Peloton stock was trading sharply higher in US premarket trading today after it announced plans to acquire fitness-equipment company Precor for $420 million. The acquisition would boost Peloton’s supply chain capabilities at a time when it is facing high demand.

Notably, during their fiscal first quarter 2021 earnings release last month, Peloton pointed to supply constraints in the “foreseeable future.” “As we rapidly scale our organization to meet the extraordinary demand for our products, we realize that some of our members have faced extended delays associated with receiving our products or having support requests fulfilled,” said Peloton’s chief executive John Foley.

Peloton acquires Precor

Meanwhile, in a bid to increase its manufacturing footprint and complement its research and development capabilities, Peloton has agreed to acquire Precor for $420 million making it the company’s biggest acquisition.

Peloton expects to produce its connected fitness equipment in the US by the end of 2021 and the Precor acquisition would help the company achieve that milestone. Commenting on the acquisition, Peloton’s President Willian Lynch said “By combining our talented and committed R&D and Supply Chain teams with the incredibly capable Precor team and their decades of experience, we believe we will be able to lead the global connected fitness market in both innovation and scale.”

What does the Precor acquisition bring for Peloton

The Precor acquisition would help Precor gain access to Precor’s manufacturing facilities and boost its production capabilities. “The acquisition adds 625,000 square feet of U.S. manufacturing capacity with in-house tooling and fabrication, product development, and quality assurance capabilities in Whitsett, North Carolina and Woodinville, Washington,” said Peloton in its release.

It added, that it would “be able to control the entire production process, from design to ship, and increase total production scale, while maintaining a high level of product quality.” Peloton expects to bring down the waiting time for its buyers as it starts manufacturing its equipment within the US.

Pandemic winner

The demand for Peloton equipment has spiked this year as more people are working out at home. The company hasn’t been able to meet the increasing demand. “We have seen a ton of growth. No one would wish a global pandemic on anybody, but it’s been a tailwind for our business,” said Lynch. He added, “Keeping up with that growth, which has been a moving target, has been a big company priority.”

Commenting on the deal’s strategic rationale, Lynch said “As we’ve been investing in scaling our manufacturing, this is an area where Precor is very strong.” Peloton stock has gained over 400% this year amid the rally in stay-at-home stocks that include the likes of Amazon and Netflix.

Peloton stock in 2020

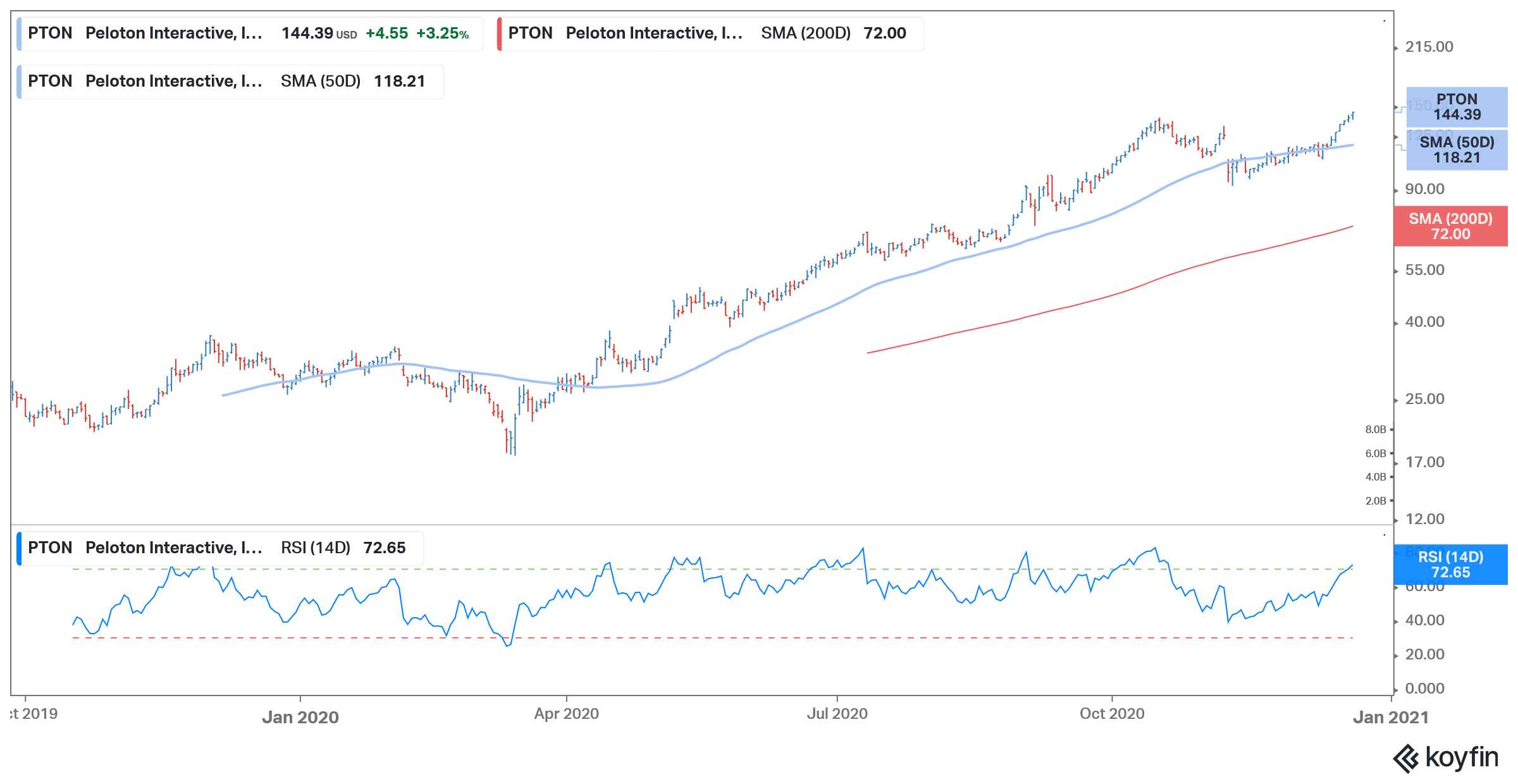

While some of the other stay-at-home stocks have come off their 2020 highs, Peloton hit a record high of $144.88 on Monday. The shares were up over 7% in premarket trading on Tuesday also.

It is worth noting that while demand growth for some of the other stay-at-home stocks might slow down after the pandemic, Peloton should see high growth rates in the near future. In its fiscal first quarter of 2021, Peloton posted a 232% year-over-year rise in revenues. It expects to post revenues of $1 billion in the fiscal second quarter 2021 which represents strong quarter-over-quarter growth.

Earnings growth

In the fiscal year 2021, Peloton expects to post revenues of $3.9 billion and achieve gross margins of 41%. The company expects to have 2.17 million Connected Fitness subscribers by the end of the fiscal year. These subscribers pay a recurring fee to Peloton and are a key earnings driver.

Meanwhile, Peloton stock looks technically overbought with a 14-day RSI (Relative Strength Index) of 72.6. RSI valued above 70 signal overbought positions while values below 30 are associated with oversold positions.

You can buy Peloton stock through any of the reputed online stockbrokers. Alternatively, if you wish to trade derivatives, we also have reviewed a list of derivative brokers you can consider.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account