Bitcoin prices are tumbling today and Tesla stock is also lower in US premarket price action today after Elon Musk’s tweet about cryptocurrencies.

Musk has the ability to influence asset price as many of his fans end up blindly buying assets that he is even remotely seen as endorsing. The most prominent instance was when his followers ended up buying the wrong Signal stock when Musk tweeted in favor of Signal’s social media app as an alternative to Facebook and WhatsApp.

Tesla invested $1.5 billion in bitcoins

Over the last couple of months, Musk has been frequently tweeting about cryptocurrencies. It all started in the first quarter of 2021 when Tesla disclosed a $1.5 billion investment in bitcoin. Musk also added a bitcoin logo to his Twitter profile. Later, the company also allowed buyers to pay for its cars in bitcoins.

Musk’s involvement with bitcoins took both Tesla stock and bitcoins to record highs. The company also amended its investment policy to allow it to buy bitcoins. “In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity,” said the company in its release.

Tesla amended its investment policy

It added, “We may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.”

Like every Tesla move, Musk’s decision to invest in bitcoins divided markets. While many like perma Tesla bull ARK Invest saw it as a wise move, many others were not impressed. Elon Musk has exposed Tesla to immense mark-to-market risk,” said Peter Garnry, head of the equity strategy at Saxo Bank. Gary Black, former chief executive of Aegon Asset Management also announced that he has sold his shares after Tesla invested in bitcoins. “$TSLA has always been higher risk, but investing $1.5B in #Bitcoin makes it more risky,” tweeted Black.

Musk is concerned about the energy intensity of bitcoins

Meanwhile, Musk’s love for bitcoins did not last long and earlier this month the mercurial leader said that Tesla would no longer accept bitcoins as payments. He said that the electric vehicle maker has “suspended vehicle purchases using Bitcoin” as the company is “concerned about rapidly increasing use of fossil fuels for Bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.”

Musk added, “Cryptocurrency is a good idea on many levels and we believe it has a promising future, but this cannot come at great cost to the environment. Tesla will not be selling any Bitcoin and we intend to use it for transactions as soon as mining transitions to more sustainable energy. We are also looking at other cryptocurrencies that use <1% of Bitcoin’s energy/transaction.”

Elon Musk on dogecoins

A few days later Musk tweeted in support of dogecoin and said that he is working with developers to make it environmentally friendly. Musk, a self-proclaimed “dogefather” also held a poll about allowing dogecoin for payments for Tesla products. His privately held SpaceX has already done so.

Would Tesla sell bitcoins?

Meanwhile, while Musk had previously said that the company would not sell the bitcoins that it is holding, he has continued to flip-flop on the issue. A Twitter handle by the name CryptoWhale tweeted: “Bitcoiners are going to slap themselves next quarter when they find out Tesla dumped the rest of their holdings. With the amount of hate @elonmusk is getting, I wouldn’t blame him…”

Musk responded with “indeed” which led to a sharp fall in bitcoin prices. Later, he clarified that Tesla hasn’t sold any bitcoins. However, it is worth noting that Tesla had sold some bitcoins and booked a profit of $102 million in the first quarter. The trading income helped the company post record profits in the first quarter of 2021.

Musk has also raised doubts about the decentralization of bitcoins. “Bitcoin is actually highly centralized, with supermajority controlled by handful of big mining (aka hashing) companies. A single coal mine in Xinjiang flooded, almost killing miners, and Bitcoin hash rate dropped 35%. Sound “decentralized” to you,” tweeted Musk.

Musk on taking Tesla private

Meanwhile, while Musk has lambasted bitcoins for their high energy usage and said that usage of fossil fuels in bitcoin mining is rising, Noelle Acheson, CoinDesk’s director of research has called the claims false. She instead claims that the use of fossil fuels in bitcoin mining is falling rather than rising.

If Acheson is right, this would be yet another instance when Musk has made misleading claims. The most prominent one was when he incorrectly said that he has secured funding to take Tesla private at $420. As part of the settlement with the SEC, Musk had to quit his position as the company’s chairman.

Tesla finds bitcoins “less risky”

Coming back to Tesla and bitcoins, while the company has enough cash to play around with, investing them in a volatile asset like bitcoin might not be the best way to invest the money. During the first quarter 2021 earnings call, Tesla said that bitcoin was a good alternative for it to park its excess cash given the low yields on other instruments.

It found bitcoins attractive as it could higher yield on its surplus cash without “taking on additional risk or sacrificing liquidity.” While there is no denying the liquidity part, I find the argument on “risk” intriguing given the massive intraday volatility that bitcoin witnesses. The digital currency has come off its recent highs and could potentially wipe off Tesla’s entire profitability in a bad quarter.

“So, it is our intent to hold what we have long term and continue to accumulate bitcoin from transactions from our customers as they purchase vehicles,” said Tesla’s CFO Zachary Kirkhorn in the earnings release.

Tesla raised $13 billion in 2020

But then, Tesla and Musk are known to reverse their positions in a short time. Before changing the mind about bitcoin, Musk has made several about turns. Last year, he had famously said that Tesla does not need to raise capital and would meet the capex needs with internal accruals. However, in a span of weeks, Tesla filed to sell shares and raise $2 billion. Musk’s views on Tesla’s valuation also changed over the last year.

Tesla troubles in China

Meanwhile, away from the noise over bitcoins, all doesn’t seem fine in Tesla’s China operations. Reuters also reported that the company has abandoned plans to expand its Shanghai Gigafactory. The company wanted to expand the plant so that it could serve the fast-growing Chinese electric vehicle market and also use it as an export base. The company anyways exports China-made cars to Europe. It was also planning to export China-made Model 3 cars to the US. However, escalation in the US-China trade war seems to have prompted the Elon Musk run company to go a rethink its China plans.

China sales fell in April

Tesla’s China sales fell sharply in April. It sold 25,845 China-made cars in the country last month, a 27% fall from March. China has been a key market for the company and falling sales in China is a negative for the company. The fall in sales comes after reports of Tesla facing a consumer backlash in China.

Last month, an agitated Tesla buyer protested against the company’s alleged poor customer service at the Shanghai Auto Show. While the company initially dismissed the claims but later tried to strike a more conciliatory tone.

Should you buy Tesla stock now

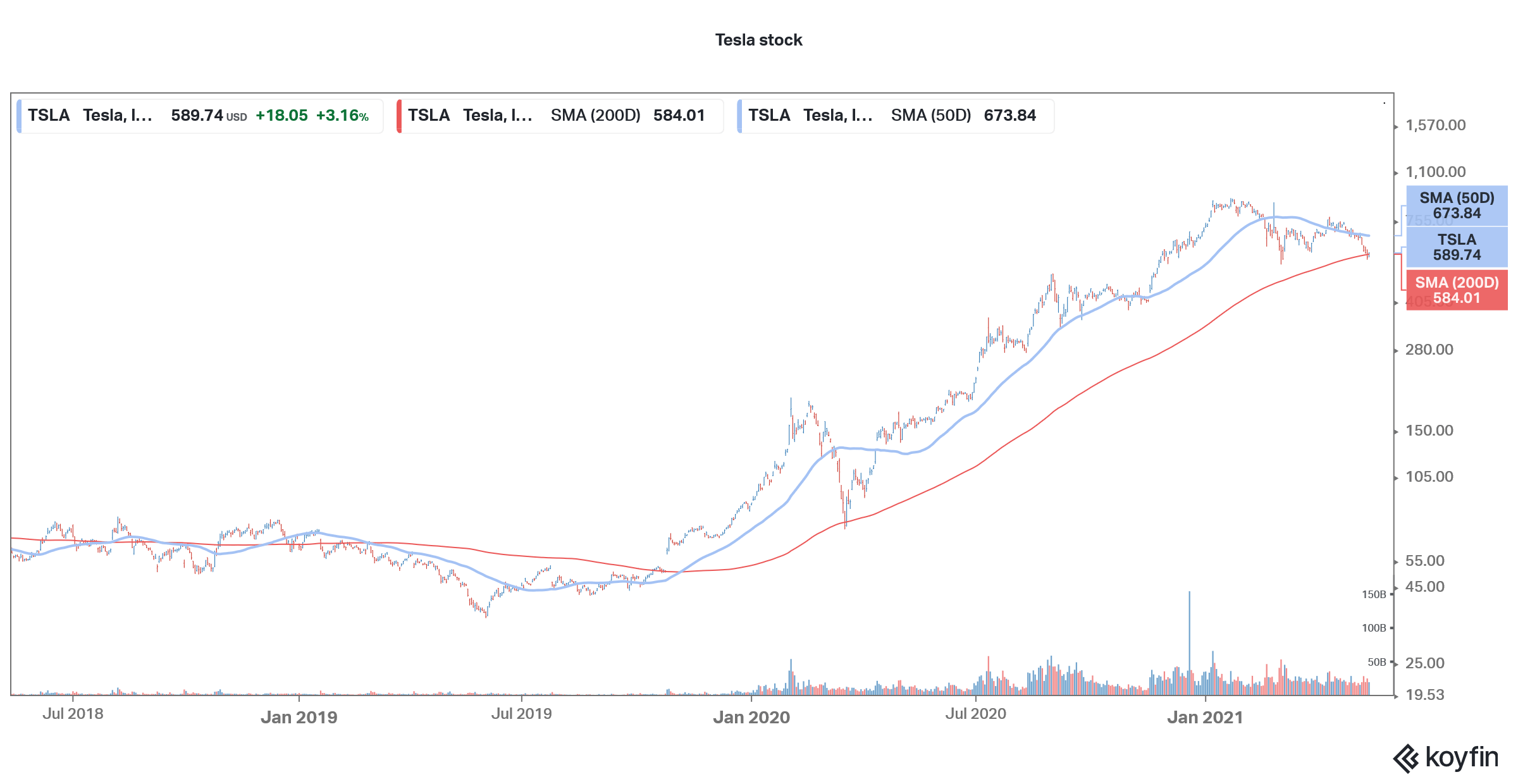

Tesla stock is now down sharply from the peaks. While valuation purists would find the still unattractive even now, some investors might see the fall as an opportunity to do some bottom fishing in the stock.

You can trade in Tesla stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account