The US dollar is taking a breather this morning after plunging yesterday, with the value of the North American currency – as reflected by Bloomberg’s US dollar index (DXY) – moving 0.13% higher at 91.424 in early forex trading activity.

The greenback saw its worst day since 5 November as it slipped 0.61% yesterday at 91.313, with traders eyeing a potential resumption in stimulus talks in US Congress amid a strong resurgence of the virus in the country.

Speaker of the House Nancy Pelosi and US Treasury Secretary Steve Mnuchin held talks on this upcoming stimulus yesterday – making it the first time the two meet since the election.

Meanwhile, reports indicated that there is bipartisan support for a bill that could inject as much as $908 billion to the US economy in the form of direct reliefs, with US Senate leader Mitch McConnell emphasizing the importance of passing more stimulus to avoid a prolonged economic downturn, as the pandemic situation in the country persists.

The number of daily virus cases reported in the United States fell from its recent record high of 204,000 contagions in a single day recorded on 20 November to 182,000 cases yesterday, according to data from virus-tracking website Worldometers. However, deaths ascended to their highest levels since May, with a total of 2,614 Americans passing yesterday due to the virus.

Despite this apparent willingness to advance on the stimulus front, traders remain skeptical about the speed at which Congress can move forward with a deal.

This view is reflected by recent comments from Masafumi Yamamoto, chief currency strategist for Mizuho Securities, who stated: “The currency market is skeptical whether these proposals could be agreed in a swift manner, since hopes were shattered once already when a stimulus package didn’t come into fruition before the presidential election”.

The pound sterling is among the biggest losers today against the greenback, as the British currency is retreating 0.5% so far at 1.1073 while the euro is holding its ground after crossing the 1.20 level yesterday for the first time since 1 September.

Data from the U.S. Commodity Futures Trading Commission (CFTC) and compiled by Tradingster indicated that open interest among non-commercial traders for short positions increased by almost 8% during the week that ended on 24 November.

Speculators have been net short on US dollar index futures since June 2020, with the current net short position among non-commercial traders sitting at 2,754 contracts.

What’s next for the US dollar?

The US dollar seems to have lost some of its appeal as a safe haven lately, as massive injections of liquidity from the Federal Reserve and Congress have triggered inflation fears.

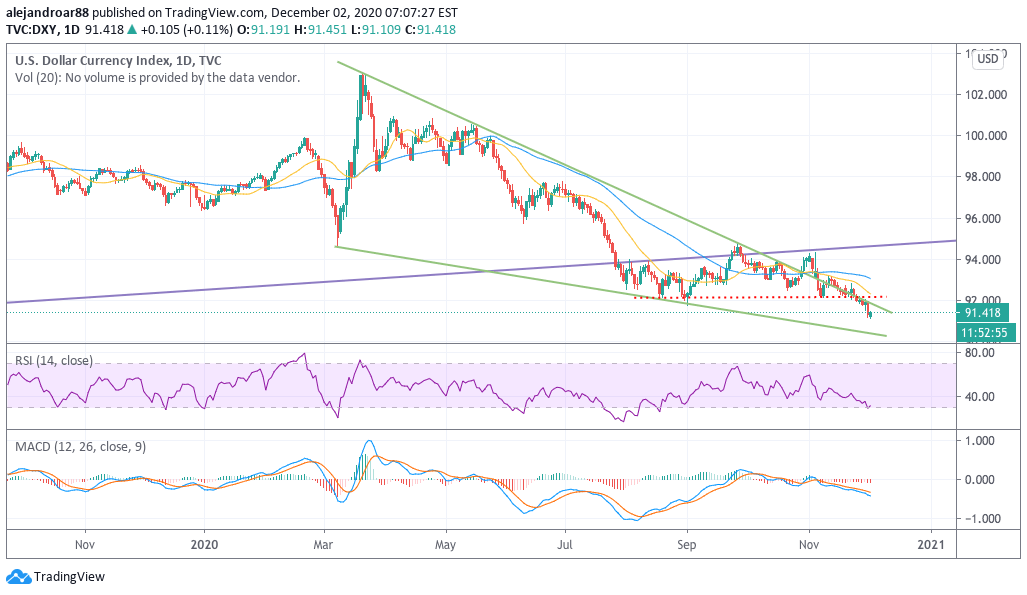

As a result, the dollar has been submerged in what seems to be a falling wedge pattern that could end up turning the tables if a strong risk-off move is to occur at any given point in time.

That said, in the absence of a major catalyst, it would be hard to see the dollar surging above the 95 level in short notice, especially if Congress moves to approve another stimulus bill or if the Federal Reserve ups its balance sheet to a greater extent in the following weeks amid a delayed response from the current administration to the economic woes caused by a persisting outbreak.

For now, the path of least resistance for the greenback continues to be down, as the benchmark fell below 92 lately – a key level that served as support more than 4 times since mid-August.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account