The US dollar snapped a 5-day winning streak by the end of yesterday’s forex trading session, as the greenback kept seeing higher demand amid an ongoing climb in US Treasury yields.

The yield of 10-Year US Treasury bonds has been rising steadily since 5 January, moving from 0.917% to 1.16% today, this being the first time that yields rise above the 1% mark since late March [bond yields move inversely to bond prices].

The sell-off seen by US Treasury notes seems to have been triggered by higher inflation expectations, as President-elect Joe Biden has already voiced his willingness to extend relief measures once he takes office – including the possibility of handing $2,000 stimulus checks while also pushing for a large infrastructure spending package.

With a Democratic-led US Senate, Biden could face fewer obstacles to approving further spending by the federal government to contain the economic fallout caused by the pandemic, which could end up sparking higher levels of inflation once the economy gets back to normal.

That said, despite the fact that higher spending should also lead to a sustained depreciation in the US dollar, inflation worries in the bond market seem to be outweighing the prospect of further dollar debasement at the moment, as the greenback – as tracked by Bloomberg’s US Dollar index – is accumulating a 1% gain so far since 6 January.

“It’s complicated because higher U.S. yields are giving the dollar a bounce, but stimulus could support U.S. equities, and the dollar would remain weak”, said Osamu Takashima, a forex strategist at Citigroup Global Markets Japan.

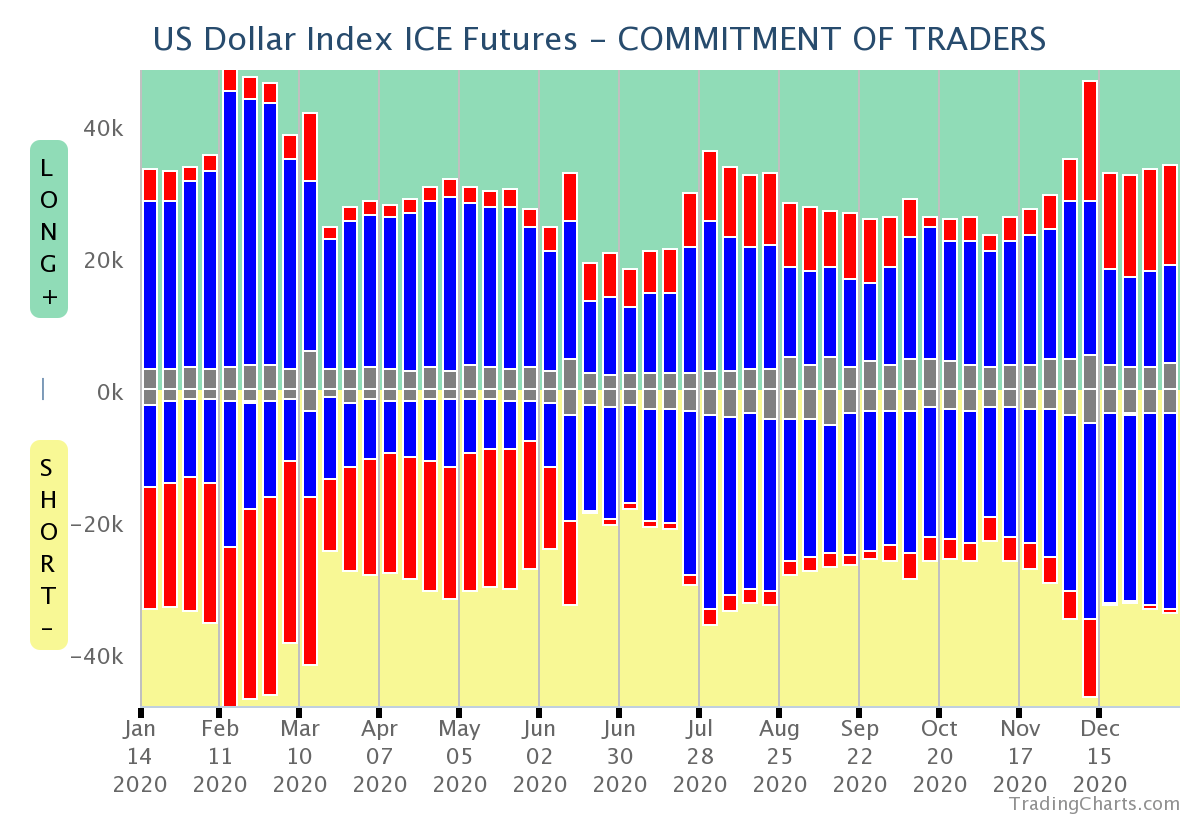

Meanwhile, institutional traders have kept a bearish outlook on the dollar amid the prospect of higher fiscal spending.

“Given the USD is modestly overvalued, we expect the recent lift in the USD to be limited”, said Joe Capurso from the Commonwealth Bank of Australia.

On the other hand, the recent uptick in treasury yields has been a cause of concern among them, especially when considering that non-commercial traders – hedge funds, banks, and other financial institutions – are net short on the dollar as indicated by data from the US Commodity Futures Trading Commission.

What’s next for the US dollar?

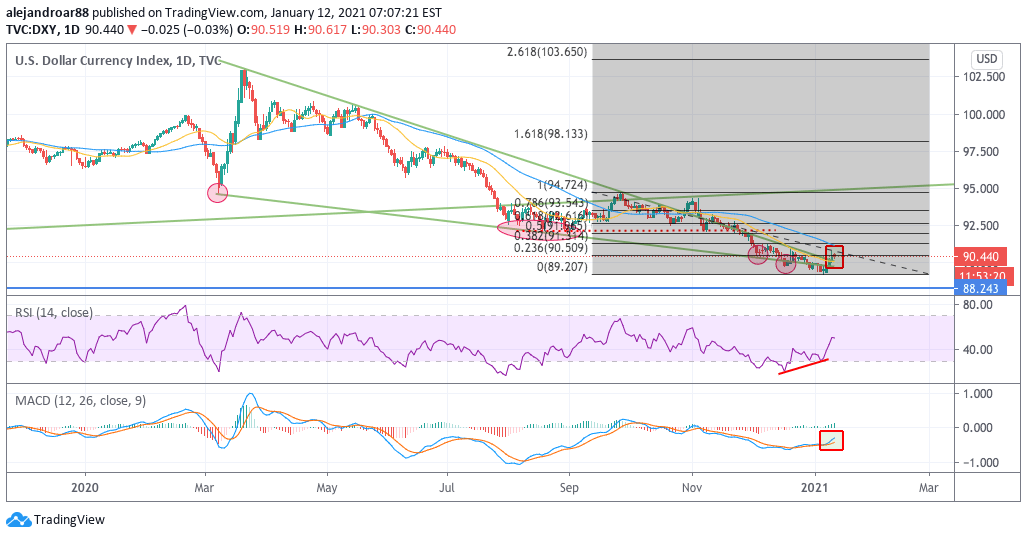

This latest 5-day winning streak has led to a breakout of a long-dated bullish falling wedge pattern that started forming since the greenback’s post-pandemic surge.

Now, with the price being pushed above the 90 mark, a short-squeeze could be unraveling while a stronger demand from short-sellers covering their positions could keep supporting higher levels for the greenback in the near future.

Meanwhile, a bullish divergence emerged from the recent US dollar sell-off, with the greenback making a new low while the RSI posted a higher low. Moreover, the MACD has already sent a buy signal, which reinforces a bullish short-term outlook for the price action over the coming days as the currency emerges off its recent depths.

The downtick in US Treasury bond prices – which has propelled yields above 1% – is potentially the most important catalyst for the greenback’s appreciation at the moment, as the demand for the North American currency will continue to increase as long if yields keep rising.

For now, this move can be categorized as a short-term breather as the greenback steps out of oversold territory. However, if the price were to move above the 91 level, a strong argument could be made that a short squeeze is effectively in play, which would lead to a quick appreciation in the US dollar as short-sellers will rush to cover their position – pushing the price higher in the process.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account