Tesla stock was trading lower in US premarket trading today even as the company posted record earnings in the first quarter which were ahead of analysts’ estimates.

Tesla reported revenues of $10.4 billion in the first quarter of 2021. The company’s sales increased 74% year over year in the quarter and were in line with analysts’ estimates. Tesla’s automotive revenues increased 75% in the quarter led by higher sales of its Model 3/Y cars in the quarter.

Tesla reported lower revenues than fourth quarter

However, the automotive revenues were $312 million lower than what the company had reported in the fourth quarter of 2020. Tesla delivered 184,800 electric cars in the first quarter of 2021 which was a new record despite the first quarter being seasonally weak for the company.

The record deliveries should ideally have led to higher revenues for the company. However, in the first quarter of 2021, Tesla’s sales mix was skewed towards the lower-priced Model 3/Y which led to lower revenues despite higher deliveries. Tesla delivered only 2,020 Model S/X in the first quarter.

Tesla posts record profits

Meanwhile, while Tesla had an unfavorable product mix in the quarter, which led to a quarter-over-quarter drop in its revenues, more sales of Model 3/Y did not negatively impact profitability. On the contrary, the company’s automotive gross profit margin expanded to 26.5% in the quarter as compared to 24.1%. After adjusting for regulatory credits of $518 million, the company’s automotive gross profit margin was 22% in the quarter as compared to 21% in the fourth quarter.

It reported a GAAP net income of $438 million in the quarter which was a new record for the company. Its EPS of $0.93 was ahead of the $0.79 that analysts polled by Refinitiv were expecting. Tesla also recorded a gain of $101 million as it sold some of the bitcoins that it was holding.

Meanwhile, as has been the case with Tesla over the last year, all its profits were due to the regulatory credits that flow to its bottomline. If we remove the gain on bitcoin and the regulatory credit, the company would turn negative on the net profit level on a GAAP basis.

Delivery guidance

Tesla said that it expects its deliveries to rise more than 50% this year which would mean car deliveries in excess of 750,000 in the year.

Tesla also shared its thoughts on the investment in bitcoin. The company surprised markets by announcing a $1.5 billion investment in the digital currency in the first quarter. Later it said that it would allow buyers to pay for its cars in bitcoin. It also said that it won’t monetize these bitcoins.

The company said that bitcoin was a good alternative for it to park its excess cash given the low yields on other instruments. It found bitcoins attractive as it could higher yield on its surplus cash without “taking on additional risk or sacrificing liquidity.” While there is no denying the liquidity part, I find the argument on “risk” intriguing given the massive intraday volatility that bitcoin witnesses. The digital currency has come off its recent highs and could potentially wipe off Tesla’s entire profitability in a bad quarter.

“So it is our intent to hold what we have long term and continue to accumulate bitcoin from transactions from our customers as they purchase vehicles,” said Tesla’s CFO Zachary Kirkhorn in the earnings release.

Elon Musk

Tesla’s CEO Elon Musk tried to portray the company as a software play during the earnings call. “Although like right now, people think of Tesla as — a lot will think of Tesla as a car company or as an energy company. I think long term, people will think of Tesla as much as an AI robotics company as we are a car company or an energy company,” said Musk. He added, “I think we are developing one of the strongest hardware and software AI teams in the world. Certainly, we appear to be able to use things with full self driving that others cannot.”

Autopilot crash

Martin Viecha, Tesla’s Senior Director of Investors Relations summed up questions from retail investors on a recent crash in a Tesla car in Texas when the Autopilot was allegedly on. Martin pointed to a “question from retail investors is, does Tesla have any proactive plans to tackle mainstream media’s imminent, massive and deceptive click-based headline campaigns on safety of autopilot or FSD for a specialty PR job of some sort.”

Musk responded by referring to “really just extremely deceptive media practices where it was claimed to be autopilot where this is completely false” adding that “those journalists should be ashamed of themselves.”

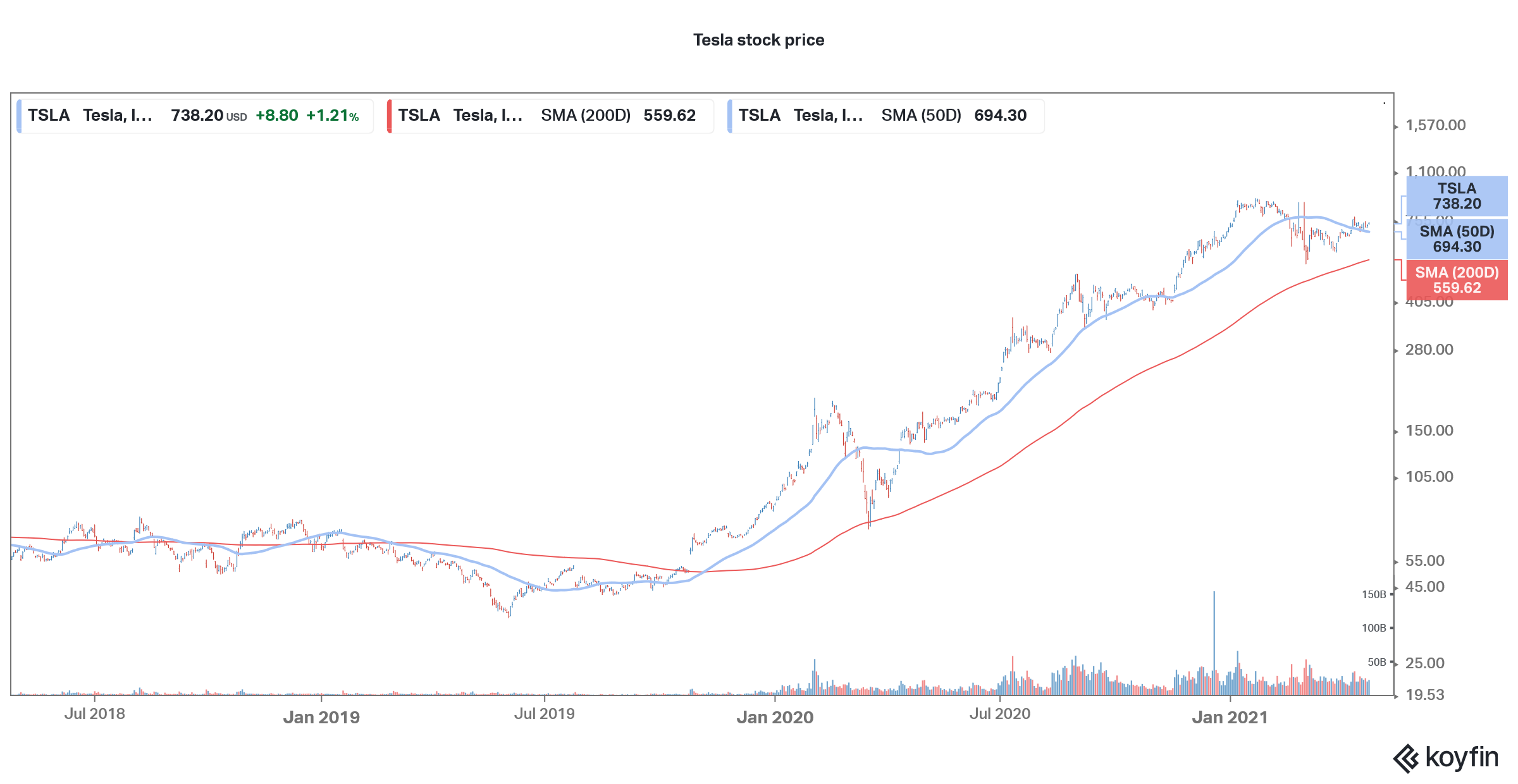

Tesla stock is off its 52-week highs

Tesla stock is now down sharply from its 52-week highs even as it has turned positive for the year. There has been an even worse sell-off in NIO, Li Auto, and XPeng Motors. Churchill Capital IV (CCIV), the SPAC (special purpose acquisition company) set to merge with Lucid Motors, is also down almost 60% from its 52-week highs.

How to invest in Tesla and green energy stocks

You can invest in green energy stocks like Tesla through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

An alternative approach to investing in the green energy ecosystem could be to invest in ETFs that invest in green energy companies like Tesla.

Through a green energy ETF, you can diversify your risks across many companies instead of just investing in a few companies. While this may mean that you might miss out on “home runs” you would also not end up owning the worst-performing stocks in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account