US stock futures are trading lower this morning after yesterday’s meeting of the Federal Open Market Committee (FOMC), accompanied by a rebound in the US dollar and a spike in volatility ahead of Friday’s quadruple witching.

The front-month E-mini futures contract of the S&P 500 is down 1.13% so far at 3,341.25, following a strong drop in the tech-heavy Nasdaq 100 futures contract, which is sliding 1.4% during this morning trading activity trading near the 11,100 level.

Meanwhile, Dow Jones futures are also down 0.9% at 27,695 while gold is also seeing a sharp drop of 1% during this morning commodity trading activity at $1,950 per ounce.

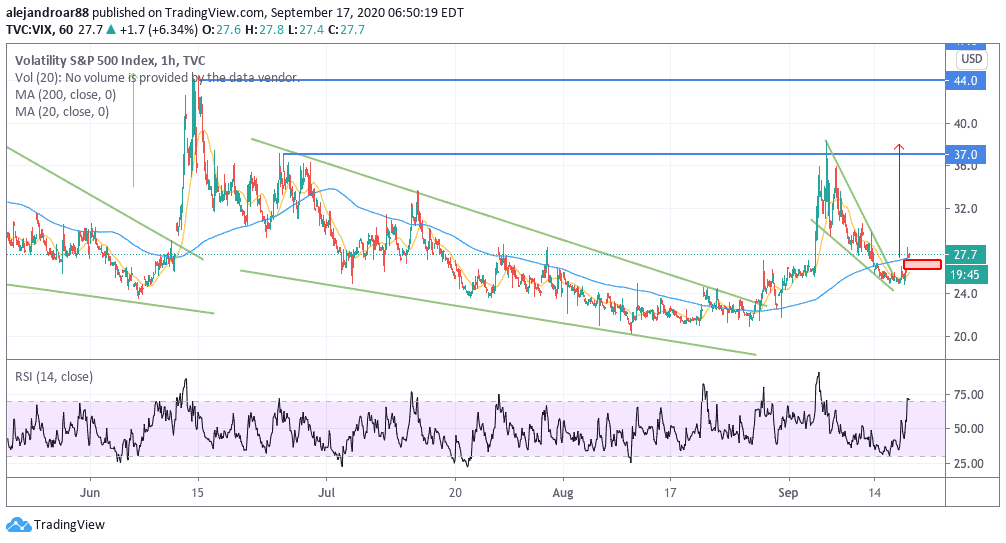

Volatility spikes ahead of quadruple witching

A phenomenon known as quadruple witching is taking place this Friday, which occurs when individual stock options, stock index options, stock futures, and stock index futures contracts expire on the same day.

This phenomenon usually leads to a spike in volatility, although the extent of that surge is usually limited. This could be one of the reasons behind today’s surge in the CBOE Volatility Index – also known as the VIX – which is up almost 7% at 28 during this morning futures trading activity.

A spike in volatility was somehow expected, following a sharp drop since the 4 September peak, which led to the formation of a falling wedge, a pattern that indicates that a trend reversal is about to take place.

Meanwhile, the US dollar is rebounding once again off the upper trend line of its recent price channel, which indicates that the market is not yet letting the dollar fall back to where it was.

What’s next for US stock futures?

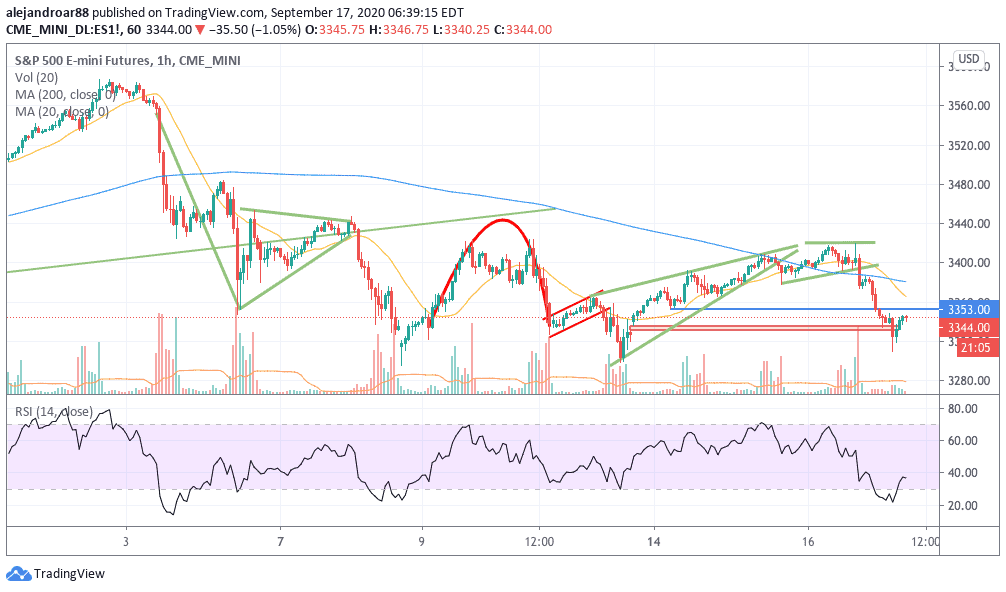

S&P 500 futures fell off an ascending triangle right after the FOMC meeting ended, as market participants were probably expecting more from the US central bank in terms of how they will continue to assist the financial markets – and corporations – in recovering from the economic fallout caused by the pandemic.

The price action during the Asian and European session has successfully filled an open gap at 3,330 with index futures rebounding right after. The 3,325 is a key level to watch as it has served as support on multiple occasions this month.

A move below that level could push index futures further down, possibly to the 3,300 psychological support.

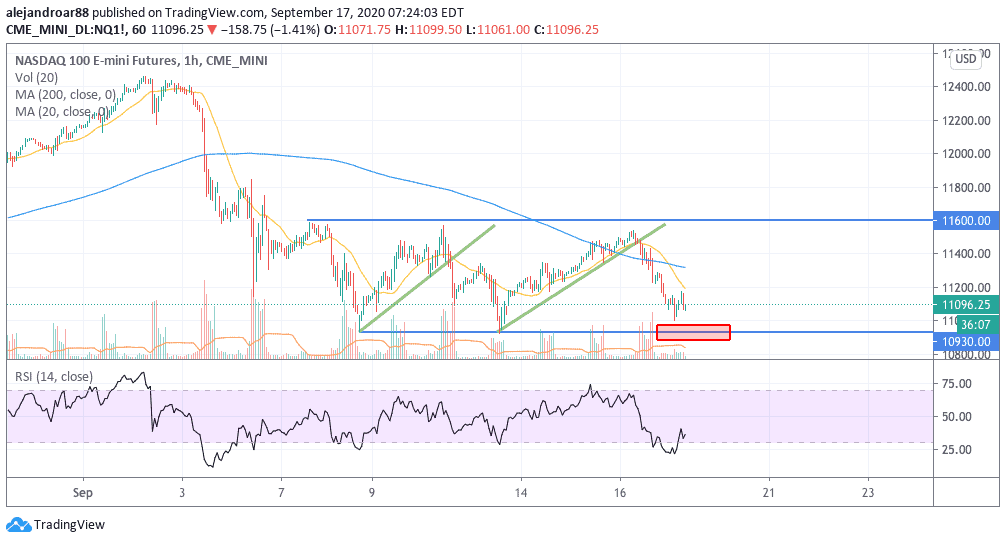

Meanwhile, the front-month futures contract of the Nasdaq 100 has consistently failed to cross the 11,600 level since their early September meltdown and they have moved down towards a 10,930 support two times now – while also rebounding very close to that level this morning.

Since this seems to be a major support level at the moment, one could expect that a move below that line could trigger an even sharper sell-off in the next few sessions – or even today.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account