Tesla stock (NYSE: TSLA) is trading higher in US premarket price action today after the company reported better-than-expected deliveries for the second quarter of 2023.

Tesla produced 479,700 cars in the second quarter of 2023 as compared to 258,580 in the corresponding quarter last year. The company’s deliveries rose 83% YoY to 466,140.

This is the fifth straight quarter when Tesla’s deliveries have trailed production. The second quarter deliveries were nonetheless ahead of the 445,924 that analysts were expecting.

Tesla reported better-than-expected deliveries in the second quarter

The Elon Musk-run company has cut car prices multiple times this year which has helped it spur sales. While it has raised car prices slightly since May, they are still much lower than they were at the beginning of the year.

Also, all Tesla Model 3 and Model Y are now eligible for the $7,500 EV tax credit. Together both these models account for 96% of the company’s total deliveries.

While Tesla does not provide a breakdown by individual models, the Model Y was the best-selling model globally in the first quarter of 2023, after excluding pickup models. It was the first time in history that an EV model was the best-selling model, beating the wide army of ICE (internal combustion engine) models from legacy automakers.

TSLA expects to produce over 1.8 million cars in 2023

TSLA expects to produce 1.8 million cars in 2023 but Musk said that the number could rise to as high as 2 million. It has set itself an ambitious task of producing 20 million cars annually by the end of 2030 – which is nearly twice what the market leader Toyota Motors currently sells.

Currently, it has two Gigafactories in the US and one each in Shanghai and Berlin. The company is setting up the next Gigafactory in Mexico and Musk last month met Indian Prime Minister Narendra Modi and talked about investing in the world’s fifth largest economy “as soon as humanly possible.”

That said, while reports of Tesla investing in India have been cropping up frequently, the company is looking at more incentives and tax breaks on automotive imports before it starts producing cars in the country.

Tesla charging ports are fast becoming the US standard

Over the last month, Tesla has signed deals with automakers like Ford, General Motors, Polestar, and Rivian to share its Supercharging network. These companies would also make their chargers compatible with Tesla superchargers, making it an almost gold standard in the US EV industry.

Musk has said that Tesla is also open to sharing its autonomous driving technology with other automakers.

The company also offers the full self-driving (FSD) which is the advanced version of the Autopilot.

Meanwhile, Tesla’s self-driving has been controversial including the very terminology “full self-driving” as the technology is nowhere near fully autonomous as the name might suggest.

In February, Tesla recalled 362,758 vehicles due to safety concerns over the FSD software.

Tesla did an over-the-air update to address the issue. Meanwhile, Musk believes that it was not a “recall” as it got fixed with an over-the-air update.

Musk says autonomous driving accounts for the bulk of Tesla valuation

At the Paris VivaTech innovation conference last month, Musk interacted with Bernard Arnault’s son Antoine Arnault who quizzed him on Tesla’s valuation which far exceeds that of their luxury group.

Musk responded by linking the company’s valuation to its autonomous driving and said “If you look at our total vehicle output, it’s almost 2 million vehicles this year or something like that. But that’s still only 2% of total vehicle production.”

Musk meanwhile said that Tesla’s valuation is “primarily based on autonomy” and emphasized, “The potential for autonomy is that the value of autonomy is so high, that even if you have a discount, a percentage probability of autonomy happening, that is so incredibly valuable.”

To be sure, this was not the first time that Musk has sought to hype Tesla’s autonomous driving and link it to the company’s valuation.

Last year, Tesla raised the FSD price from $10,000 to $15,00 and Musk believes that it would eventually rise to $100,000.

During the Q1 2023 earnings call, Musk said, “I hesitate to say this, but I think we’ll do it (full autonomy) this year.” Markets meanwhile don’t seem to buy his argument as the Tesla CEO has made such comments almost every year since 2015.

What to expect from TSLA’s Q2 2023 earnings?

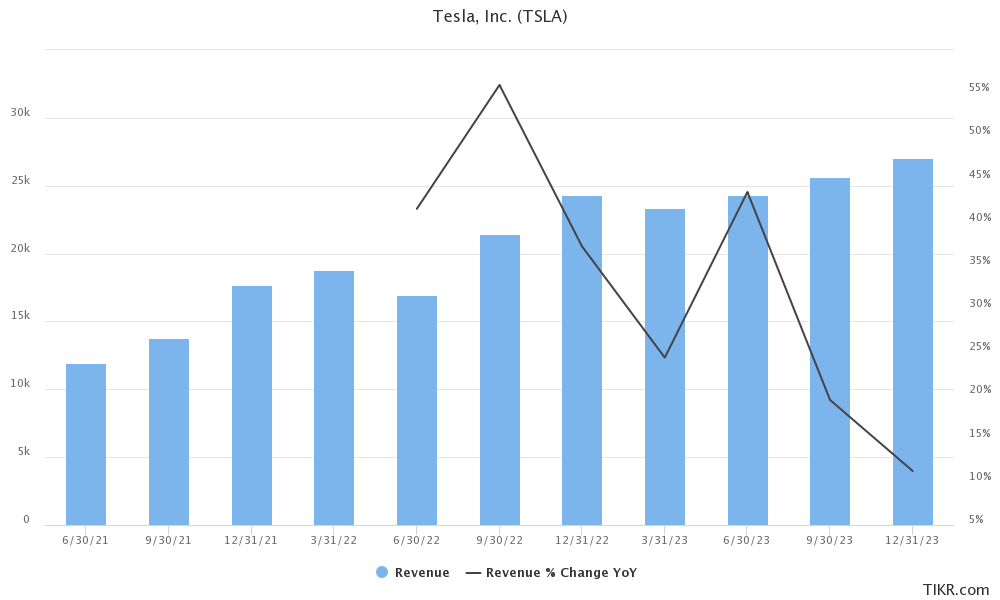

TSLA would release its Q2 2023 earnings on July 19 after the close of US markets. Analysts polled by TIKR expect the company to post revenues of $24.3 billion in the quarter – a YoY rise of 43.6%.

The sales growth is however expected to taper down to 19.5% and 11.3% respectively in the third and fourth quarter.

Meanwhile, when Tesla reports its earnings later this month, markets would especially watch the commentary on 2023 production guidance and the progression in margins.

Amid the price cuts, Tesla’s operating margin fell to 11.4% in the first quarter – as compared to 16% in the fourth quarter and 19.2% in the first quarter of 2022 – and trailed analysts’ estimate of 12.2%.

EV price war

Musk has meanwhile defended the price cuts and said “We’ve taken a view that pushing for higher volumes and a larger fleet is the right choice here versus a lower volume and higher margin.”

Meanwhile, Tesla’s price cuts triggered an industrywide price war and companies including Ford, NIO, and Xpeng Motors lowered EV prices in response to TSLA’s price cuts.

While TSLA still has industry-leading margins, many startup companies might face troubles as they are already posting massive losses which could only intensify due to the price cuts.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account