This week’s Reddit-fueled weed stock rally faced a strong U-turn yesterday, as shares of the biggest cannabis companies faced double-digit drops after being frantically pushed by retail traders who coordinated efforts through the popular message board.

Shares of Canopy Growth (CGC), an Ontario-based weed producer, were among the most battered during yesterday’s stock trading activity, with its price retreating almost 22% at $40.65 while swinging to negative weekly performance after jumping as much as 11% on the day that the company released its earnings report covering the third quarter of its 2021 fiscal year.

Meanwhile, other big names in the industry lost big as well, with shares of Aphria (APHA) and Tilray (TLRY) going down 36% and 50% respectively during the day, resembling what happened to heavily shorted stocks like GameStop (GME) and AMC Entertainment (AMC) recently only days after Reddit traders managed to pull a historical short-squeeze that spooked a few institutional players and caused them massive losses before the whole thing collapsed.

The industry-wide rally can be traced back to Canopy’s quarterly earnings report, as the company told investors that it expects to become a profitable venture by the second half of 2022 – an important milestone in an industry filled with money-losing companies.

Moreover, comments from the company’s Chief Executive David Klein instilled further optimism to the market by saying that he anticipates the approval of positive legislation that should lead to the “ending” of cannabis prohibition on a federal level.

Those comments seem to have been enough to push the price of the ETFMG Alternative Harvest ETF (MJ) – the biggest pot exchange-traded fund (ETF) with almost $2 billion in assets under management – 13% on the day that the report was released and 14% the day after.

However, similar to what happened to GameStop and other Reddit darlings recently, yesterday’s downtick can be the result of a plain reversion to the mean, as market players take sizable – and possibly unexpected – profits off the table at a point when the stock price has grown beyond the fundamentals of the underlying businesses.

What’s next for weed stocks?

Although the weed stock rally had a major impact on the short-term performance of the stocks involved, the momentum seems to have lasted much less than it did for GameStop and other heavily shorted stocks recently.

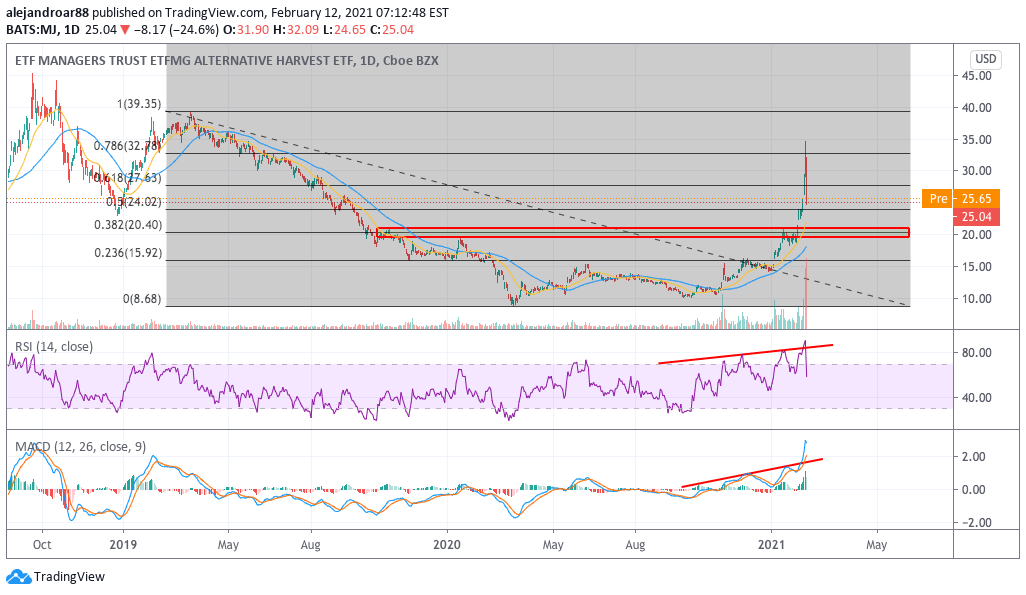

The chart above shows that the ETFMG Alternative Harvest ETF didn’t even manage to overturn its most recent retracement, although it is still plausible that bulls could seize the opportunity to buy into a promising industry at a much decent price.

For now, the ETF seems to have found support at the 0.5 Fibonacci and this level is an interesting one to watch as a move below it could signal the start of a sustained downturn towards the fund’s long-term moving averages – currently standing at around $15 per share.

On the other hand, if the price were to bounce off this level, chances are that the bull run might continue, although possibly at a much quieter pace, as the industry is still enjoying a favorable backdrop based on the prospect of the federal legalization of marijuana in the States.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account