US stock futures are heading down slightly this morning as traders await the release of the results from the auction of 3-year and 10-year US Treasury notes to gauge the market’s appetite for government bonds and its corresponding impact on yields.

After closing the week with a 2.7% gain, E-mini futures of the S&P 500 are down 0.16% at 4,113 while futures of the Nasdaq 100 are retreating 0.3% at 13,790 following a remarkable week as well where the tech-heavy index advanced 3.9%.

Among other important events this week, investors will be eagerly awaiting the release of last month’s inflation data from the United States this Tuesday.

Data from Koyfin indicates that economists forecasting a 0.5% monthly advance in prices and an annualized inflation rate of 2.5%. Meanwhile, annualized core inflation is expected to land at 1.6% or 30 basis points higher than last month’s reading.

Finally, as we advance further into this week’s economic calendar, other major data points including a monthly update on retail sales from the US Department of Commerce and industrial production and capacity utilization readings from the Federal Reserve will mark the tone of the market’s this week with economists expecting to see retail sales advancing 5.5% compared to the previous month as the US economy keeps stepping out of the virus crisis.

“US data is expected to be strong this week and US vaccinations are increasing”, said Evercore ISI analyst Dennis Debusschere in regards to this week’s events and data points.

Meanwhile, on the Treasury securities front, analysts coincide that this week’s auctions will be closely followed by market participants, with the United States planning to float a total of $96 billion in 3-year and 10-year notes today and another $24 billion in 30-year Treasury bonds tomorrow.

“No matter how you slice it, supply auctions will be in focus”, Justin Lederer, a bond analyst for Cantor Fitzgerald told Reuters this morning.

Although any sign of weak demand in these auctions as a result of a strong risk-on attitude from market players could result in another short-term spike in Treasury yields, analysts believe that certain supportive factors will play in favor of a stable outcome.

What’s next for US stock futures?

Given the fair share of stability predicted for both retail sales and CPI readings for the period, chances are that volatility this week for US stock futures could be kept in check. However, the outcome of US Treasury auctions today could mark the tone for the rest of the week in case the demand for government bonds comes out weaker than expected.

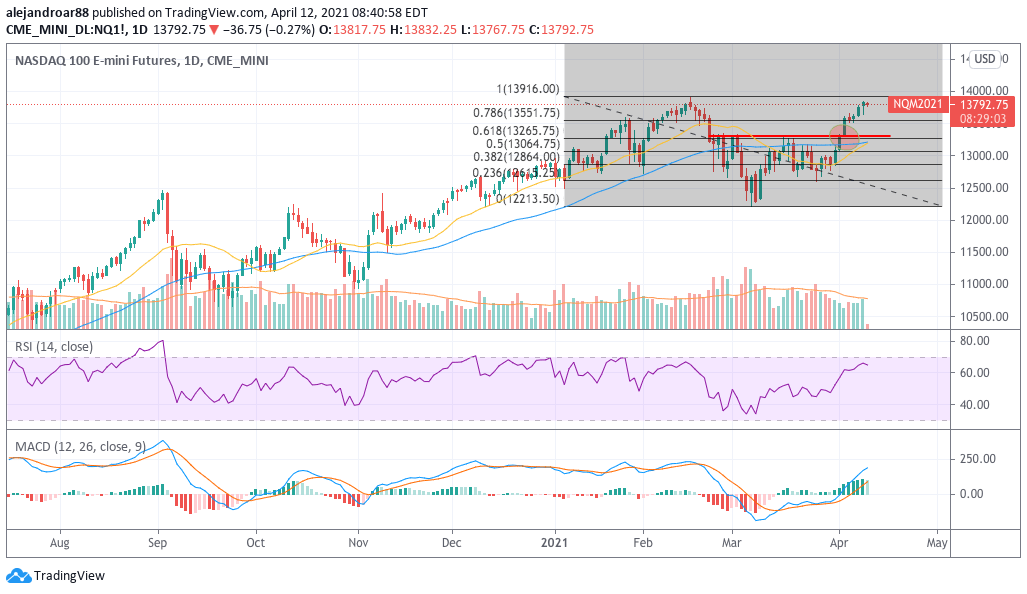

On Monday last week, we anticipated that a break above the Nasdaq’s key resistance of 13,300 could trigger a short-term uptrend and that is exactly what happened.

This week, the tone is a bit more cautious as we are approaching the index’s all-time high. The price action around this particular area of resistance at 13,900 will possibly determine if we move higher from here or if the tech-heavy benchmark will continue to post some choppy performance as market participants keep rotating to the virus-battered areas of the market.

In this particular context, a strong retail sales report could play against the performance of the Nasdaq while favoring the advance of the value-focused Dow Jones Industrial Average (DJIA).

Meanwhile, CPI data and the outcome of this week’s Treasury auctions could have a market-wide impact depending on where they land compared to analysts’ estimates. For now, it would be plausible to expect that the Nasdaq will jump above 13,900 at least in intraday stock trading action today or even tomorrow while traders should keep an eye on how the market reacts once that happens.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account