US stock futures are dipping this morning in early futures trading action ahead of a landmark meeting of the Federal Open Market Committee (FOMC) in which US central bankers are expected to discuss last week’s blow-off-top inflation data while dozens of companies in the retail sector are expected to report their earnings.

E-mini futures of the Nasdaq 100 index are leading today’s downtick as they are declining 0.5% at 13,321, followed by futures of the Dow Jones Industrial Average and S&P 500 index, which are dropping 0.4% each at 34,166 and 4,152 respectively.

Even though the Chairman of the Federal Reserve, Jerome Powell, has stated multiple times that the central bank is willing to tolerate higher inflation rates during a certain period to keep boosting the economy in a post-pandemic scenario, last week’s data will probably be considered while the market expects some sort of chatter or guidance about upcoming tapering to the institution’s $120 billion asset purchase program as one potential measure to contain the advance of the consumer price index (CPI) in the nation.

Last week, the annualized inflation rate landed at 4.2%, surpassing economists’ forecasts by 60 basis points, while core inflation in the past 12 months advanced 3%, also above analysts’ estimates of 2.3% for the period. Meanwhile, a similar measure, the producer price index (PPI) jumped 6.2% while the core PPI went up 4.1% – both higher than Wall Street’s consensus.

Meanwhile, on Friday, the widely-followed Purchasing Managers Index (PMI) compiled by IHS Markit will also be released for the United States and the Eurozone along with data on existing home sales.

Moreover, a handful of companies in the retail space will be reporting their earnings for the first quarter of the year including Walmart (WMT), Home Depot (HD), Target (TGT), and L Brands (LB) – among others.

This important sector of the economy could provide further indications about the pace of the recovery during the first three months of the year, although retail sales came in flat last month as indicated by last week’s report from the US Department of Commerce, for which analysts expected a 1% advance in the indicator. Meanwhile, excluding auto sales, retail sales actually retreated 0.8 vs. a 0.7% estimate for the period.

The top US stock indexes posted their worst weekly loss in the past 12 periods, with the Nasdaq 100 retreating 2.4% at 13,393 while the S&P 500 went down 1.4% at 4,173. Meanwhile, the Dow Jones Industrial Average (DJIA) dropped 1.14% at 34,382.

This is the fourth consecutive losing week for the tech-heavy Nasdaq 100 index as an ongoing sector rotation has contributed to depress the index’s performance this year, currently lagging the S&P 500 by as much as 7.2%.

In regards to last week’s performance, Nikolas Panigirtzoglou, managing director of global market strategy for JP Morgan, said: “Not only are [last] week’s events a warning sign of how uncomfortable inflation prints can become but also a warning sign of how overbought equity markets have become”.

What’s next for US stock futures?

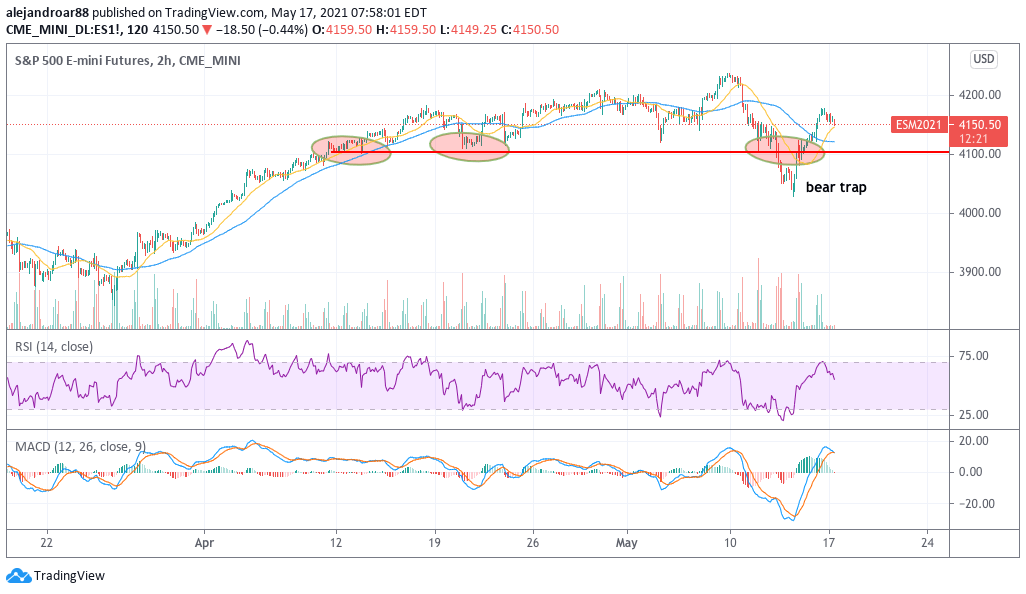

The most interesting chart for this week is that S&P 500 futures, as the index has successfully recouped its lost 4,100 lost support during Friday’s stock trading session, effectively, with the price action showing what could be a potential bear trap that should lead to a move higher in the following days.

A bear trap is a pattern that indicates that bulls led those with a bearish outlook to believe that they have capitulated, only to repurchase a certain instrument at a lower price, which results in a reinforcing loop as bears will then struggle to cover their shorts while pushing the price higher as a result.

When that happens, bulls tend to remain in control of the price action for a while, even though certain negative catalysts can lead to the continuation of the downturn later on.

The FOMC meeting is without a doubt the most important event to watch this week, as indications that the Federal Reserve is considering the possibility of tapering its asset purchases earlier than expected could produce a short-term downtick in equities.

Aside from that, the outlook for the week remains bullish as long as the S&P 500 remains above that 4,100 threshold indicated in the chart.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account