Tesla delivered 184,800 electric cars in the first quarter of 2021 which was a new record despite the first quarter being seasonally weak for the company.

Generally, Tesla’s delivery numbers are lower than the production numbers as some cars produced in the quarter remain in transit. Unlike legacy automakers that carry huge inventories, Tesla is a supply-constrained company and can only deliver as many cars as it can produce in the quarter.

Tesla’s first quarter delivery report

Tesla produced 180,338 cars in the first quarter and all of these were the Model 3/Y. The company did not produce even a single Model S/X in the quarter. As for deliveries, it delivered only 2,020 Model S/X in the quarter while the remaining 182,780 were Model 3/Y.

The company does not provide the individual break up for Model 3 and Model Y but the sales of these two models have been rising even as the sales of the premium Model S/X have been tepid.

In the first quarter, Tesla started delivering China-made Model Y to customers. It began the deliveries of China-made Model 3 towards the end of 2019 and ramped up the deliveries last year. “We are encouraged by the strong reception of the Model Y in China and are quickly progressing to full production capacity,” said the company in its release.

As for Model S/X, the company is revamping the models. “The new Model S and Model X have also been exceptionally well received, with the new equipment installed and tested in Q1 and we are in the early stages of ramping production,” it said in the release.

Tesla’s deliveries were better than expected

Meanwhile, Tesla’s first quarter deliveries were better than expected. Analysts polled by Refinitiv were expecting the Elon Musk run company to deliver 177,822 vehicles. RBC Capital Markets analyst Joseph Spak expected the company to deliver 170,000 cars in the first quarter.

NIO and XPeng also beat delivery estimates

Last week, NIO said that it delivered 20,060 electric vehicles in the first quarter which were higher than its guidance of 19,500. The company had scaled back its guidance by 1,000 units as it had to curtail production in the first quarter due to the global chip shortage.

XPeng delivered 5,102 cars in March, a year over year rise of 384%. Its deliveries were also ahead of its guidance of 4,262 cars.

China ramp up helped Tesla’s deliveries

Meanwhile, Tesla beating the delivery expectations in the first quarter is significant as the quarter is seasonally slow for the company. However, during the fourth quarter earnings calls, CFO Zachary Kirkhorn sounded bullish on the first quarter deliveries. “Specifically for Q1, our volumes will have the benefit of early Model Y ramp in Shanghai. However, S and X production will be low due to the transition to the newly re-architected products,” said Kirkhorn.

While Tesla provides annual delivery guidance, it has only provided qualitative guidance for 2021 and not a quantitative one.

During their fourth quarter 2020 earnings call, the company said that it expects its deliveries to rise at a CAGR of 50% over the long term and expects the growth rate in 2021 to be “materially higher.” Tesla also said that “As we increase production rates, volumes will skew toward the second half of the year, and ramp inefficiencies will be a part of this year’s story and are necessary to achieve our long-term goals.”

Geographical breakup

Tesla does not provide the geographical breakup of deliveries in the release. However, according to data from China’s Association of Automotive manufacturers, Tesla sold 18,318 electric cars in China in February. China has emerged as a major market for Tesla even as it is facing intense competition in the US and European markets. Volkswagen has already dislodged it as the market leader in Europe. In the US market, it is getting tough competition from new models from legacy automakers like Ford.

Tesla delivery forecast for 2021

Meanwhile, Dan Ives of Wedbush Securities, who holds a bullish view of Tesla, believes that demand from China and Europe was strong for the company in the first quarter. “We believe China and Europe were particularly robust this quarter,” said Ives and forecast that the company would deliver 850,000 cars in 2021. Ives’ forecast would mean a year-over-year growth of 70% for Tesla.

How could Tesla stock play out in 2021?

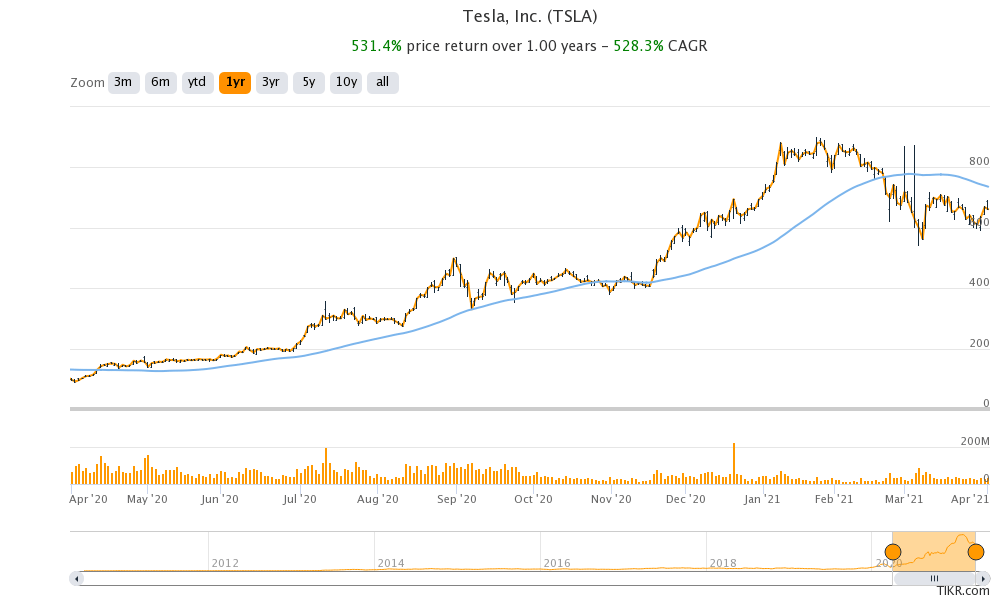

2020 was an incredible year not only for Tesla but for all the companies in the electric vehicle ecosystem. The stock rose 740% in 2020 while NIO gained over 1,100%. The S&P 500 also added Tesla to the prestigious index last year which helped bring some legitimacy to the company.

However, 2021 hasn’t been good for electric vehicle companies. While the year began on a positive note and Tesla stock made new record highs, it has since looked weak. It is now down 26% from its 52-week highs. There has been an even steeper fall in Chinese electric vehicle stocks like NIO, XPeng Motors, and Li Auto.

Tesla’s long-term outlook

Meanwhile, after the better-than-expected Q1 delivery report, Tesla stock was trading almost 6% higher in US premarket trading today. That said, while the delivery report is a positive for the stock, it might not fully mask the concerns over its overvaluation. Despite the fall in its stock price, Tesla commands a market capitalization of $635 billion which makes it the world’s most valuable automaker.

Meanwhile, Tesla bulls expect the stock to move higher, Gene Munster of Loup Ventures expects the company’s market capitalization to hit $2 trillion by 2023 while ARK Invest expects the company’s stock to hit $3,000 by 2025 which would mean a market capitalization of over $3 trillion.

Cathie Wood on Tesla

ARK Invest is led by Cathie Wood who is known for her bullish views on Tesla. The fund house recently launched its eighth ETF which is based on the space exploration theme. However, many including Jim Cramer were critical of ARK Invest for having companies like Deere, Amazon, and Netflix in an ETF focused on space exploration.

You can invest in electric vehicle stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account