Every month Bank of America (BoA) conducts a global fund manager survey. The December survey findings show that the stock markets could be headed for a pullback based on the cash levels that fund managers are holding.

The Band of America surveyed 190 fund managers with cumulative assets of $534 billion. The monthly survey is closely watched by stock market investors to get a clue on what global fund managers are thinking.

Bank of America December global fund manager survey

The December Bank of America global fund manager survey showed that fund managers are positive about the global economy in 2021. A net 89% of fund managers expect the global economy to improve in 2021 with over 70% expecting the economy to improve in the first half of the year itself. An economic recovery coupled with the expected rebound in earnings is positive for stock markets.

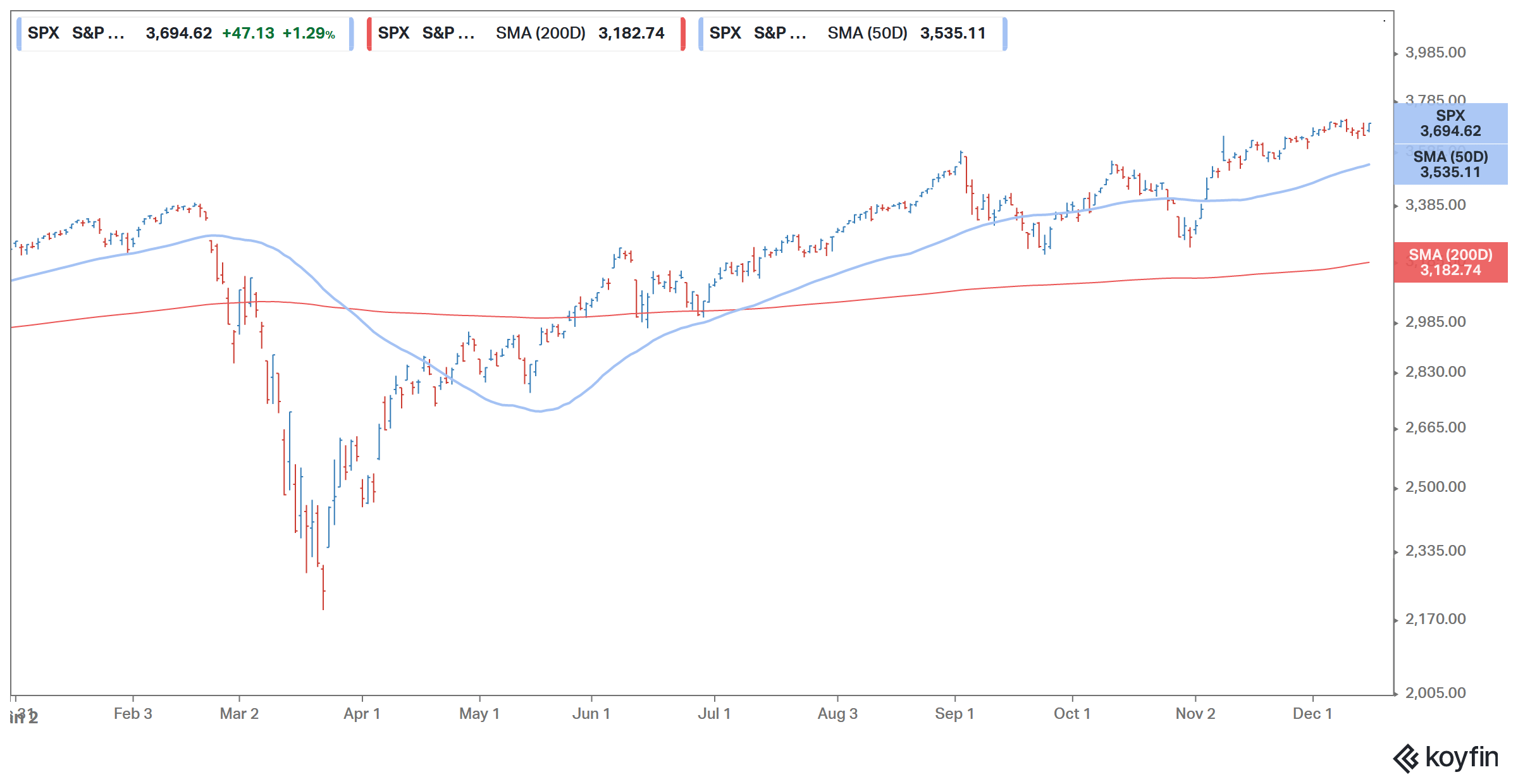

Stock markets saw a V-shaped recovery

Meanwhile, fund managers’ opinion is quite divided over the shape of the economic recovery. While 34% believe that we’ll see a W-shaped recovery, 29% see a U-shaped recovery. Only 26% of the respondents see a V-shaped economic recovery. That said, looking at the stock markets, it has been a perfect V-shaped recovery from the March lows.

Separately from the Bank of America survey, the consensus estimates for S&P 500 compiled by FactSet suggest that analysts expect the index to rise to 4,000 next year which would mean another upside of 8% from these levels.

What are the biggest risks for stock markets?

30% of the surveyed fund managers see COVID-19 as the biggest tail risk for stock markets. Notably, the percentage of fund managers who see COVID-19 as the biggest risk fell by 11 percentage points between November and December. In November, both Moderna and Pfizer reported encouraging trial results for their COVID-19 vaccine candidates. Countries across the world have started to approve the vaccine now.

Inflation is a big risk for stock markets

24% of the surveyed fund managers see inflation as the biggest tail risk for stock markets. If inflation rises above comfort levels, central banks globally would have to reconsider their easy monetary policies. Massive central bank support has been the key driver of the rally in stock markets and even a hint that central banks would reverse their accommodative stance could trigger a sell-off in stock markets.

Lower cash is a contrarian sell call

Meanwhile, fund managers are now underweight cash and the average cash holdings are only 4%. While lower cash holdings suggest that fund managers are bullish on stock markets, according to Bank of America, it is a contrarian sell signal. In the past, such low cash holdings have been followed by -3.2% returns from the S&P 500 over the next month.

Long US tech is the most crowded trade

The December Bank of America global fund manager survey showed that long US tech stocks is the most crowded trade. The trade has held its rank as the most crowded for the last many months. While US tech stocks have come off their 2020 highs as investors moved to cyclical and value stocks, long US tech stocks remain the most crowded trade. The sharp rise in US tech stocks has helped the tech-heavy Nasdaq Index outperform the S&P 500 and Dow Jones this year.

Meanwhile, there has been some unwinding in the long US tech stock trade. In the December survey, only 52% of fund managers termed it as the most crowded trade—down from 80% in September. That month, the long US tech stocks trade earned the dubious tag of becoming the most crowded trade ever.

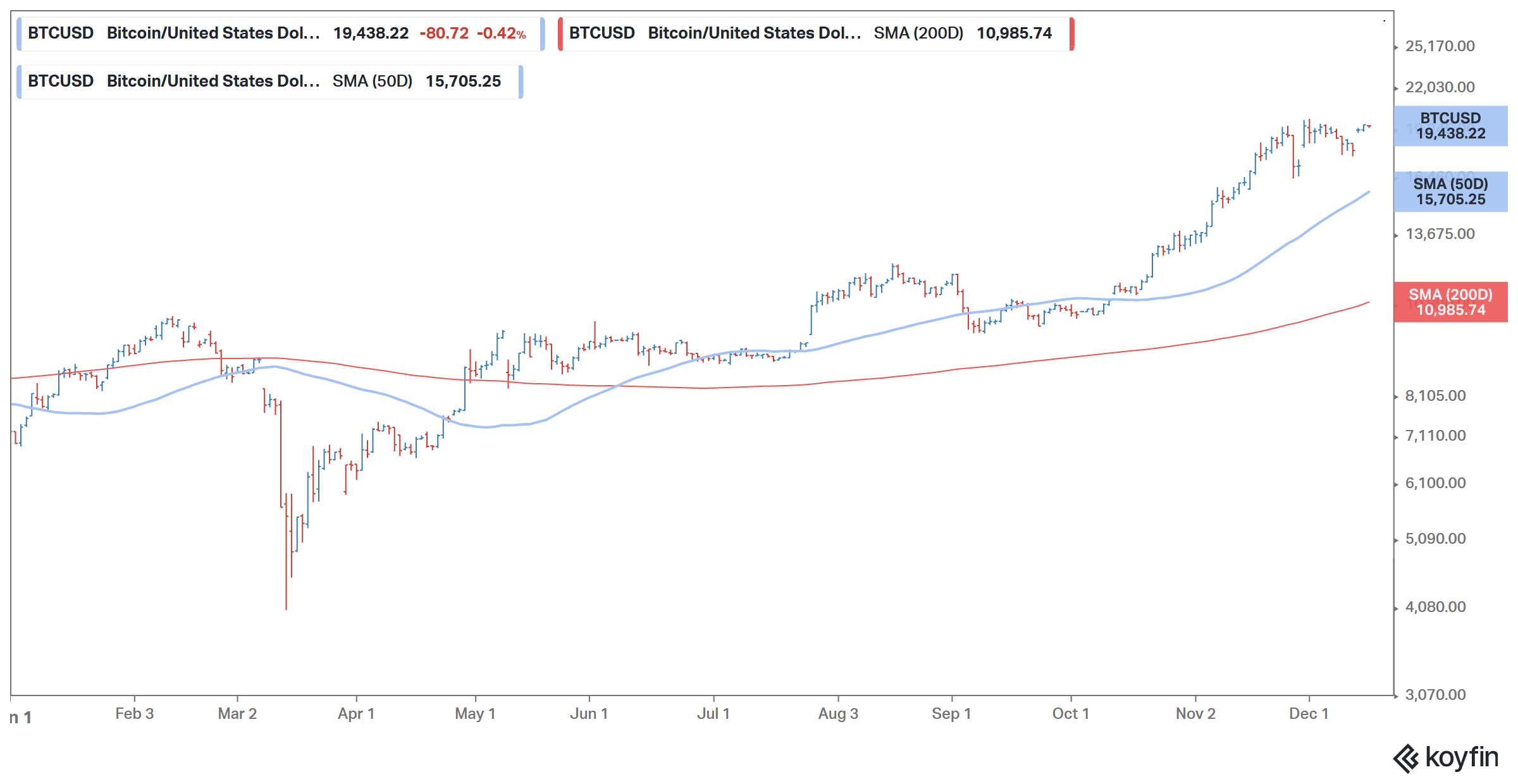

Bitcoin has outperformed stock markets in 2020

Short US dollar and long bitcoins are the other two most crowded trades in that order. However, all these trades have been profitable for investors. The greenback has fallen after it hit its all-time high earlier this year. The dollar index is trading at near two-year lows currently. Bitcoin also hit a record high this year surpassing its 2017 highs. While bitcoin has come off its 2020 highs, it has more than doubled this year and has outperformed stock markets in 2020.

Where to invest in 2021?

Despite the COVID-19 pandemic, 2020 was a good year for US stock markets. Gold, bitcoins, commodities, and debt also delivered good returns. Looking forward to 2021, we could see continued rotation to cyclical and value stocks.

There are several strategies through which you can play the sector rotation from tech stocks to cyclical stocks. One way is by buying stocks of cyclical companies that trade at reasonable valuations You can buy stocks through any of the best online stockbrokers.

Also, if you are not well equipped to research stocks or want to avoid the hassle of identifying and investing in stocks, you can pick ETFs that invest in value stocks, cyclicals, and industrials to play the sector rotation from tech.

By investing in an ETF, one gets returns that are linked to the underlying index after accounting for the fees and other transaction costs. There is also a guide on how to trade in ETFs.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account