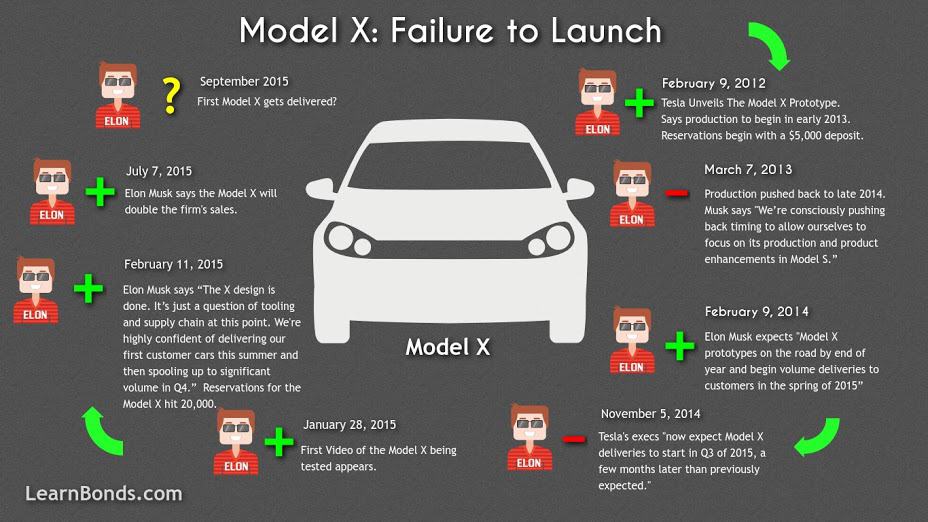

Tesla Motors Inc has a history of pushing back the release of its Model X. The SUV is the one perfect thing in the company right now, simply because it hasn’t been maligned by the public just yet. It looks like it’ll take some time for them to do that. Tesla Motors, in its earnings reveal on Wednesday, seems to have suggested that the release date for the EV SUV has been pushed back.

Elon Musk stated, as he has done countless times in recent months, that the Model X will be sent to its first buyers before the end of the quarter. He did, however, add two important addendum. The first is that the engineering problems with the second row of seats haven’t been sorted out. The second is that the release date won’t really be a release date.

Tesla Motors slows the Model X down

The most important number in the Tesla Motors report wasn’t how much money it lost, or how many cars it sold, it was the number of cars it thinks it will sell before the end of the year. Shares fell by 10 percent on Thursday because Elon Musk said shipments would likely come in below the firm’s last guidance of 55,000.

50,000-55,000 is the new number, and Mr. Musk’s policy of over-promising and under-delivering hasn’t found too many backers on Wall Street today. Some, if not much, of the fall in guidance is down to a slower roll out of the Model X than Wall Street was looking for.

Adam Jonas of Morgan Stanley said earlier this year that he was looking to see 50 units of the Model X shipped in the first quarter and 5,050 by the end of the year. Ben Kallo of Baird was more optimistic. He was looking for shipments of 7,000 Model X SUVs before the end of December.

It doesn’t look like either of those analysts, or the thousands waiting for their Model X to arrive, are going to get their wish.

Looking for the real Model X release date

The first time the Model X is sent to a buyer isn’t a real release date. Just ask the thousands of angry Apple fans who saw the Watch on Beyonce before it arrived in stores. The real release date will be when Tesla Motors is making the Model X en masse.

On Wednesday Mr. Musk said that he expects 12,000 car shipments. That number includes, according to a letter he sent out, “a small number of Model X deliveries.”

That appears to fall in line with Mr. Jonas’ view that around 50 units of the car will arrive before the end of the quarter, but the ramp up in production may not be followed through as quickly as Wall Street was hoping.

Tesla Motors, with its legion of test vehicles, could likely make the symbolic delivery of the first Model X any time it wants. The arrival of a few before the end of the quarter doesn’t mean much.

The firm was clear for months that the first Model X will arrive before the end of the third quarter, and the firm looks like it will stay true to that promise. It’s a “letter of the forecast, spirit of the forecast” sort of thing.

For the thousands that have already ordered the car, or the thousands more that want to but can’t afford a year-long wait, the date of first shipment is arbitrary. The real release date is the one that Tesla Motors will email to them when they confirm their purchase.

Explaining Tesla Motors guidance

There are only two good explanations for the drop in Tesla Motors guidance. Either the firm is seeing soft demand, or it’s having trouble on the supply side. The second seems more likely given reports that the firm sold 2,000 EVs in China during the June quarter.

Those supply issues likely stem from the Model X. Either putting it together is harder than the firm thought, or it’s going to disrupt normal factory hours as they work out how to get its production line going.

Elon Musk said in his letter that “Model X production challenges could slow Model S production,” and that the real ramp up in production of the Model X would not come until late in Q4. A one week delay from suppliers, could, according to Musk could lower sales figures by up to 800.

That suggests that Tesla Motors is looking to finish and ship about 800 units of the Model X once it ramps up production. It’s not going to do that until late in Q4, however, so expect shipments to remain at half that, or below, for most of the three months. The later ramp up appears to be the reason for the drop in guidance.

It’s clear that the Model X release date, which was already pretty soft, is getting softer, and what Nishit Madlani of Standard & Poor’s called “potential execution missteps or inefficiencies” could drive the date at which people can expect to get their Tesla Motors Model X even further back.

The Model X is on the way

The first people to get their Model X, apart from those that get a free one through the Tesla Motors referral program, have been waiting for more than three years. Another couple of months isn’t likely to make or break them, though the wait may be hard to tolerate once the first SUVs hit the road.

The push back in the Model X release date shows that Tesla Motors is still having trouble growing, and it’s still running into the kind of problems that Wall Street wants it to figure out.

In the long term, as Ben Kallo was quick to point out in a report released on Thursday morning, none of this really matters for Tesla Motors. He says that the Model X is “worth the wait.” He added that “Perspective is important, however, as this is a short-term issue, which on the positive side reduces production ramp risk for the fourth quarter.”

That’s a difficult sell for those that loaned Elon Musk $40,000 three years ago in order to secure the Model X Signature, but they’ll have to make due as the firm figures out those “sculptural” second row seats.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account