Tesla Motors Inc CEO Elon Musk likely doesn’t need much more money, but when he gets his salary from the EV firm, it might pinch a little. Assuming his check arrives once a month, Mr. Musk cashes in a little over eight cents every pay period, but he has earned a whole lot more.

Mr. Musk, when Tesla Motors was in financial trouble, agreed to take a salary of a nominal $1 in order to save the firm the expense of keeping his fridge stocked. He still holds the single biggest chunk of the firm, with around 23 percent of shares held under his name. This is interesting given the announcement he made last Friday.

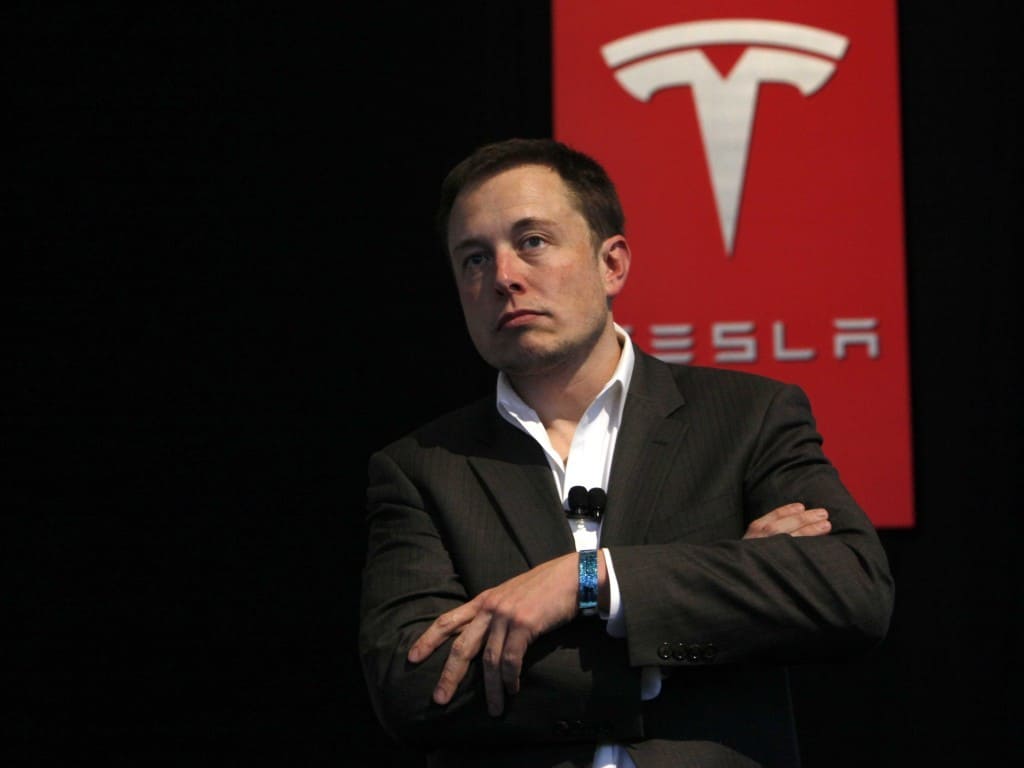

Elon Musk drives Tesla Motors

The last time Mr. Musk reported his ownership to the SEC, on February 13 2015, he had 35,528,859 shares in Tesla Motors and options to buy 7,240,162. Without those options exercised he owns about 23 percent of the firm.

So far in 2015 Mr. Musk’s share of Tesla Motors has appreciated to more than $8 billion. It started the year at around $6.3bn. Mr. Musk has gained $1.8bn in net worth from the rise in the value of the firm. On Friday Tesla Motors shares rose strongly after Mr. Musk delivered some fairly minor updates in a phone event that drew a large amount of attention.

After more than one meeting was called at fairly short notice earlier this year, some began to question Mr. Musk’s motives. Though his efforts have undermined the growth in the value of Tesla stock in the past, it looked like he was more concerned with the price of shares in 2015.

Mr. Musk was forced to defend himself earlier this year. He Tweeted “Some people seem to think I tweet to affect share price. This is false. A brief rise in $TSLA stock obviously does no good for Tesla or me.”

The firm’s events are similar to the tweets. Tesla Motors has turned many humdrum reveals, like last Friday’s boost to acceleration, into major media events. With its cultural influence, it draws huge press attention when it does meaningless things like announce that a software update is coming months down the line.

Manipulating Tesla Motors shares

Traders know that a brief jump in Tesla Motors stock isn’t what Mr. Musk is after, and he was disingenuous in denying that strawman. Mr. Musk has been accused of manipulating the share price, not in the long run but in the short run.

Last Friday’s odd announcement was a perfect example of the spin that Mr. Musk likes to put on stories. Two relatively simple model upgrades, a new 90 kWh option and a cheaper 70 kWh option were added, at the event.

Another feature, Ludicrous mode, was arguably much more headline worthy. It’ll get a Tesla with the right upgrade package from 0-60mph in 2.8 seconds.

The event came just as Tesla Motors shares had lost momentum because of a number of Wall Street reports that called its value “full” leading into the release of the Model X.

The state of affairs was the same last spring before Tesla announced the self-driving car update was on the way, and then launched a battery product that appears to be pretty far away from commercial application.

Though the PowerWall has been lauded by many on Wall Street, but the shipping date was not made clearer than “this Summer.” With so many launch delays behind the Model X and other projects, it’s not clear if Mr. Musk is likely to meet that blurry date.

Those who think that Mr. Musk’s behavior is less than above board don’t think that he’s looking for one-day spikes, they think that he’s looking to keep momentum behind the stock so that the news cycle following it, and trader interest, doesn’t slow down.

Tesla Motors shares reflect a story

Jim Cramer calls Tesla Motors a story stock, and most of Wall Street would agree, at least in part, with that conception of how shares trade. Tesla also has a story product, however. People buy a Model S for a lot of reasons, but chief among them is how innovative and exciting it is.

A 2014 Consumer Reports survey on brands in the auto world found that Tesla Motors was seen as the most innovative. The Model S wasn’t particularly fuel efficient in the eyes of those that answered the survey, but it was doing something new.

On Friday Tesla Motors tried to present itself as a firm that keeps changing things and keeps getting better. Mr. Musk told those on the call “If you want to wait to buy a car until there won’t be a better one in the future, you’re going to wait forever.” He says the Tesla Motors team makes about 20 small changes to the design of the Model S every single week.

The cheaper 70 kWh Model S helped to show that power cells was getting cheaper. The 90 kWh Model S showed that the tech around the cars was getting better. Ludicrous mode showed that the firm still has a flair for the dramatic and a focus on performance.

The story that Mr. Musk wants to tell about Tesla Motors is strongly linked with the firm’s share price. When he tries to remind or alter the image that the media has about the firm, as he did last Friday, he’s also changing what traders think about the stock.

Cashing checks at Tesla Motors

Elon Musk doesn’t have much of a base salary to fall back on at Tesla Motors . Despite the recent surge in the value of the dollar, $1 isn’t worth much in Mr. Musk’s circles. He’s relying on the value of his 23 percent stake in the firm in order to make his time there worth it.

Elon Musk may not like that Tesla Motors stock relies on his words in order to keep moving, but, for the time being at least, it does. So far this year he has managed to talk his way to a $1.8bn pay check.

That’s not because he’s been manipulating the stock, it’s because he’s been paying attention to the whole story of Tesla Motors, filling it out and preening it in all the right places.

If the firm’s stock is so out of whack with the market that it trades based on that kind of marketing, that can’t be blamed on Mr. Musk. If he wanted to sell off part of his holding, he likely couldn’t justify it given the sell-off it would result in.

Mr. Musk’s net worth has become highly reliant on the kind of story he’s able to tell the market. That situation is going to continue until Tesla Motors actually manages to turn a profit and that’s not likely to happen until 2020. That’s only if that part of the story Elon is telling turns out to be true.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account