reserve, Jerome Powell, will be hosting a press conference on Wednesday after the monthly meeting of the Fed’s Open Market Committee concludes, with the market expecting no changes to the central bank’s ultra-accommodative policy.

That said, ears will probably be tuned to comments from Chairman Powell about the pace of the economic recovery and more guidance on what to expect on the interest rate front during the next few quarters.

Finally, the week will end with the release of relevant data on personal income, consumption, and spending from last month, with economists expecting a strong pick-up in the three indicators compared to the month before amid the distribution of stimulus checks during March.

All in all, everything points to a bumpy week for Wall Street as the potential impact of Biden’s allegedly upcoming tax hike continues to be assessed while fears about a potential fourth wave of the virus in the US continue to cap bullish sentiment to some extent despite the fast pace at which vaccinations are advancing.

“If we learned anything from the data last week it is that 1) Europe is not showing signs of being the drag on global activity and 2) pent up consumer demand is proving resilient to negative COVID headlines”, commented Evercore’s ISI strategist Dennis DeBusschere about the week ahead.

What’s next for US stock futures?

Both the Nasdaq and the S&P 500 will have to find a way to surge above their all-time highs this week or chances are that both indexes could face a short-term pullback as bullish momentum seems to be exhausting.

The tone of this week’s earnings releases will probably have the strongest influence in the performance of indexes during the first three days of the week while the outcome of Treasury auctions could also decide the faith of equities as well.

At this point, either the markets move higher or they will likely take a breather before resuming their latest uptrend on the back of vaccinations and more positive data on the economic front.

For the Nasdaq, the golden cross seen last week continues to support a bullish short-term outlook as recent history shows that the index has advanced more than 20% in the two to three months that have followed the occurrence of this crossing between the 20-day moving average and the 50-day moving average.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account