Oil stocks, as tracked by State Street’s Energy Select Sector SPDR® ETF (XLE), retreated sharply yesterday, as President Joe Biden seems resolved to curb the industry’s impact on the environment by tightening regulations.

The exchange-traded fund, which invests in a basket of selected oil stocks like Exxon Mobil, Chevron Corporation, and ConocoPhillips, slid 3.4% by the end of yesterday’s stock trading session in New York, finishing the day at $42 per share only hours before the Biden administration moved to suspend new oil and gas drilling permits on federal land.

The measure, which was announced after the market was closed, consists of a 60-day halt to all leasing and drilling permits for both oil and gas in federal lands and waters, effectively reversing the pro-drilling policies of the Trump administration.

Meanwhile, the order doesn’t really come as a surprise, as President Biden signed during his first day in office multiple executive orders that were considered hostile towards oil companies, including rejoining the Paris Climate Accord and another revoking the approval of the Keystone XL oil pipeline.

Industry groups and trade associations have already responded to the measure, with the President of the American Petroleum Institute (API), Mike Sommers, qualifying the order as one that would “only serve to hurt local communities and hamper America’s economic recovery”.

Moreover, Republican Senator John Barrasso, said that Biden’s administration was “off to a divisive and disastrous start” while saying that the government cannot go against the law when it comes to granting these permits.

What’s next for oil stocks?

Yesterday’s downtick seen by oil stocks could be the beginning of a trend reversal if market players believe that the Biden administration will adopt an increasingly hostile position against the industry during its first period.

Meanwhile, it is important to note that these measures should have a positive impact on oil prices, as they could end up affecting supply levels from US-based oil companies, while corporations outside the US should emerge as winners if the price of crude were to be lifted.

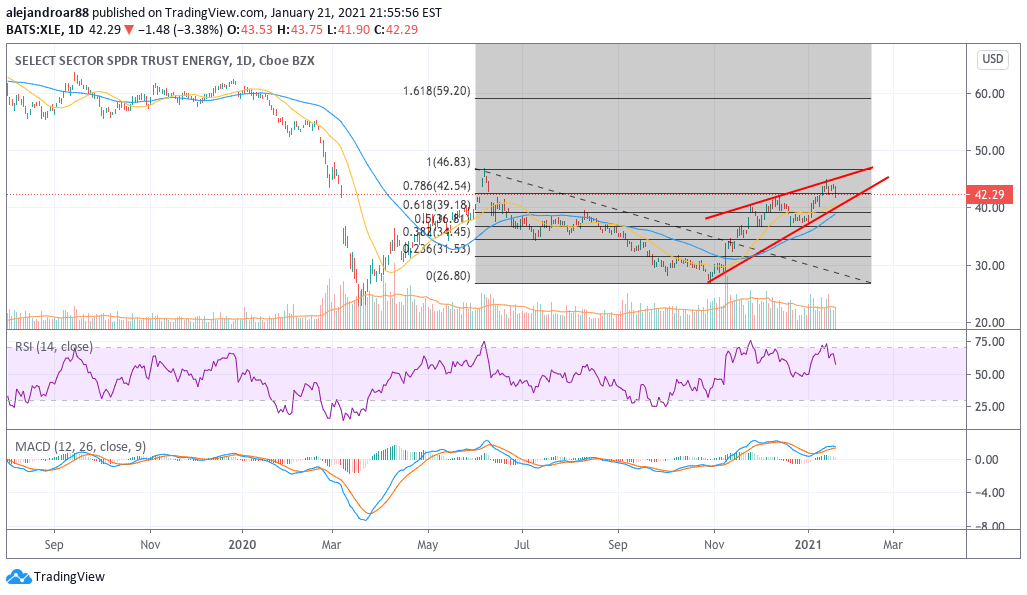

A closer look at State Street’s oil ETF shows that the latest uptrend seen by oil stocks could be about to reverse its course, although no clear signal has yet confirmed this move.

For now, traders should keep an eye on the price action in the following days. If the price were to move below the $36 level, chances are that bears will end up taking over the upcoming sessions as the sector could experience some negative momentum amid Biden’s administration hostile attitude towards the industry.

Such a move would break both the 0.5 Fibonacci level and the lower trend line of what seems to be a bearish rising wedge formation as indicated in the chart, while the MACD seems poised to send a sell signal if such a downtick were to occur.

Trusted & Regulated Stock & CFD Brokers

What we like

- 0% Fees on Stocks

- 5000+ Stocks, ETFs and other Markets

- Accepts Paypal Deposits

Min Deposit

$200

Charge per Trade

Zero Commission on real stocks

64 traders signed up today

Visit Now67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Available Assets

- Total Number of Stocks & Shares5000+

- US Stocks

- German Stocks

- UK Stocks

- European

- ETF Stocks

- IPO

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 Zero Commission

- NASDAQ Zero Commission

- DAX Zero Commission

- Facebook Zero Commission

- Alphabet Zero Commission

- Tesla Zero Commission

- Apple Zero Commission

- Microsoft Zero Commission

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account

- Paypall

- Skrill

- Neteller

What we like

- Sign up today and get $5 free

- Fractals Available

- Paypal Available

Min Deposit

$0

Charge per Trade

$1 to $9 PCM

Visit Now

Investing in financial markets carries risk, you have the potential to lose your total investment.

Available Assets

- Total Number of Shares999

- US Stocks

- German Stocks

- UK Stocks

- European Stocks

- EFTs

- IPOs

- Funds

- Bonds

- Options

- Futures

- CFDs

- Crypto

Charge per Trade

- FTSE 100 $1 - $9 per month

- NASDAQ $1 - $9 per month

- DAX $1 - $9 per month

- Facebook $1 - $9 per month

- Alphabet $1 - $9 per month

- Telsa $1 - $9 per month

- Apple $1 - $9 per month

- Microsoft $1 - $9 per month

Deposit Method

- Wire Transfer

- Credit Cards

- Bank Account