Snowflake stock was trading almost flat in US premarket trading today after reporting mixed fiscal fourth quarter earnings and forecasting a growth slowdown.

Snowflake reported its fiscal fourth quarter 2021 earnings yesterday after the close of markets. It reported revenues of $190.5 million in the quarter. The revenues increased 117% on a year over year basis and were ahead of the $178.5 million that analysts were forecasting. However, the company missed bottomline estimates.

Snowflake’s earnings miss estimates

It posted an adjusted loss per share of $0.70 which was ahead of the $0.43 per share loss that analysts were projecting. While the company’s revenues have been growing, its losses have also been widening and more than doubled in the fiscal fourth quarter of 2021. Meanwhile, Snowflake expects its profitability in the future. “We have implemented operations that will help us show more profitability,” said the company’s CFO Mike Scarpelli during the earnings call.

Product revenues rise

Snowflake reported product revenues of $178.3 million in the fiscal fourth quarter of 2021 which were 116% higher than the corresponding quarter last year. The metric was higher than what the company had guided for in the fiscal third quarter earnings release. During their fiscal third quarter 2021 earnings call, Snowflake said that it expects its product revenues to be between $162-$167 million in the fiscal fourth quarter.

“We finished our fiscal year with strong performance and reported triple-digit product revenue growth,” said Snowflake CEO, Frank Slootman. He added, “Remaining performance obligations showed a robust increase year-on-year, reflecting strength in sales across the board.”

Snowflake guidance

All said, Snowflake’s growth rates have been tapering down. The company expects its growth to fall further in the fiscal year 2022. Snowflake expects to post product revenues between $1-$1.02 billion in the fiscal year 2022 which was in line with what analysts were projecting. Snowflake expects its product sales growth to be between 81-84% in the fiscal year 2022 which is visibly lower than the 120% growth that it reported in the fiscal year 2021.

Key earnings metrics

Snowflake has been expanding its customer base and had 4,139 total customers at the end of the fiscal fourth quarter. Snowflake reported 3,554 total customers at the end of the third quarter and 65 of these had product revenues of more than $1 million in the trailing 12 months. The number of customers having a trailing 12-month revenue of more than $1 million also increased to 77 in the fiscal fourth quarter. Snowflake’s net revenue retention rate also expanded from 162% to 168% between the fiscal third and fourth quarter.

The company added 19 Fortune 500 companies as customers in the fiscal fourth quarter including Mastercard and Northern Trust. In the fiscal third quarter, it added 12 news Fortune 500 companies to its client list.

Snowflake ends dual share structure

In another development, Snowflake got rid of the dual share structure that gave the founders more voting rights. Dual voting rights shares have been popular among tech companies that want to go public yet don’t want to cede control. These shares come with higher voting rights.

Even Berkshire Hathaway has dual shares where the lower-priced Class B shares have only 1/10,000 voting rights of the Class A stock. Incidentally, Berkshire Hathaway is among the investors of Snowflake, and the company co-invested in the IPO along with Salesforce.

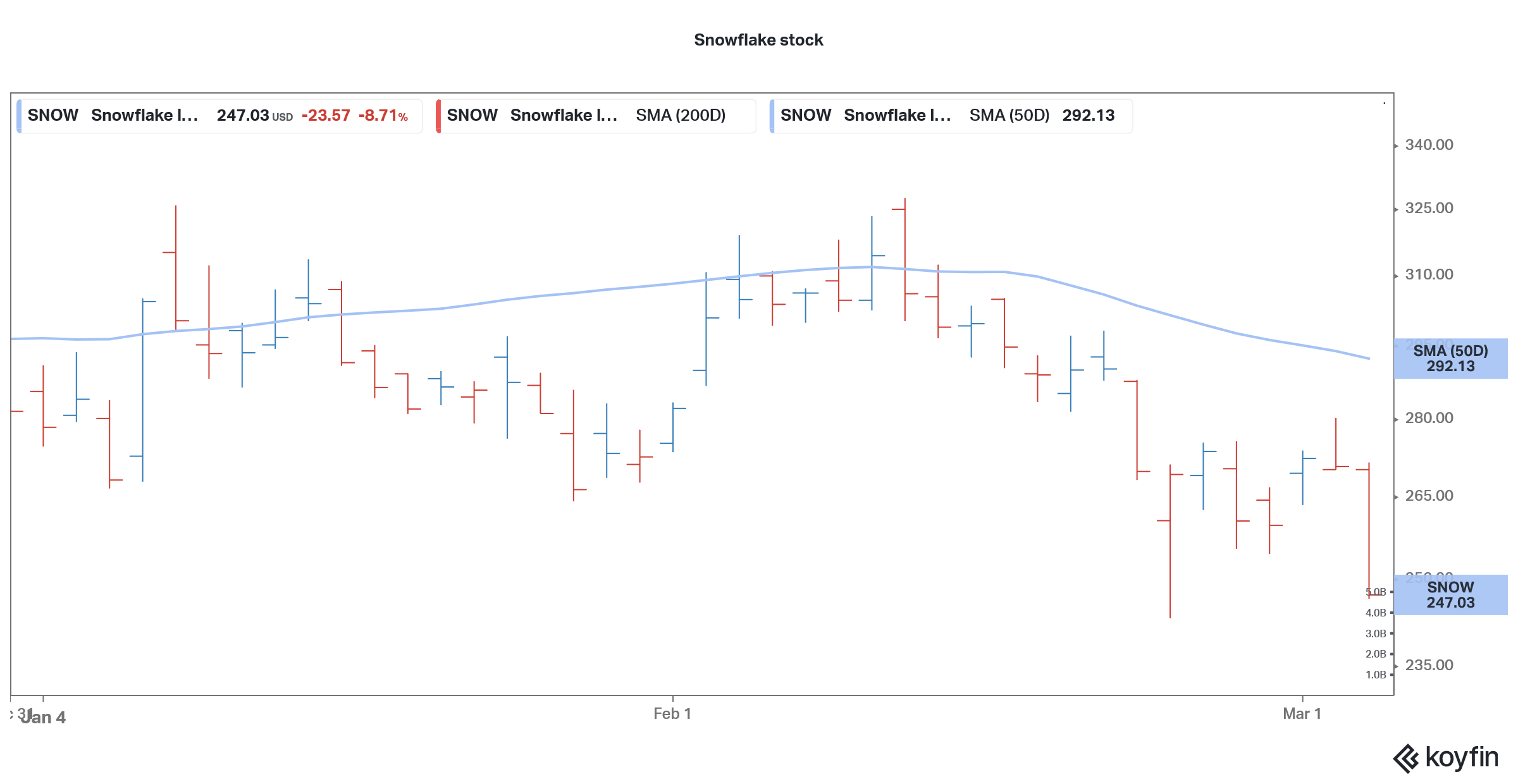

Snowflake stock performance

Snowflake had a massive debut as a public company last year and it became the biggest software IPO ever. It priced its IPO at $120 and swelled above $300 on the first trading day. The stock hit a 52-week trading high of $429 but is now down over 42% from the peaks.

Snowflake stock lost 8.7% in the regular trading session yesterday and was trading almost flat in the premarket trading today. Incidentally, the stock had tumbled after its fiscal third quarter 2021 earnings release amid concerns over slowing growth.

However, given the fact that much of the growth slowdown is already baked in prices, the stock gained after reporting its fiscal fourth quarter 2021 earnings.

How to buy Snowflake stock

You can buy Snowflake stock through any of the best online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

As an alternative, you can look at ETFs like the Renaissance IPO ETF that invests in newly listed companies to get diversified exposure to newly listed companies.

Through an IPO ETF, you can diversify your risks across many companies instead of just investing in a few IPOs. While this may mean that you might miss out on “home runs” as we saw in Snowflake IPO, you would also not end up owning the worst-performing IPOs in your portfolio.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account