US stock futures are climbing this morning ahead of the release of retail sales data from the US Department of Commerce as traders appear to be exhausting their ammunitions to trim this week’s losses.

As of yesterday, the top stock indexes were booking their worst week in months, with the S&P 500 and the tech-heavy Nasdaq 100 sliding 2.84% and 4.45% respectively after inflation concerns triggered a major sell-off in the tech sector.

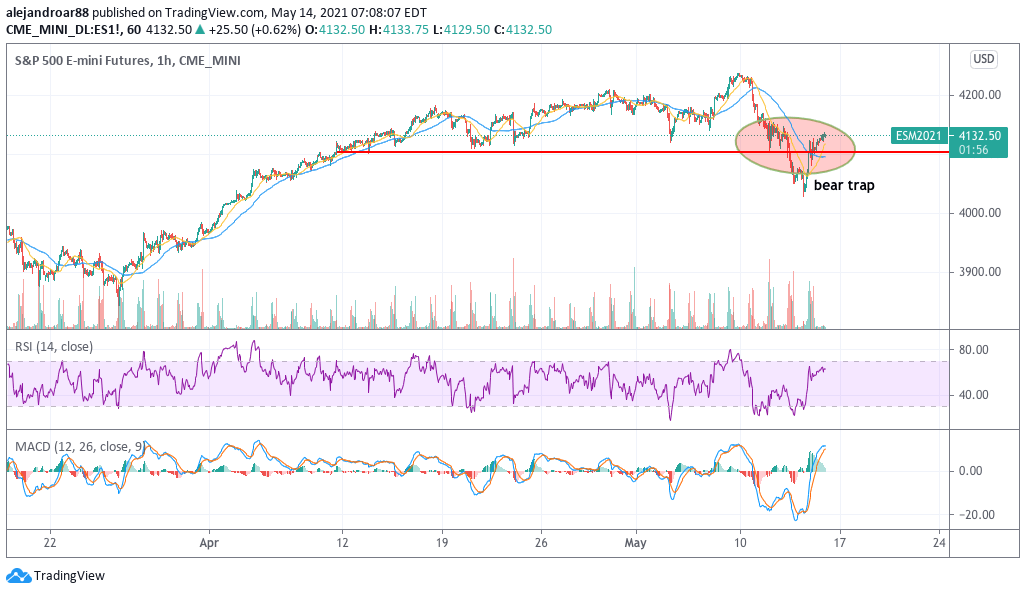

However, the performance of US stock futures this morning seems to indicate that investors are starting to perceive the retreat as a buying opportunity, with E-mini futures of the Nasdaq 100 leading the charge as they are advancing 1.1% so far in early futures trading action. Meanwhile, the S&P 500 E-mini futures are trading 0.6% higher at 4,132 while Dow Jones futures are up 0.4% as well at 13,240.

A retreat in 10-Year Treasury yields appears to be the leading cause of this morning’s uptick in equity futures, as the benchmark rate is sliding 6.4 basis points from yesterday’s high of 1.704%, currently standing at 1.639%.

This drop in long-dated Treasury yields comes as a result of the positive outcome of yesterday’s 30-Year Treasury notes auction, which reported a high yield of 2.395% for almost 61% of the bonds allotted – a rate that was 2 basis points lower than the pre-auction quote. Meanwhile, the median yield landed at 2.315% or 10 basis points lower than the pre-auction reading.

Investors will be eyeing the release of retail sales data this morning, with the consensus estimate currently expecting a 1% jump in the indicator compared to a month ago along with a 0.7% advance in core retail sales – which exclude auto sales.

Data on import prices will also be published in a few hours, with the consensus currently forecasting a 0.6% positive variation. However, based on the inflation data published earlier in the week, chances are that import prices could move beyond analysts’ expectations and that could further deepen the market’s concerns about stronger inflationary pressures.

Moreover, industrial production data will also be released before the market opens along with Inflation Expectations readings from the Michigan University – which could reflect how concerned consumers are about an upcoming sharp rise in prices.

For now, if US stock indexes manage to hold on to these early gains, weekly losses could be trimmed to around 3.5% for the Nasdaq 100 and 2.4% for the S&P 500 – still the worst weekly performance booked by the two indexes in the past three months or so.

What’s next for US stock futures?

This morning’s price action in E-mini futures of the S&P 500 indicates that a reversal of the downtrend could be in play as bulls have reclaimed the 4,100 level – a key support for the index since the beginning of April.

If that is the case, chances are that the latest correction might have hit bottom for now, even though it remains to be seen if this bullish activity in the futures market can be translated to gains during the live session.

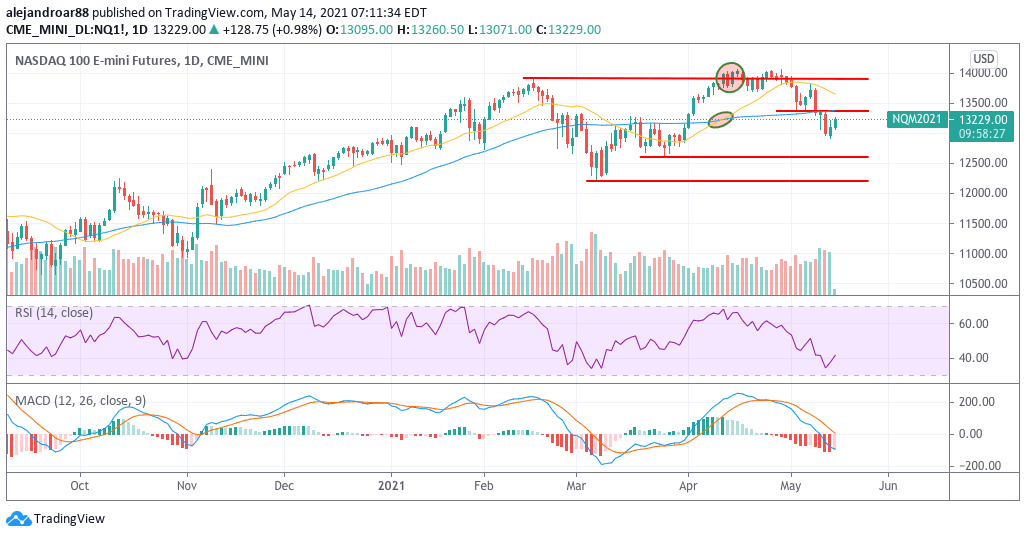

On the other hand, the situation is quite different for the Nasdaq 100, as the index has lost an important intraday support after sliding below the 13,370 level and is now struggling to climb back up.

Chances are that this support level will now become resistance as bears conquered the price action earlier this week and that could result in a prolonged downtick for the tech-heavy index. Moreover, the index has also broken below its short-term moving averages – a situation that reinforces a bearish outlook.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account