The price of Bitcoin is retreating slightly today in early cryptocurrency trading activity a day after the coin rallied nearly 20% on the back of Tesla’s $1.5 billion investment in the crypto asset.

Yesterday’s uptick pushed the price to a fresh all-time high of $46,712, although the value of the coin rose to as much as $48,216 earlier in the session but failed to hold on to those gains as sellers seem to be taking some profits off the table.

Tesla’s announcement was embedded in the firm’s 2020 annual report, where the company emphasized that to “further diversify and maximize returns” of their cash holdings the management team could invest the funds in certain “reserve assets” including digital assets, gold bullion, and gold exchange-traded funds (ETF).

Meanwhile, the firm disclosed that it had already invested an aggregate of $1.5 billion in Bitcoin (BTC) while planning to acquire and hold other digital assets as well.

Additionally, Tesla (TSLA) announced that it plans to start receiving Bitcoin as a form of payment for its products. The firm said that it believes that its Bitcoin holdings are “highly liquid”, although it acknowledged that the value of cryptocurrencies is subject to high levels of volatility – which could result in losses for the electric-vehicle giant headed by Elon Musk.

Even though Tesla’s investment is just the last in a long list of Bitcoin purchases made by institutional players that already seem to back the cryptocurrency as a feasible store of value, Mr. Musk’s support for any kind of financial asset lately has ended up pushing their short-term performance dramatically.

Only a few days ago, Musk seemingly signaled yesterday’s announcement after changing his Twitter bio to “#bitcoin” while tweeting shortly thereafter: “In retrospect, it was inevitable”.

Back then, Bitcoin supporters took this statement as evidence that Tesla might have already invested a portion of its massive $19.38 billion cash stockpile into BTC – a situation that helped propel the price of the coin by roughly 10% back then.

Meanwhile, crypto supporters remain optimistic that other institutional players could continue to jump on board in the following months, as governments keep debasing their fiat currencies through highly-accommodative monetary policies implemented to cushion the impact of the pandemic in their domestic economies.

What’s next for Bitcoin (BTC)?

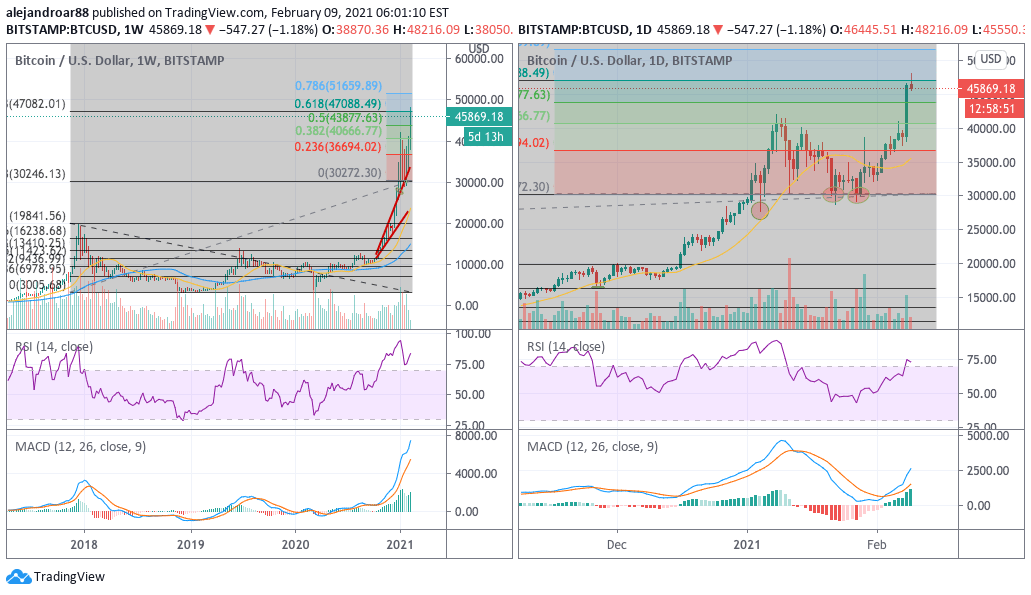

The chart above shows how our latest projections for Bitcoin remain relevant, as the price action is seemingly rejecting the 0.5 Fibonacci extension highlighted right there as market players take a breather – possibly before resuming the bull run.

The healthiest development for Bitcoin at this point would be to keep surging over the coming days, taking advantage of the positive momentum prompted by Tesla’s decision and from Paypal’s continuing support for the cryptocurrency market – after the digital payments giant announced the creation of a business unit that will solely focus on these digital assets.

At the moment, the MACD is already embarked on another trip to new highs, while the RSI has already stepped on overbought levels.

If the price were to keep moving higher from here, a first target for BTC could be set at $51,650. Meanwhile, if today’s retreat accelerates, the trend could end up reversing its course temporarily, with a first floor found at the $43,800 level, or much lower – possibly aiming for the $40,000 psychological support as a plausible landing zone.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account