Tesla (NYSE: TSLA) and Ford (NYSE: F) have announced a partnership under which Tesla would open up over 12,000 Superchargers across the US and Canada for Ford drivers beginning early next year.

The two companies announced the partnership during a live, audio discussion on Twitter Spaces yesterday. Notably, Musk also owns Twitter even as now he has transitioned to the role of the CTO.

Ford CEO Jim Farley said, “Working with Elon and his team, I’m really excited for our industry and for the Ford customers.” Musk too appreciated the relationship and said, “It’s an honor to be working with a great company like Ford.”

Notably, both have previously also praised each other even as they are rivals in the EV industry. While Tesla is the market leader in the US EV market Ford came second last year – albeit a quite distant one.

Ford and Tesla partner to share Supercharging infrastructure

The partnership between the two companies goes beyond the agreement and Ford said that its next generation of vehicles which would be launched towards the middle of the decade would have charging ports compatible with Tesla which would eliminate the need for adapters while charging the vehicles.

Ford CEO Jim Farley pointed to the different charging ports in EVs and said, “It seems totally ridiculous that we have an infrastructure problem, and we can’t even agree on what plug to use.”

He added, “I think the first step is to work together in a way we haven’t, probably with the new EV brands and the traditional auto companies.”

Tesla has over 45,000 Superchargers

In its Q1 2023 earnings release, Tesla said that it has 45,000 Supercharger connectors globally spread across 4,947 stations. As is the case with deliveries, Tesla did not provide a breakdown by different regions.

That said, the Superchargers are a key competitive advantage for Tesla as it has built a sprawling charging infrastructure across the world. In the past, the company has used free Supercharging as bait to spur sales toward the end of the quarter.

Tesla does not disclose the revenues that it derives from Superchargers but instead clubs in under the “Services and others” segment. During Q1 2023, the segment posted revenues of $1.83 billion – a YoY rise of 44%.

Tesla’s profit margins fell in the quarter

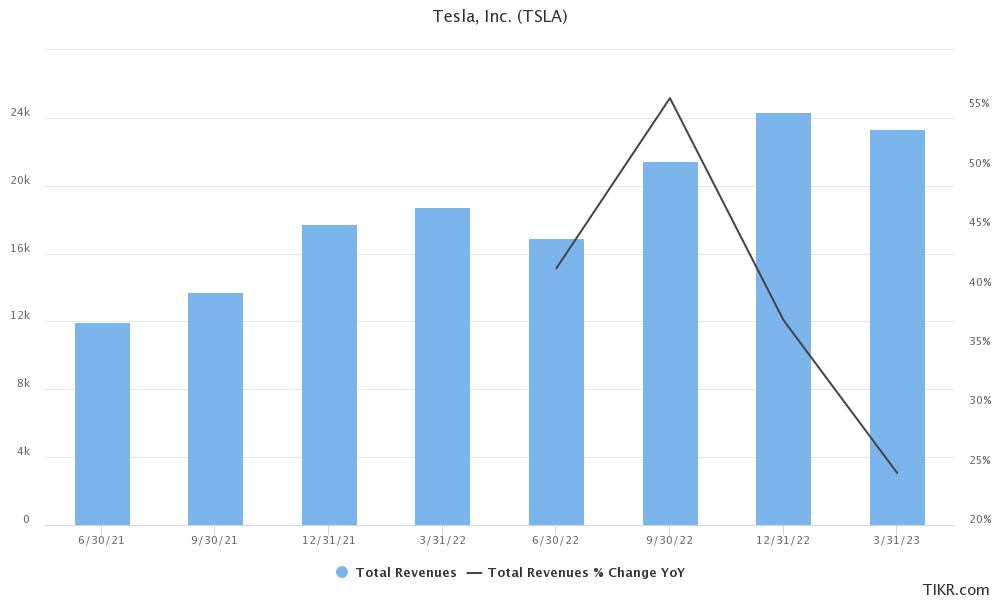

To put that in perspective, it reported revenues of $23.33 billion in the quarter which were 24% higher YoY. The Energy segment’s revenues soared 148% while the automotive revenues rose only 18% as compared to the corresponding quarter last year.

However, its operating margin fell to 11.4% in the quarter – as compared to 16% in the fourth quarter and 19.2% in the first quarter of 2022.

The company did not disclose the automotive gross margin – a key metric that markets were looking for – but said that it “reduced sequentially.”

Meanwhile, the partnership looks like a win-win for Ford and Tesla. Tesla would earn revenues when Ford customers charge on its network, which Ford said “will be competitive in the marketplace.”

On the other hand, the partnership would mean that Ford would not need to spend on its own charging infrastructure.

Ford is ramping up its EV capacity

Ford is ramping up its EV capacity and said that the nameplate capacity to produce F-150 Lightning should double to 150,000 this year. Overall, the company is targeting an annual EV capacity of 600,000 by the end of 2023 and 2 million by 2026.

Ford is spending billions of dollars every year to ramp up its EV capacity. The business is posting losses though and Ford expects the EV business to lose $3 billion this year. Despite the losses, it expects a company-wide pre-tax profit of between $9 billion-$11 billion this year.

Ford F-150 is the best-selling pickup

Meanwhile, Ford and Tesla are competing in the EV industry. Earlier this year, Ford lowered the price of its Mach-e to make it competitive against Tesla Model Y.

Ford also sells the F-150 Lightning – which is the EV avatar of its best-selling Ford F-150 pickup. The model would compete with Tesla’s upcoming Cybertruck.

Tesla unveiled its Cybertruck pickup in 2019 but it is running behind schedule. During the earnings call, Musk said, “we continue to build Alpha versions of the Cybertruck on our pilot line for testing purposes” and said that deliveries should begin in the third quarter of this year.

He added, “As with all new products, it will follow an S curve, so production starts out slow and then accelerates.”

Tesla Cybertruck deliveries to begin in 2023

Previously also Musk predicted that the model’s mass production would begin only in 2024.

During the shareholder meeting earlier this month, Musk said that Tesla should be able to deliver upto half a million Cybertrucks annually once the production ramps up.

He also said that Tesla Roadster – originally set to go into production in 2020 – would go into production in 2024.

During his interaction with Farley yesterday, Musk acknowledged that the Roadster is still not fully designed.

All said, the charging station partnership between Ford and Tesla looks encouraging as it would help both the companies as well as in the overall EV adoption.

It might also set the template for other automotive companies, as they weigh the trade-off between partnership versus building their own charging infrastructure like Tesla has done.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account