On Friday, the S&P 500 hit 4,300 for the first time since August 2022 ahead of the Fed’s upcoming meeting for June. The world’s most popular index has now closed with gains for four consecutive weeks.

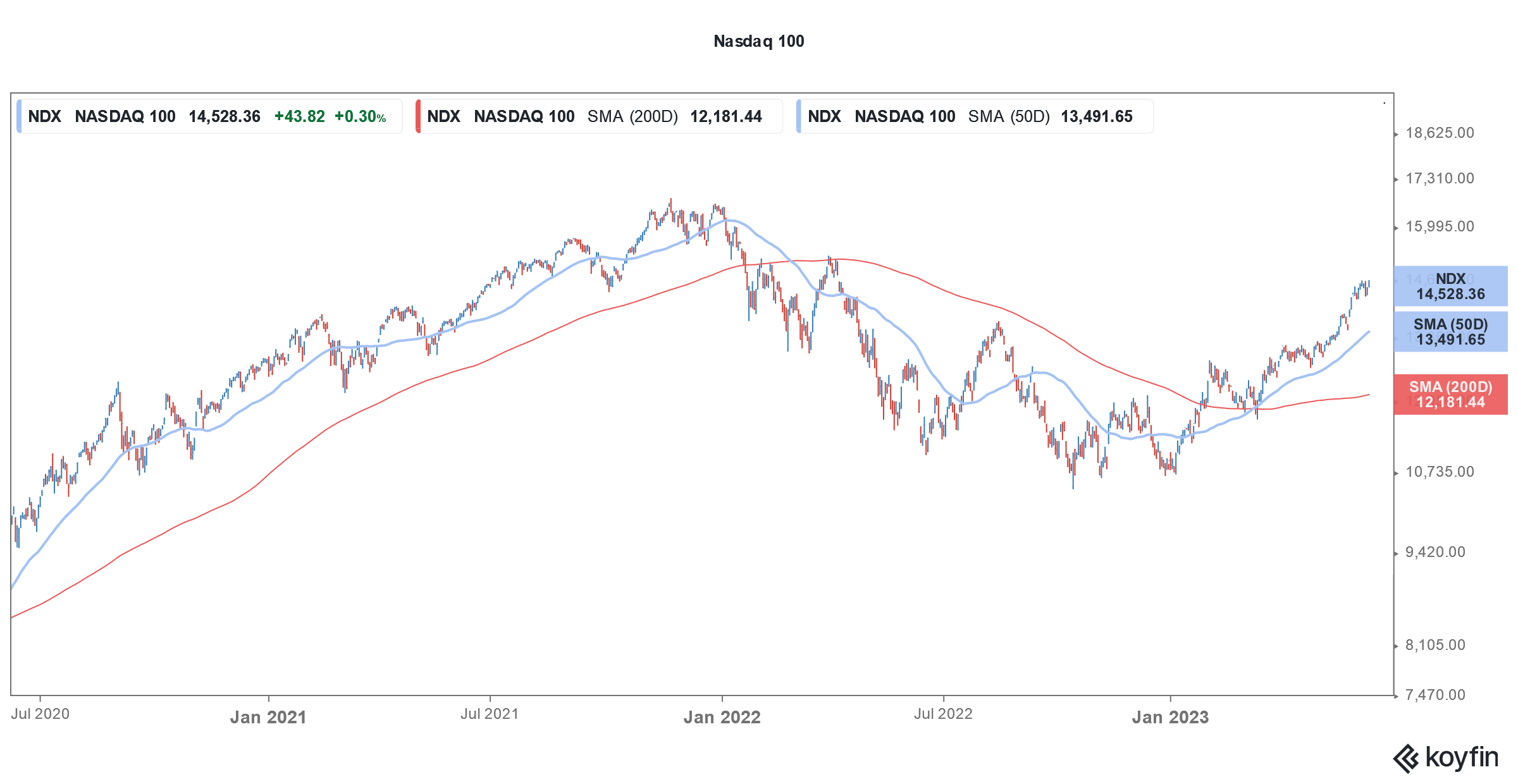

The broader markets traded on a flat note last week but built on their YTD gains with the S&P 500 up almost 12%. The tech-heavy Nasdaq 100 which shed a third of its value last year has now closed with gains for seven consecutive weeks and is up almost 33% for the year.

So far, the US stock market has defied all the slowdown and recession noise and has looked quite resilient – partially because of the rally in tech names which is driven by the AI boom.

S&P 500 hits multi-month highs

Greg Bassuk, CEO at AXS Investments said, “It’s the first time in a while where investors seem to be feeling a greater sense of certainty. And we think that’s been a turning point from what had been more of a bearish cautious sentiment.”

Scott Ladner, chief investment officer at Horizon Investments also echoed similar views and said, “We think that as we walk through these next few weeks, that will be increasingly clear that the economy is more resilient than folks have given it credit for the last six months.”

He added, “That will sort of dawn on people that small-caps and cyclicals probably have a reasonable shot to play catch up.”

Goldman Sachs raised its target for S&P 500

Goldman Sachs has raised its year-end target for S&P 500 by 5% to 4,500 even as it kept the index’s EPS target unchanged at $224.

“The P/E multiple of 19x is greater than we expected, led by a few mega-cap stocks,” said Goldman Sachs chief US equity strategist David Kostin.

He added, “But prior episodes of sharply narrowing breadth have been followed by a ‘catch-up’ from a broader valuation re-rating.”

To be sure, select tech stocks have helped propel the S&P 500 higher this year and Tesla, Meta Platforms, and Nvidia have more than doubled this year. Nvidia incidentally joined the $1 trillion market cap club last month after its earnings and guidance beat street estimates by a wide margin.

Fundstrat expects S&P 500 to rise 20% this year

Fundstart’s Tom Lee believes that the fall in VIX or “fear index” is a positive for markets” calling its impact “least appreciated.” He said, “Our work from December 2022 shows that in [the] last 30 years, post-negative equity year (2022) when VIX is down YoY, the median gain is 22%.”

He added, “Our view remains that inflation is tracking lower than consensus/Fed see and it is just a matter of time before the lagged CPI/PCE reports reflect this reality.”

Lee emphasized, “And if this plays out, the Fed’s pause will morph into a data dependent mode, where the bar is raised for further hikes.”

Lee believes that the S&P 500 would rise 20% this year and is among the most bullish on the markets in 2023.

Recession fears haven’t abated yet

Recession fears haven’t abated yet however and Bob Michele, chief investment officer for JPMorgan Chase’s asset management business compared the current environment to the period between March and June 2008.

Michele said, “I’m highly confident that we’re going to be in recession a year from now” and added, “We’re seeing things that you only see in recession or where you wind up in recession.”

He termed the nearly 500 basis point rate hike by the Fed since March 2022 as a “rate shock.”

Fed rate hikes

The Fed’s June meeting is scheduled for this week and CME’s Fed Watch tool shows a nearly 30% probability of a 25-basis point rate hike. The remaining 70% of traders believe that the Fed would hold rates at the current level.

The Fed raised rates by 25 basis points in May. It was the tenth-rate hike in the ongoing tightening that started in March 2022 with a 25-basis point rate hike. The Fed graduated to a 50-basis point rate hike at the next meeting. Thereafter the US central bank raised rates by 75 basis points at four consecutive meetings before lowering the pace to 50 basis points in December.

It has raised rates by 25 basis points at all three meetings this year.

US inflation has moderated

Notably, the 25-basis point rate hike in May was unanimous, unlike the previous meeting where some members contemplated a 50-basis point rate hike.

Meanwhile, the Fed signaled a pause in the tightening cycle and the post-meeting statement omitted reference to “the Committee anticipates that some additional policy firming may be appropriate.”

The Fed however continued to maintain that it would be data-dependent. The statement said, “In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

US annualized CPI fell to 4.9% in April which helped bring relief to markets and supported the ongoing rally in S&P 500.

However, the labor market is still running strong which complicates the scenario.

Could the rally in S&P 500 continue?

While the S&P 500 hit a multi-month high ahead of the Fed meeting as most expect the US central bank to now hit the pause button on rate hikes, Jim Cramer advised caution.

“I’d be very surprised if Wall Street’s thrilled with next Wednesday’s Fed meeting. So prepare yourself, even as I’d love to be wrong on this,” said Cramer.

He also advised to not get “lulled into complacency” as “there’s still a lot of things that could go wrong in the market.”

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account